Is Long-Term Disability Taxable?

Navigating Long-term disability (LTD) insurance can be confusing and adding tax considerations on top of that can be stressful. Long-term disability provides financial benefits to you if you are unable to work for a long period due to disability. But are the benefits you receive taxable?

In short, long-term disability benefits can be taxable or tax-free. You should speak to an accountant or other tax professional to determine whether your benefits are taxable and to make sure your benefits are reported correctly on your tax return.

However, whether your long-term disability benefits are taxable can depend on a number of factors. This can include whether you are part of an ERISA-governed group policy or a private policy, whether you make premium payments with pre- or post-tax dollars (i.e., before-tax or after-tax dollars), and the percentage of how much of your premiums you pay within your policy.

Is Long-Term Disability Taxable if You Have a Private Long-Term Disability Policy

A private long-term disability policy is a policy that you pay for yourself outside of your employment. This means that you pay for the entirety of the premiums yourself. Whether your benefits are taxable depends on whether you pay the premiums with pre- or post-tax dollars. Pre-tax dollars are a payment made that has not yet been taxed. Post-tax dollars are a payment that includes withheld tax dollars, so you will not have to pay it later.

If your long-term disability premiums are paid with pre-tax dollars, you will likely have to pay taxes on your long-term disability benefits. If your long-term disability premiums are paid with after-tax dollars, your benefits are likely not taxable, though you will be paying more now. Private policy premiums are typically paid with post-tax dollars, but it is up to the claimant on how they file their taxes and whether they pay with pre- or post-tax dollars. It is most common for people to choose the post-tax option so that when they receive their long-term disability benefits, the taxes will already have been paid, and they will not have to worry about the expense.

Is Long-Term Disability Taxable if You’re Part of a Group Long-Term Disability Policy

A group policy is a policy that you get through your employer. If your employer pays the entire premium for your long-term disability insurance, then your long-term disability benefits are likely taxable. This means that while your employer pays the premiums for your long-term disability insurance, you will have to pay income taxes on the benefits you receive through your policy.

Sometimes, the premiums for your long-term disability insurance may be split between you and your employer. If this is the case, then at least a portion of your long-term disability benefit will likely be taxable. The percentage paid by your employer will generally be taxable, while the percentage covered by you will depend on whether you pay your premiums with pre- or post-tax dollars.

While it is likely the employer-paid portion is taxable, this also takes into consideration whether the employer is paying with pre- or post-tax dollars, which would be specified by your company or plan policy.

Is Long-Term Disability Taxable if You Accept a Long-Term Disability Lump-Sum Settlement?

A lump-sum settlement might be offered through your long-term disability insurance company instead of intermittent payments. This means you would receive your entire long-term disability benefit in one payment. Before you settle on a lump-sum claim, it is advised that you consult a disability lawyer.

In cases where this happens, whether your lump sum is taxable also depends on if you pay with pre- or post-tax dollars. If your lump-sum settlement is taxable, it is possible that you will see your lump-sum total reduced significantly by taxes.

Is Long-Term Disability Insurance Tax-Deductible?

You cannot deduct long-term disability insurance premiums from your personal income taxes. Long-term disability insurance is often confused with medical insurance, which is tax-deductible. Long-term disability premiums are not considered medical expenses by the IRS. Disability insurance of any kind is generally not tax-deductible.

If you pay with post-tax dollars, the premiums have already been taxed upfront, these payments cannot be claimed again. Any premiums paid with pre-tax dollars must be filed as income.

It Comes Down to Whether Premiums are Paid with Pre- or Post-Tax Dollars

Generally, whether you pay long-term disability benefit premiums with pre- or post-tax dollars is largely what determines if your long-term disability benefits will be taxable. Be aware of how you are making your payments, your plan’s policy, and what portions of the payment you are responsible for.

If your long-term disability benefits are taxable, there are tax forms you can submit to the insurance company to have them withhold taxes from your monthly disability benefits so that you will not owe taxes later. An accountant or other tax professional can help you determine how much you should withhold.

Contact Chisholm Chisholm & Kilpatrick Today

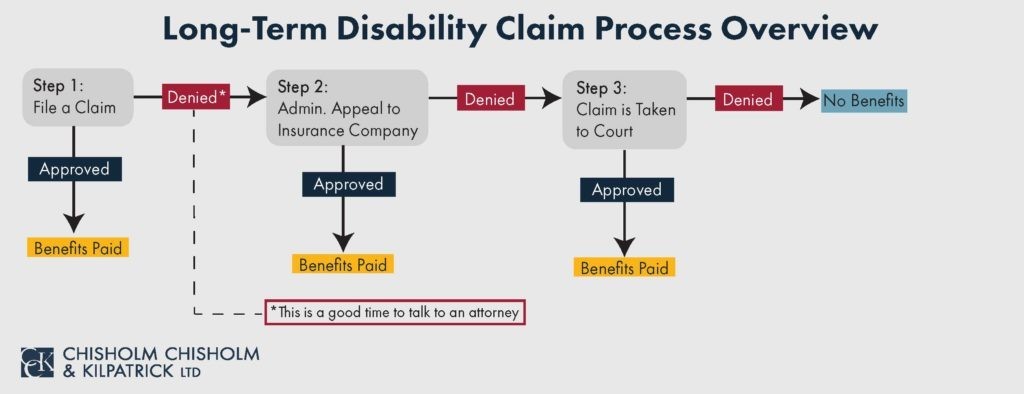

The long-term disability claim and appeal process is challenging. LTD claimants may not understand their insurance policies or may receive a denial of their claim from their insurers. CCK Law has been helping long-term disability claimants for over 25 years and may be able to help you, too. Whether you’re filing an initial claim or an administrative appeal, our team is prepared to review your case. Call us today at (800) 544-9144 for a free case evaluation with a member of our team.

Note: CCK Law does not offer tax advice. Please speak with an accountant if you need help with the taxability of your benefits.

About the Author

Share this Post