Sun Life Long-Term Disability Denial: How to Appeal

If your doctor diagnosed you with a debilitating health condition that is preventing you from working, you may have a long-term disability (LTD) policy through Sun Life. Sun Life Financial Inc. is one of the biggest insurance companies in the world, and they are well known for their life insurance policies. Nevertheless, they offer both short- and long-term disability insurance, which you may have as a group policy through your employer.

A long-term disability policy under Sun Life will cover a percentage of your income should you become disabled by a medical condition or injury. However, these benefits can only begin after Sun Life has approved your claim. Insurance companies are not always easy to work with, especially when it comes to long-term disability benefits.

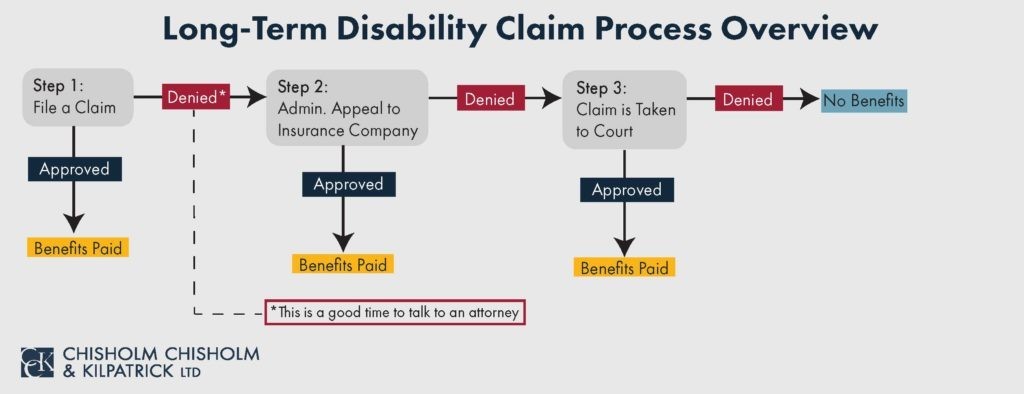

Long-term disability claims are often denied by insurance companies. However, you have the right to appeal a denial by Sun Life as you would any other insurance company. Appealing a claim denial can get you the benefits you need and to which you are entitled.

While some claimants decide to handle an appeal against Sun Life by themselves, it is beneficial to contact an experienced long-term disability lawyer who can help guide you through the process so that you may receive your benefits. An attorney is a powerful asset when appealing denials from large insurance companies like Sun Life.

The long-term disability lawyers at Chisholm Chisholm & Kilpatrick have over three decades of experience dealing with insurance companies, and they know how to help claimants get the benefits they deserve. Contact us today at 800-544-9144 for a free case evaluation regarding your appeal and see if we can help you.

Why Did Sun Life Deny My LTD Claim?

When you file a claim for long-term disability benefits, you must meet the definition of disability as written in your policy. The long-term disability policy information you received from Sun Life will have this definition. If Sun Life does not think that your claim meets this definition of disability, they will deny you your benefits. Your policy will have one of two common definitions of disability: “own occupation” or “any occupation.”

The “own occupation” definition asks whether you can perform the duties of your specific job, whereas an “any occupation” definition asks whether you can perform the duties of any job whatsoever—regardless of whether it is like your current profession. As is evident, the “own occupation” definition is easier to prove than an “any” definition.

Nevertheless, Sun Life, upon denying your claim, should mail you a denial letter. This letter will explain the reasons behind their decision. Most likely, it will describe why the documentation and evidence you submitted did not satisfy the requirements put forth in the policy. It is important to carefully read this letter so that you can best understand how to move forward with your appeal.

There are other reasons, too, that Sun Life may deny your initial claim, including:

- Your evidence was not sufficient: Medical records are the primary source of evidence that claimants submit as part of their claim, but these records are not always sufficient by themselves to win. Sun Life may determine that the evidence you submitted was not sufficient to prove you meet the definition of disability. Therefore, it is important that claimants provide as much supplemental evidence as possible.

