Long-Term Disability Policies: Definition of Disability

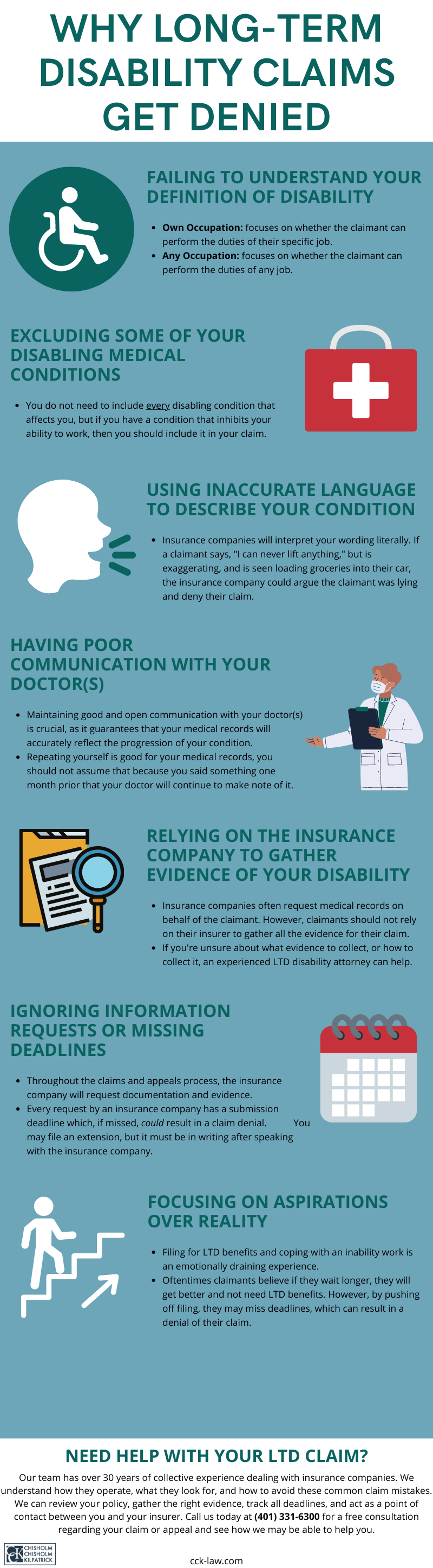

When an insurer denies an individual’s long-term disability (LTD) claim, they will often reference that the individual does not meet the policy’s definition of disability. To receive benefits, claimants must prove that their condition meets their policy’s specific definition. Often, this definition of disability changes after a set period. This article will explain what LTD claimants must know regarding their policy’s definition.

Why Is It Important To Understand Your Policy’s Definition of Disability?

The definition of disability is essentially the core of a long-term disability policy and is a good place to start to understand the type of disability coverage you have. This definition can help you identify what kind of protections your long-term disability insurance policy affords you; what types of evidence you may need to prove you meet that definition; and how to effectively communicate with your doctor when filing a claim.

Since insurers often deny claims because the definition of disability is not met, it is imperative that you read and understand your policy’s definition so that you may recognize the position they are taking. It is important to note that those handling their own long-term disability claims should read their insurance plan’s policy in its entirety to understand the scope and limitations of their disability plan’s coverage. Such policies contain a lot of valuable information, such as if/when claimants may return to work; the elimination period, i.e., the waiting period; limitations and exclusions; and more. Some claimants may opt to file for short-term disability benefits to help cover a waiting period.

Although language varies from policy to policy, there are typically two definitions of disability that appear within LTD policies: “any occupation” and “own occupation.” Many policies have dual definitions of disability, meaning that the policy’s definition switches from own occupation to any occupation after a period of time, typically between 12 and 36 months. Regardless, when you are unable to work due to an illness or injury and are filing for LTD benefits, you must understand the differences between these definitions.

Own Occupation Definitions

Generally, own occupation definitions of disability ask whether you are able to perform the material duties of your own occupation. In other words, is this person able to perform the daily tasks associated with the job they worked when they became disabled? Some own occupation policies answer this question by considering the material duties of that job based on how it is performed in the national economy. This means that the material duties of your job will be based on how that job is performed, on average, across the country, instead of your specific job description.

It is important to note that the material duties of a job include both cognitive and physical capabilities. Physical duties can consist of how often a person is expected to stand, walk, lift, sit, etc. Cognitive duties can consist of elements such as the ability to carry out complex tasks or to concentrate. Often, we see disability insurers deny long-term disability claims because their focus is exclusively on physical duties, but cognitive duties are equally significant. Insurance companies do not like paying benefits, so it is essential to be prepared for all outcomes.

How Do I Determine the Material Duties of My Own Occupation?

In order to get an idea of whether you meet your policy’s own occupation definition of disabled, try obtaining and studying a copy of your job description. Although own occupation definitions may compare your job’s material duties to those of that job in the national economy, examining this description and comparing it to your limitations can help you get a better idea of how your disability impacts your ability to perform your job — or any job for that matter.

Not all material duties of your job will be listed in the job description, such as arriving at work on time every day; however, these are still material duties. For example, if your disability often prevents you from getting a full night of sleep, you may experience difficulty reliably and consistently arriving to work on time.

Any Occupation Definitions

Any occupation definitions of disability seek to determine if a person is able to perform the material duties of any job. Some policies, but not all, will ask whether you are able to participate in a “gainful” occupation. To quantify what a “gainful” occupation is, many policies will consider the amount a person made prior to becoming disabled. A gainful occupation would be one in which you earn a certain percentage — usually 60 to 80 percent — of your pre-disability earnings. This can be an important factor in your LTD claim, especially if you were a high-earner.

For example, a surgeon who is no longer able to perform surgery due to disability, but may be able to work as a receptionist can still be considered disabled under the any occupation definition of disability due to the income gap between the two jobs.

In addition to the gainful component of any occupation definitions, many policies will state that you must reasonably be able to perform the tasks of a job based on educational background, previous work experience, training, and sometimes age. In other words, your insurance company must take these things into account when determining whether you would reasonably be able to perform the material duties of an occupation.

Social Security Disability vs. Long-Term Disability

Those collecting Social Security for a disability from the federal government do not automatically qualify as disabled under long-term disability policies. This is because the two programs have different standards for evaluating disability. Your long-term disability insurance company will probably require you to file for SSDI benefits as part of the LTD process.

The Social Security standard refers to the ability of a person to engage in any substantially gainful activity. This usually refers to a job that pays above the federal poverty threshold. Effectively, this definition is similar to that of any occupation definitions in LTD policies; however, the Social Security qualifications are usually more difficult to meet. To use the surgeon example again, Social Security would not deem a surgeon unable to perform surgeries as disabled because he or she would be able to earn a gainful wage, above the poverty threshold, as a receptionist.

Call CCK Today for a Free Case Evaluation

CCK understands how difficult it can be to file for long-term disability benefits. Our legal team is prepared to assist you at any stage of the process. Whether your employer offers an LTD group policy or you have bought your policy yourself, this is not a process you must do alone. We have over three decades of experience dealing with insurance companies and can help you file your claim. Call us today at (800) 544-9144 for a free case evaluation with a member of our team. We will analyze your case and see if we can help.

About the Author

Share this Post