Own Occupation vs. Any Occupation Long-Term Disability Insurance Policies

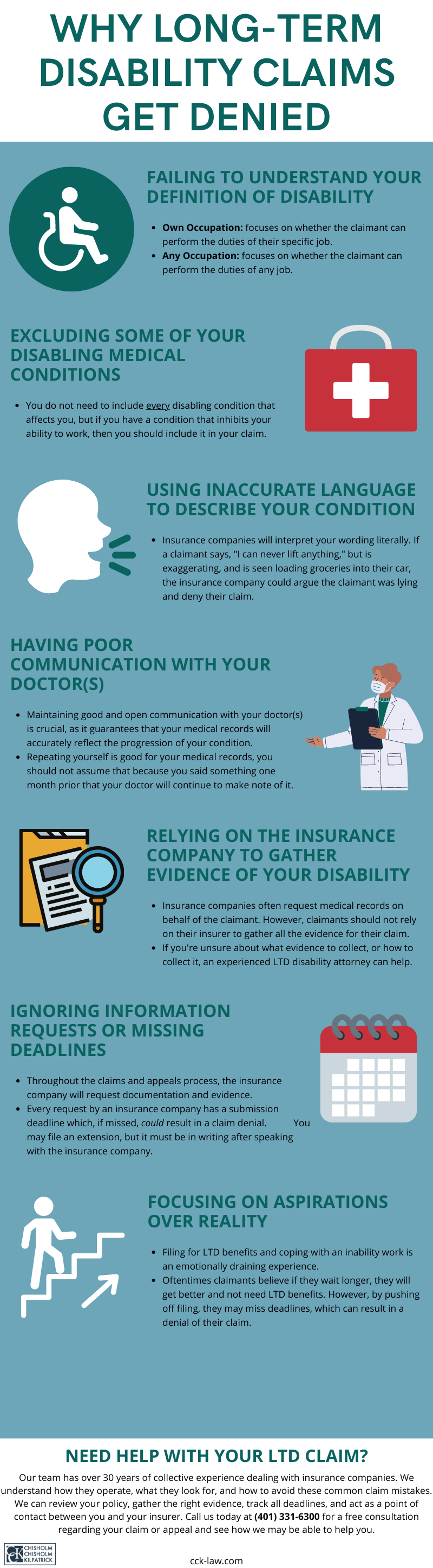

Your long-term disability (LTD) insurance policy will specify what definition of disability you need to meet in order to receive benefits. Many definitions of disability contain language specifying what occupation(s) you must be disabled from to meet the definition of disability. LTD policies commonly refer to these definitions as own occupation and any occupation.

Most long-term disability policies will require that you be disabled from working in your own occupation for the first 24—48 months that benefits are payable. After this period, many policies will then require that you be unable to work in any occupation, i.e., be totally disabled, to continue your monthly benefit payments. However, some long-term disability policies only require you to be disabled from working in your own occupation for the entirety of the claim.

Own Occupation Long-Term Disability Policies

Under most long-term disability insurance policies, your claim begins with a definition of disability that requires you to be disabled from working in your own occupation. In evaluating your claim under this definition of disability, the insurance company must first determine what your job is and how it is performed before it can assess your ability to do it. As part of this evaluation process, many insurers require claimants to attend an independent medical exam (IME), but these exams are often biased in favor of the insurer.

It is important to note that, when determining whether you meet this definition, the insurance company usually considers how your occupation is performed in the national economy, not how it is performed at your specific place of employment. It is important that you thoroughly read your policy to ascertain whether you have a true own occupation definition of disability. Regardless, insurance companies typically use resources from the Department of Labor to define the duties and requirements of your occupation. It is crucial that the insurance company consider both the physical and cognitive duties of your job.

Sometimes, insurance companies will incorrectly determine what your occupation is and what its requirements are. This can have significant a impact on your long-term disability claim and ultimately result in an improper denial of benefits, even if the insurance company agrees with your asserted medical impairments.

