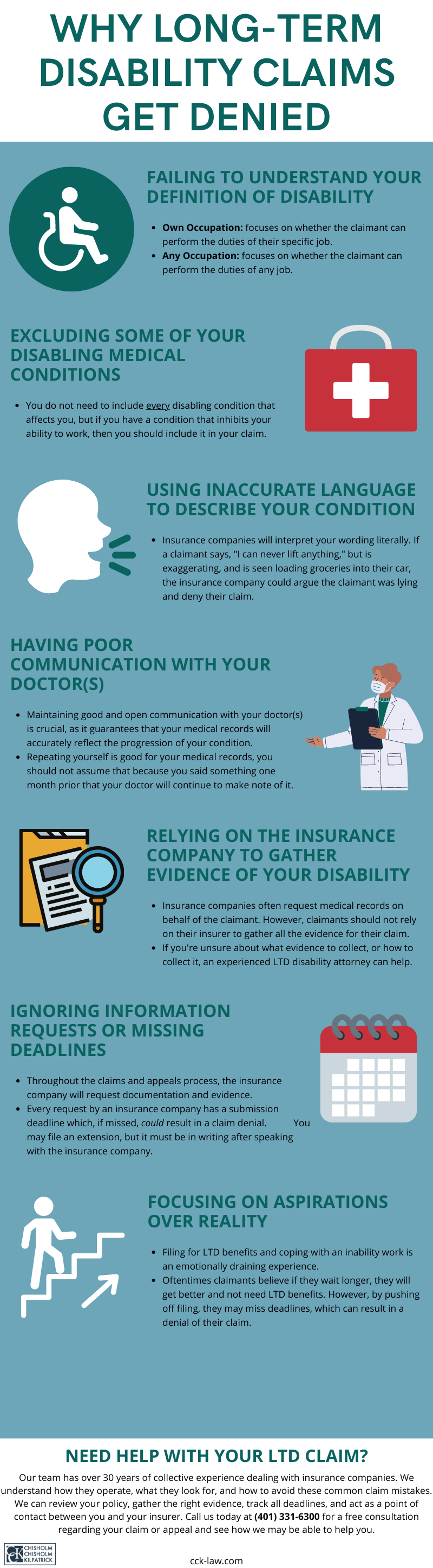

Effective Communication and Long-Term Disability Claims

Long-term disability insurance can be purchased by individuals or can be received through your employer. If you lose income due to a covered disability, long-term disability insurance can replace all or some of your income and may provide other benefits. To receive these benefits, you must file a claim with your insurer.

In this article, CCK Law will discuss why effective communication with your doctor(s) is an important aspect of filing your LTD claim. It will cover:

- Why it’s important to have an open dialogue with your doctor

- How your doctors can help refute insurance company surveillance tactics

- The definition of disability present in LTD insurance policies

- And more

Why Is It Important to Have an Open Dialogue With My Doctor About My Disability?

When you develop a disability, it is important to be open and honest with your doctor about your symptoms and limitations. This helps your doctor treat your condition to keep you working for as long as possible. It also builds a record of treatment that you can include with the evidence you submit as part of your disability claim.

Disability insurers will often first look at your doctor’s records and treatment notes when you file your disability claim. These records can be critical to your disability claim, so it is important that your doctor know the impact your disability had on your work and daily life prior to your claim.

It is very important to be honest with your doctor. Do not exaggerate or downplay your symptoms; be honest about how your condition impacts your daily life. Ask your doctor to report any findings regarding your condition so they are well documented in your medical records in case you need to file a claim.

Surveillance and Long-Term Disability Claims

In the modern world, surveillance is becoming a part of everyday life. This can be either a benefit or a detriment to your long-term disability claim. Insurers may look at surveillance to see if your claims of disability are accurate based on how you perform activities in your daily life, such as grocery shopping or traveling.

Video surveillance can be a benefit if it supports the claims you have made to the insurer and your doctor. Additionally, if surveillance finds you are unable to perform a certain activity due to your disability, then your doctor can speak to this finding.

Conversely, surveillance may catch you doing something you said you could not do. For example, you may claim you cannot lift a gallon of milk. However, if surveillance shows you listing two gallons of milk at the supermarket, then the insurance company can use this as evidence against your claim.

Open and effective communication with your doctor is vital to handling the surveillance aspect of your claim if it does occur.

Definitions of Disability: Own Occupation vs. Any Occupation

The definition of disability for long-term disability is different from that of the Social Security Administration or other entities. Additionally, different long-term disability plans can have two different definitions of disability: “own occupation” and “any occupation.”

Own occupation is a definition of disability that qualifies a person for benefits if they are unable to perform the material duties of the job that they were performing at the time their disability began. Typically, the insurance company will define your occupation based on how it is performed in the national economy.

Any occupation definitions of disability qualify a person for benefits if they are disabled from working in any job, full-time, reliably or consistently. Some policies that have the any occupation definition of disability may also pay benefits if you can work in a job in which you would earn a percentage of your pre-disability earnings, i.e., a “gainful occupation” component. This percentage can vary depending on the terms of your policy.

Typically in long-term disability benefits offered by employers, the first 12 to 24 months of coverage will be under the own occupation definition. After that period, the coverage will transition to the any occupation definition. When this transition occurs, the insurance company will re-evaluate your claim to see if you still qualify for benefits under the new definition. If you don’t, then the insurance company can terminate your benefits.

It is always important to read your policy to determine which definition of disability your policy contains and if there is also a gainful occupation component.

Should My Doctor Know About the Terms Of My Policy?

Yes, it can be important for your doctor to be aware of the definition of disability that is included in your policy. This way, they can speak to the specifics of your limitations as they apply to your policy’s specific definition of disability. Your doctor may need to assess your limitations and abilities to do different things as they relate to doing your pre-disability work, or your ability to do any work whatsoever.

If your policy includes the own occupation definition of disability, it is important for your doctor to know that your inability to perform your current job or pre-disability job renders you disabled under your policy.

Tips for Dealing with Busy Doctors

Doctors are busy, and some may not have the time during their workday to fill out a disability form for one of their patients. Our long-term disability attorneys have a couple of tips for how to work with busy doctors:

- Schedule an appointment: If your doctor does not have the extra time to fill out your disability form during the workday, schedule an appointment with the doctor to fill it out. This way, you are scheduled into their busy workday, and they do not have to find the time themselves to fill out the form. Scheduling an appointment also allows the doctor to assess you in person and remain up-to-date with your symptoms and treatment plan. They will also be able to report your condition and limitations accurately to the insurance company.

- Offer to compensate your doctor for the time they take to fill out the form: Busy doctors may not have time during their regular workweek to fill out your disability form. They may have to do so after work hours. Offering to compensate your doctor for this time can be helpful in getting them to fill out the form.

What If My Claim Is Denied?

If you receive a denial of your LTD claim, then it may be time to contact a lawyer. Under ERISA, this stage is often the claimant’s last chance to submit substantive evidence to the record. A lawyer can help identify the specific aspects of the insurer’s denial to your doctor so they can respond accordingly. Additionally, at this point in the process, it is likely that the insurer has issued a decision disagreeing with your doctor. A lawyer can help facilitate the process of speaking with your doctor about this.

Call CCK Law Today

Call Chisholm Chisholm & Kilpatrick today at (800) 544-9144 for a free case evaluation with a member of our team. A member of our experienced team will analyze your case and determine if we can assist you.

About the Author

Share this Post