How to Win Your TDIU Claim

CCK Law: Our Vital Role in Veterans Law

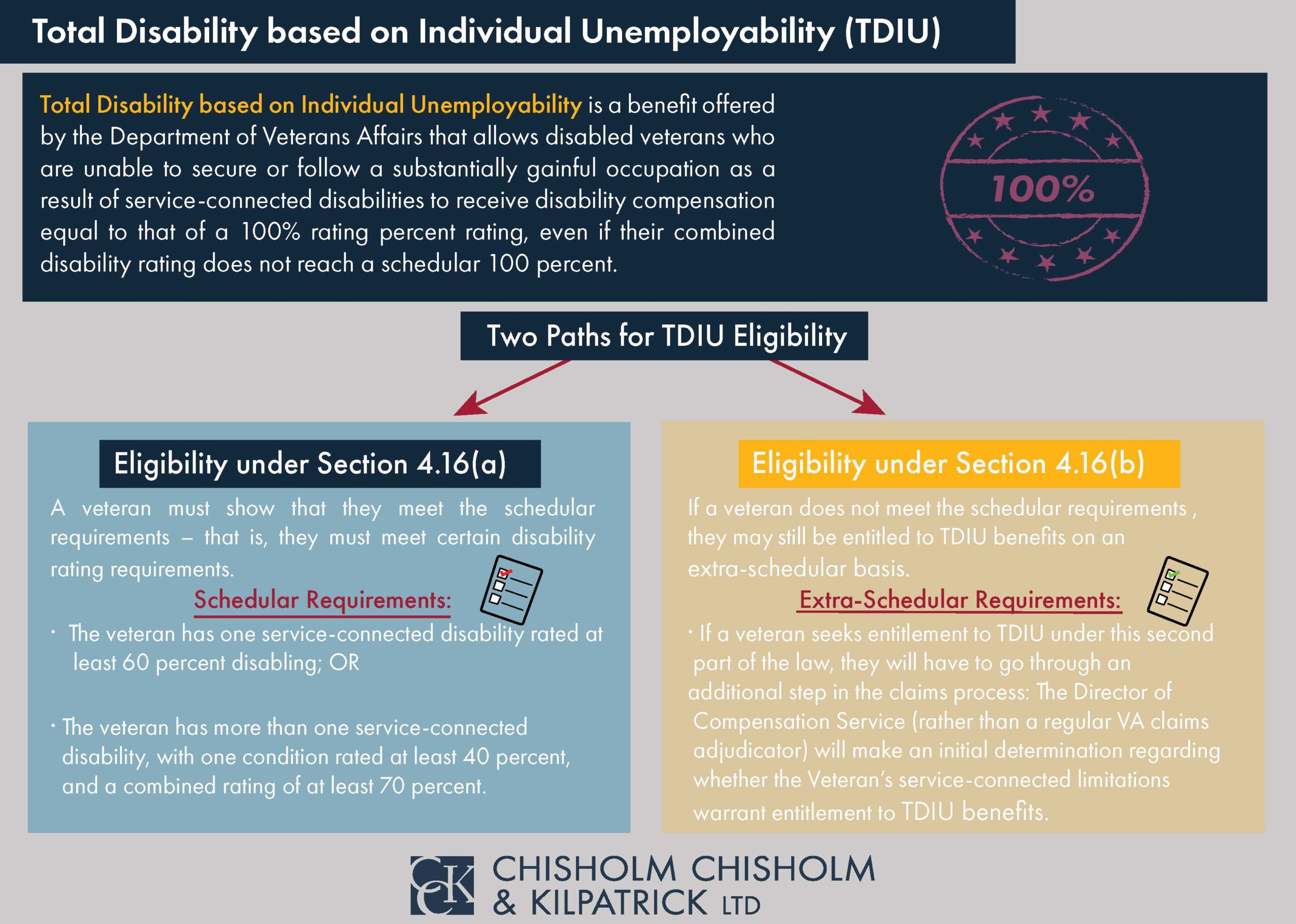

What is Total Disability Based on Individual Unemployability (TDIU)?