- Sun Life’s doctors evaluated your condition: Sun Life may use their own doctors to conduct an evaluation of your condition. While these doctors should be neutral in their assessments, they are often biased and evaluate you in Sun Life’s favor since they work for the insurance company. It is important to find your own doctor who can provide objective, unbiased evidence.

- Sun Life used surveillance tactics: Sun Life may hire a private investigator to provide surveillance on you. These tactics include photographs; videos; stakeouts near your home; and social media surveillance. If the investigator finds something that could even remotely contradict your claim, the insurance company will use it against you.

What You Need to Appeal a Denied Sun Life Long-Term Disability Claim

After you have thoroughly reviewed the denial letter, it is time to begin determining the best evidence needed for your appeal. It is important to use this opportunity to strengthen any weak areas in your claim. Therefore, it is crucial to get the best evidence submitted during the appeal stage.

Evidence submission becomes even more important if you have a group policy that ERISA law governs. ERISA law stipulates that new evidence cannot be submitted after the appeal stage; this means that if your appeal is denied, and must go to litigation, you cannot submit further evidence.

There are steps you can take to gather the best evidence for your appeal. These steps include:

- Obtain additional medical evidence: As mentioned, medical records alone are not always enough to win a claim. Additional medical evidence can include opinions from outside experts who conduct functional capacity and neurophysiological evaluations.

- Contact a vocational expert: A vocational expert can evaluate your ability to perform the duties of your specific job. This evaluation can illustrate the limitations your condition imposes upon you. Moreover, a vocational expert can vouch for how your condition prevents you from working.

- Request a specialized report from your doctor: A specialized report from your doctor, or other treating physician, can highlight certain aspects of your condition that a normal medical report cannot. It is important to maintain an open dialogue with your doctor so that they can accurately and thoroughly explain how your condition impacts you each day.

- Get witness statements from family, friends, and coworkers: Often, the people who see you each day know how your condition impacts your ability to function and work. Obtaining witness statements from family and friends can show how your condition affects you in your personal life. Witness statements from coworkers can speak to how your condition affects you in the workplace.

- Do not miss any deadlines associated with the appeal: A missed deadline can result in a denial of your appeal. ERISA deadlines are strict, so it is important to keep track of them to ensure that you do not miss any.

It is also important to update any evidence you submitted with your initial claim. If you had an evaluation for your initial claim, it is good practice to have this evaluation done again. This will show Sun Life that your condition is still affecting you.

How Chisholm Chisholm & Kilpatrick Can Help You With Your Sun Life LTD Appeal

It is possible to submit an appeal by yourself, but it is important to remember that a denial during the appeal stage can make it even harder to get the court to approve your claim if or when it goes to litigation. It is beneficial to contact a long-term disability lawyer who can help you receive your benefits through an understanding of the claims and appeals process.

The long-term disability team at Chisholm Chisholm & Kilpatrick has over three decades of experience and expertise with ERISA, LTD policies, and insurance companies. We will evaluate your long-term disability policy and denial letter so that we can determine the best way to move forward with your claim.

CCK works with a variety of outside experts who can provide supplemental evidence by conducting objective evaluations on your condition to prove that you meet Sun Life’s definition of disability.

Additionally, Chisholm Chisholm & Kilpatrick understand how difficult insurance companies are to deal with at a time you should be focusing on your health. Therefore, we act as a point of contact between you and Sun Life, so you will not have to deal directly with them. Further, we will ensure that all evidence and updated documentation is submitted to Sun Life efficiently and on time. We will take care of your appeal to Sun Life so you can take care of your well-being.

Contact CCK Today for a Free Consultation Regarding Your Sun Life LTD Appeal

The long-term disability attorneys at Chisholm Chisholm & Kilpatrick are ready to help you if Sun Life denies your claim. We have the experience to help bolster your appeal and assist you in getting the long-term disability benefits you deserve.

For a free case evaluation regarding your appeal, you can call us today at 800-544-9144 to speak with a member of our team and see how we may be able to help you win your case against Sun Life.

Share this Post