What to Expect with the Long-Term Disability Claims and Appeals Process

The long-term disability (LTD) claims and appeals process may seem overwhelming for those in need of disability benefits. Coping with a diagnosis that prevents you from working is difficult and handling all the complexities of the claim process can add anxiety to an already stressful situation.

Many claimants do not know what to expect when filing for long-term disability benefits. While claimants may decide to file these claims alone, it can be beneficial to consult with an LTD attorney to avoid common mistakes that could result in a denial. Regardless of whether you are filing on your own or with an attorney, it is vital to understand the claims and appeals process before you begin.

Overview of the LTD Claims and Appeals Process

If you develop a debilitating medical condition that prevents you from working, you may need to file for long-term disability benefits if that coverage is available to you. While many professionals have these benefits, they often do not fully understand what they are or how to obtain them.

There are three primary stages in the LTD claim process:

- The initial claim;

- The administrative appeal; and

- Litigation.

You may receive an approval of your benefits during any of these stages. However, it can become increasingly difficult as you move through these stages.

Understanding Your Long-Term Disability Policy

Before filing for LTD benefits, it is important to thoroughly read your policy. While policies are often complicated and difficult to understand (a long-term disability attorney can help with this), it is vital to comprehend their contents.

First, you must ascertain which type of policy you have. There are two types of policies a claimant may have: a group policy or an individual policy. Some professionals may have both policies at the same time.

Group policy LTD policies are provided by employers to their employees. Typically, these policies are part of a benefits package and are governed by a federal law known as ERISA. ERISA can further complicate the LTD process, as it has its own set of rules and deadlines that claimants must meet if they wish to receive an approval from their insurance company concerning their claim.

The second type of policy is an individual policy. Claimants usually purchase these policies directly from the insurance company. Such policies, unlike their group counterparts, are typically not governed by ERISA.

Regardless of which policy type you have, it will contain a lot of invaluable information concerning your claim. This information can include benefit amount, the maximum benefit period, how long the waiting period is, certain limitations and exclusions, how to appeal a denial, and more.

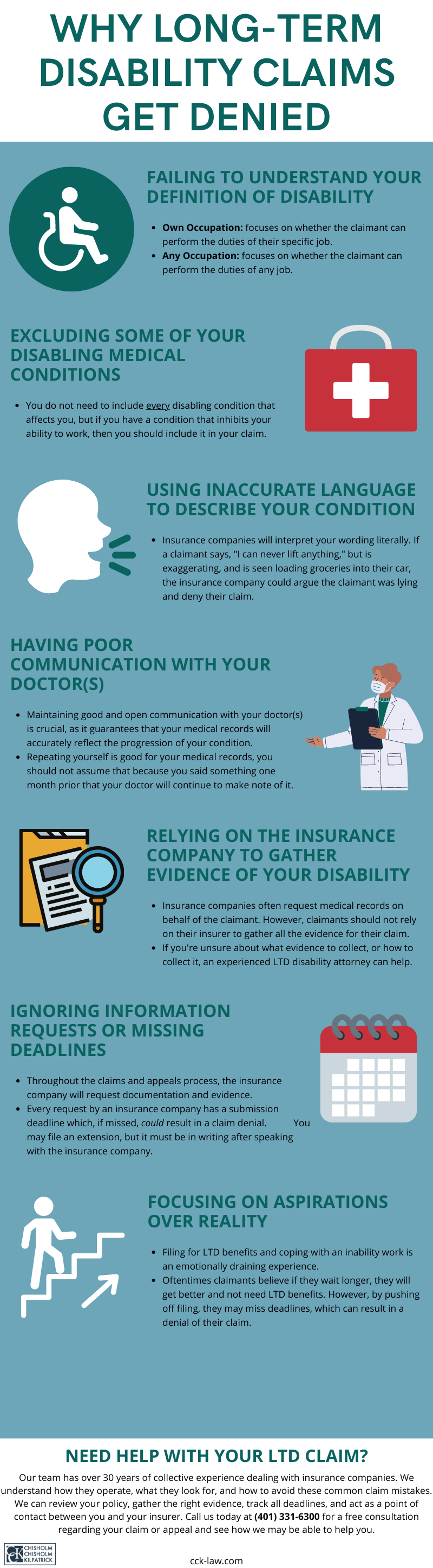

Perhaps the most important piece of information located within your LTD policy is the definition of disability. This definition outlines what standard you must meet to receive benefits. For the insurance company to issue an approval, they must consider the claimant disabled per the definition within their policy.

Typically, there are two definitions of disability that a claimant is likely to encounter: own occupation and any occupation. Sometimes, however, a policy may contain an own occupation definition that transitions—after a certain period, usually around 24 months—to an any occupation definition.

An own occupation definition can often be easier to meet than an any occupation definition since the own definition focuses on the claimant’s specific profession whereas the any occupation definition does not.

Stage One: The Initial Claim

When a person develops a condition that prevents them from working, they most likely will turn to their LTD policy. The first stage of the long-term disability claims and appeals process is filing the initial claim.

When a person realizes that they can no longer adequately perform the duties of their job due to a medical condition, they must submit a notice of claim to their insurance company. This notice of claim essentially lets the insurance company know they plan on filing a claim for long-term disability benefits.