Total disability based on individual unemployability, or TDIU is a disability benefit that allows for veterans to be compensated at VA’s 100 percent disability rate, even if their combined schedular rating does not equal 100 percent. In this way, it is an alternative path to receiving maximum benefits. TDIU is awarded in circumstances in which veterans are unable to secure and follow substantially gainful employment as a result of their service-connected conditions. Here, substantially gainful employment refers to whether a veteran’s annual income meets or exceeds the federal poverty threshold for a single person.

Eligibility Requirements for TDIU

VA outlines TDIU regulations under 38 CFR § 4.16, which encompasses subsections (a) and (b). Each subsection describes the ways in which veterans can meet the eligibility requirements for TDIU. In order to qualify for TDIU under 38 CFR § 4.16(a), or schedular TDIU, a veteran must have:

- One service-connected condition rated at 60% or higher; or

- Two or more service-connected conditions, one of which is rated at 40% or higher, with a combined rating of 70% or higher.

Veterans who do not meet the schedular requirements under 38 CFR § 4.16(a) may still be considered for extraschedular TDIU under § 4.16(b). Extraschedular TDIU does not have any rating requirement. If veterans do not meet the criteria for schedular TDIU, VA will determine if their case should be referred to the Director of Compensation Service for extraschedular consideration.

If their TDIU claim is referred, the Director will look at their case and write an opinion on whether their service-connected conditions prevent them from securing and following substantially gainful employment. VA will then agree or disagree with the Director’s opinion to either grant or deny TDIU on an extraschedular basis.

Whether you qualify for TDIU on a schedular or an extraschedular basis, the amount of monthly compensation you receive will be the same. As of December 2023, a single veteran with no dependents will receive $3,737.85.

What Factors Does VA Consider When Adjudicating Claims for TDIU?

When adjudicating claims for TDIU, VA should consider various factors including a Veteran’s limitations, educational background, vocational history, etc. It is important to note that VA cannot consider a veteran’s non-service-connected conditions, age, or reason for retirement (if applicable). On March 14, 2019, the Court of Appeals for Veterans Claims (CAVC) issued a precedential decision in which it outlined certain standards for VA to uphold when adjudicating the issue of TDIU.

Specifically, it clarified the meaning of the phrase “unable to secure and follow substantially gainful employment.” The Court found that the phrase has both an “economic” and “noneconomic” component. Economic refers to the veteran’s ability to earn more than a marginal income. The noneconomic component involves what to assess in determining if a veteran can actually work. The Court concluded that attention must be given to the following:

- Veteran’s history and education, skills, and training

- Whether the veteran has the physical ability, both exertional and non-exertional (mental), to perform the type of activities (e.g. sedentary, light, medium, heavy, or very heavy) required by the occupation at issue – including limitations on lifting, bending, sitting, standing, walking, etc., and auditory/visual limits; and

- Whether the veteran has the mental ability to perform the activities required by the occupation at issue – including limitations on memory, concentration, ability to adapt to change, handle work place stress, get along with coworkers, and demonstrate reliability and productivity.

Evidence addressing these factors usually comes from a veteran’s own descriptions, buddy statements, and Compensation and Pension (C&P) examinations. In C&P examinations, healthcare professionals should describe a veteran’s limitations and how those limitations may or may not be relevant to the veteran’s ability to work at a competitive and substantially gainful occupation.

However, it may be helpful for veterans to submit vocational evidence in addition to medical evidence. Medical professionals (e.g. physicians, nurse practitioners, psychiatrists, etc.) may be able to talk about the veteran’s actual limitations, but how those translate to his or her ability to work is a vocational question. Specifically, when answering the question of whether a veteran is capable of working, VA must address what work actually requires, and what physical and mental capacities are needed for that. Medical experts do not typically have any training relating to that. Vocational evidence then becomes critical to address this issue.

How to Apply for TDIU

To apply for TDIU benefits, veterans must fill out and submit VA Form 21-8940: Veteran’s Application for Increased Compensation Based on Unemployability. The purpose of VA Form 21-8940 is to provide VA with additional information about the veteran, such as his or her level of education and employment history, to supplement the request for TDIU. It is important to note that TDIU is not a separate claim in and of itself, but rather part of an underlying claim or appeal for an increased rating. This was reaffirmed in a recent Court decision issued in Harper v. Wilkie where the Court held that TDIU is part and parcel of an increased rating claim whenever raised by the record or explicitly raised by the veteran.