For example, if your occupation was very physically demanding, even mild physical impairments might prevent you from completing the required duties. However, an insurance company might incorrectly conclude that your job was less physically demanding than it was and deny your claim for benefits.

Alternatively, you may have worked in an office but performed very complex tasks, and if you suffer from mild cognitive impairments, you may no longer be able to perform these tasks. But if the insurance company only considers the physical demands of your occupation and ignores the cognitive demands, it may determine you are capable of working in your occupation simply because you are physically capable of sedentary work.

Accordingly, you should be sure that the insurance company is correctly defining your occupation, otherwise, the insurance company may evaluate your claim improperly, and you may be denied benefits. You should consider contacting an attorney if you believe the insurance company made an error in defining your own occupation.

Any Occupation Long-Term Disability Policies

Typically, after 24—48 months of benefits, the definition of disability in long-term disability policies will transition to an any occupation definition. In the months preceding the official date of definition change, the insurance company will usually begin reviewing updated medical evidence to determine if you meet the any occupation definition of disability.

These definitions of disability can vary widely, so it is important that you thoroughly read your policy and understand what standard you need to meet. It can be very challenging to meet this definition, and you should consider contacting an attorney if you run into any issues during this transition period.

Some long-term disability policies have a very broad any occupation definition of disability and simply state that you must be disabled from working in any job whatsoever, not just your regular occupation. Policies that provide a simple or vague definition of disability can cause issues with your claim because it allows the insurance company to consider most jobs in the national economy and opens the door for the insurance company to argue that if you can do any work, even on a part-time basis, you are no longer entitled to long-term disability benefits.

Understanding the Gainful Component

Alternatively, other long-term disability policies examine your ability to perform any occupation that you are reasonably qualified for by your training, education, or experience. Some other long-term disability policies contain any gainful occupation definitions of disability after 24—48 months.

Typically, these definitions will require that you be unable to perform an occupation that would earn you a certain percentage, typically 60 -80 percent, of your pre-disability earnings. For example, if your policy’s any gainful occupation definition required you to be disabled from any job in which you could earn at least 60 percent of your pre-disability earnings and you previously earned $100,000 per year, you only have to demonstrate that you are disabled from occupations that would earn you at least $60,000 per year.

These definitions are typically easier to meet if you were a high-wage earner before your disability because the gainful threshold will also equal a higher wage, and such occupations usually have more demanding requirements. Typically, the more demanding a job is, the fewer impairments it takes to disable you from doing that job.

For example, high-earning occupations often require significant cognitive demands. If you suffer from a medical condition like chronic pain, it can be distracting and cause cognitive issues such as lack of focus or inability to process large amounts of information. As a result, if you had high pre-disability earnings, you may be disabled from any gainful occupation due to your chronic pain, even if you are still physically capable of performing sedentary work.

Even when it is clear that you are disabled from both your own and any occupation, insurance companies do not always do what they are supposed to do for business reasons. Regardless of whether your policy has an any gainful occupation definition of disability, you should still consider contacting an attorney if your claim is transitioning to the any occupation definition to make sure that your claim is strong and is being handled correctly by the insurance company.

Was Your Long-Term Disability Claim Denied? Contact CCK

At Chisholm Chisholm & Kilpatrick we are experienced in handling claims that fall under both definitions of disability. Our team of experienced attorneys and professionals has also assisted many clients as they navigate transitions in their definitions of disability. We understand the nuanced details involved with correctly defining your own occupation, as well as how to transition to any occupation as smoothly as possible. Our team can help claimants at any point in the LTD claim and appeal process.

You should be focused on your health and your family. CCK can handle your initial disability claim or administrative appeal for you so you can take care of what is most important. Contact us now at 800-544-9144 for a free case evaluation to see if we can help you get on claim and stay there.

About the Author

Share this Post