Next, the claimant must fill out the claim forms, which are typically mailed to the claimant after the insurance company receives the notice of claim. These forms usually contain three main elements: the claimant statement; the attending physician statement; and the employer statement.

Along with these forms, a claimant should also submit evidence proving they meet the definition of disability within their policy. Medical records are usually the primary source of evidence. However, it can be beneficial for claimants to submit additional evidence with their claim. This supplemental evidence can include items such as specialized reports from your treating physician(s), witness statements, daily logs of your condition, vocational evaluations, outside expert opinions, and more.

The Insurance Company Will Investigate Your Claim

Once you have submitted the completed claim forms and any relevant evidence, the insurance company will begin investigating your claim. It is important to remember that insurance companies do not want to pay claims. Such companies are—first and foremost— businesses and, consequently, prioritize their financial needs rather than the health needs of their clients. Unfortunately, this leads to many denials.

Insurance companies will employ several “tools” to investigate your claim during this process. Insurers may:

- Conduct “file reviews”: Often, insurance companies will hire a doctor or other medical professional to review the medical files of a claimant. After the review is completed, the doctor will offer an opinion about the claimant’s impairments based on these medical records. Unfortunately, some initial claims are denied based on this opinion.

- Request independent medical exams (IMEs): Insurance companies sometimes require claimants to participate in an independent medical exam. While these so-called independent medical exams are administered by doctors who are usually paid by the insurance company and thus are not really “independent,” insurers routinely use them to inject doubt into a claim. If the insurance company is requesting that you undergo an IME, it can be a good time to contact a long-term disability lawyer.

- Use surveillance tactics: Insurance companies use a variety of surveillance tactics to monitor claimants. Such tactics can include hiring private investigators to stake out at a claimant’s house; take photographs, audio recordings, and/or videos of the claimant; and more. The insurance company will use anything that could remotely inject doubt into a claim as a reason for a denial.

- Monitor claimants’ social media accounts: Insurers are increasing their surveillance of claimants’ social media accounts. This includes monitoring what they post on Twitter, Facebook, Instagram, and personal websites and blogs. But because people do not always post their troubles on social media, their online profiles may not accurately depict the truth. Unfortunately, this will not stop insurance companies from using these profiles against claimants.

After this investigation, the insurance company will either issue an approval (wherein monthly benefits will begin, usually after a waiting period) or a denial.

If your claim is approved, you will likely still receive correspondence from the insurance company. They will periodically “check-in” to see if you continue to meet the criteria to receive benefits. If they believe you no longer meet the definition of disability per your policy, they may terminate your benefits.

Stage Two: The Administrative Appeal

If you receive a denial at the initial claim stage, you have the right to appeal. The administrative appeal stage is a critical moment during the long-term disability claims and appeals process, especially if you have an ERISA-governed group policy.

When you have an ERISA-governed group policy, this administrative appeal is typically the last chance you have to submit new or updated evidence to reinforce your claim. Therefore, it is critical you gather all your evidence and get it on the record.

Insurance companies will issue a denial letter to a claimant explaining the reason for the denial. If there is something specific that caused the denial, the claimant’s appeal should specifically address this. The appeal stage is the perfect time to fix gaps present in the initial claim, address specific issues the insurance company raised, and add additional evidence to bolster your claim.

This is also a crucial time to consult with a long-term disability attorney. Often, claimants who file an appeal on their own do not collect the right evidence or enough of it. If the insurance company denies your appeal, you likely will not be able to submit new evidence onto the record during litigation. An LTD attorney, after thoroughly reviewing your policy and denial letter, will know the best evidence to gather to strengthen your claim.

Typically, it takes insurance companies 45 to 90 days to issue a decision after your appeal is submitted—though this can sometimes take even longer if they request further information.

Stage Three: Litigation

The final stage of the long-term disability claims and appeals process is also—especially under ERISA—the most difficult. If your appeal is denied, you may file a suit in court. Under ERISA, this litigation process looks very different from what most people envision when they think of “court.”

When you have an ERISA-governed group policy, in court you generally must rely on the evidence that was previously submitted to the insurance company. Moreover, under ERISA, there is typically no jury during such proceedings. It is up to the judge to decide on your benefits.

However, the judge will sometimes give deference to the insurance company. In this circumstance, the court is not seeking to declare whether the insurance company is “right” or “wrong” in its denial. Rather, they are looking to see if the insurance company had a reasonable basis for issuing the denial. This can create a very high and difficult hurdle to overcome.

Should the court uphold the claim denial during the litigation stage, you will not receive your benefits at all. The court handles individual policies differently during the litigation stage as they are not bound by the procedural technicalities of ERISA. Typically, individual policies will be governed by state insurance law.

Call Chisholm Chisholm & Kilpatrick Today

Handling a long-term disability claim on your own can be an overwhelming task. There are many complexities with which you must deal. However, this is not a task that you must undertake alone.

The long-term disability insurance attorneys at Chisholm Chisholm & Kilpatrick have over 30 years of combined experience dealing with insurance companies and understand how they work. Moreover, our attorneys are well-versed in ERISA and will ensure that you are submitting the strongest possible claim or appeal.

Call us today at (800) 544-9144 for a free case evaluation with a member of our team and see how we may be able to assist you.

About the Author

Share this Post