Here, raised by the record means if there is evidence in the veteran’s file that implicates his or her service-connected conditions contribute to or cause his or her inability to maintain substantially gainful employment, then VA should adjudicate the issue of TDIU. There are multiple ways in which TDIU can be raised by the record even if a veteran has not submitted VA Form 21-8940. For example, if a veteran submits evidence showing that they were receiving Vocational Rehabilitation and Employment benefits because they were found too disabled to work, TDIU should be considered raised by the record.

Nonetheless, it is very important for veterans to submit VA Form 21-8940 when explicitly applying for TDIU, or when VA asks for it. In some cases, VA will deny a veteran’s claim for TDIU if they did not submit this form. Although a claim for TDIU is simply part of an increased rating claim, VA sometimes treats it as its own claim, which can lead to the wrong effective date if benefits are awarded. Specifically, VA may grant TDIU with an effective date based on when the veteran submitted the 8940 form. In this case, veterans have the right to appeal and make sure the effective date is correct. For TDIU, the effective date must be attached to both an open increased rating claim and when the issue was raised by the record.

Employed While Receiving TDIU Benefits

Although entitlement to TDIU is based on a veteran’s inability to secure and follow substantially gainful employment, there are certain circumstances in which veterans can continue working and still receive unemployability benefits. Namely, if a veteran’s occupation is considered to be marginal employment or a protected work environment, they may still be eligible for TDIU. Marginal employment refers to a job in which the veteran earns below the federal poverty threshold. Therefore, it is not considered substantially gainful and does not preclude the veteran from TDIU benefits.

A protected work environment allows veterans to be eligible for TDIU even if their income is above the poverty level. While VA has not specifically defined what it actually means to work in a protected work environment, CCK believes it means the veteran is at least receiving unreasonable accommodations. In other words, the employer is making changes to the essential functions of the veteran’s job, but still paying him or her at the same amount as other employees. For example, employers might not demand the same levels of productivity and reliability from the veteran, or allow more time off than typically permitted. Whether a work environment is considered “protected” is established on a facts-found basis, meaning VA will make a judgment on the facts in each individual case.

In February 2017, CCK delivered an oral argument at the CAVC, which addressed the issue of a protected work environment for TDIU purposes. In a precedential decision, the Court agreed that without a definition or a set of factors, there was no standard against which VA adjudicators could assess the facts of a case to determine whether a veteran is employed in a “protected work environment.” The Court concluded that remand was required for VA to either define the term or create a list of factors for adjudicators to use.

Are TDIU Benefits Permanent?

While TDIU benefits are not always considered permanent, they can be. If the VA decision granting TDIU also grants entitlement to Dependents Educational Assistance (DEA) benefits, that serves as an indication that the TDIU grant is permanent in nature. In the past, VA has sent out an annual form, VA Form 21-4140 to act as an employment verification form. Veterans were required to complete this form and indicate to VA if they worked at any point during the last 12 months. If they did not work, then TDIU benefits would continue. If they worked for 12 consecutive months, then TDIU can be discontinued.

However, VA recently replaced this form and now uses income verification through the Social Security Administration. Here, the fundamental question involves whether there is a reasonable likelihood in VA’s eyes that the veteran will be able to return to substantially gainful employment in the foreseeable future. If there is evidence of improvement in the veteran’s conditions or that they can return to work, then it is possible that VA can re-examine the TDIU grant and reduce benefits.

Mistakes to Avoid When Applying for TDIU

When applying for TDIU, there are several mistakes that veterans can avoid. First and foremost, if VA requests Form 21-8940, veterans should return it as soon as possible. Furthermore, it is important for veterans to fill it out correctly and completely, making sure it is consistent with what they have previously submitted. Second, VA will often look to a veteran’s non-service-connected conditions and use those as the reason why he or she is unable to work.

Veterans can try to prevent this from happening by refraining from including non-service-connected conditions in their lay statements. Instead, the lay statements should focus only on the impact of a veteran’s service-connected conditions on his or her ability to work. Finally, veterans should be completely honest about their limitations when attending C&P examinations addressing the issue of TDIU.

About the Author

Share this Post