Long-Term Disability (LTD) Claims for Accountants

There are, in the United States, approximately 1.32 million accountants. These hardworking professionals are a vital part of many major businesses, as they are responsible for the financial data of a given company or individual. As such, the cognitive abilities of an accountant are a priority for them to maintain. A medical condition that affects their cognitive skills could be detrimental to their livelihood.

Long-term disability (LTD) benefits may be necessary for an accountant who develops a medical condition that prevents them from working. They may have a “group policy” or an “individual policy,” but whichever policy they have, its purpose is the same: to protect their income when they cannot work.

How Can an Accountant Determine If They Have a Long-Term Disability Policy?

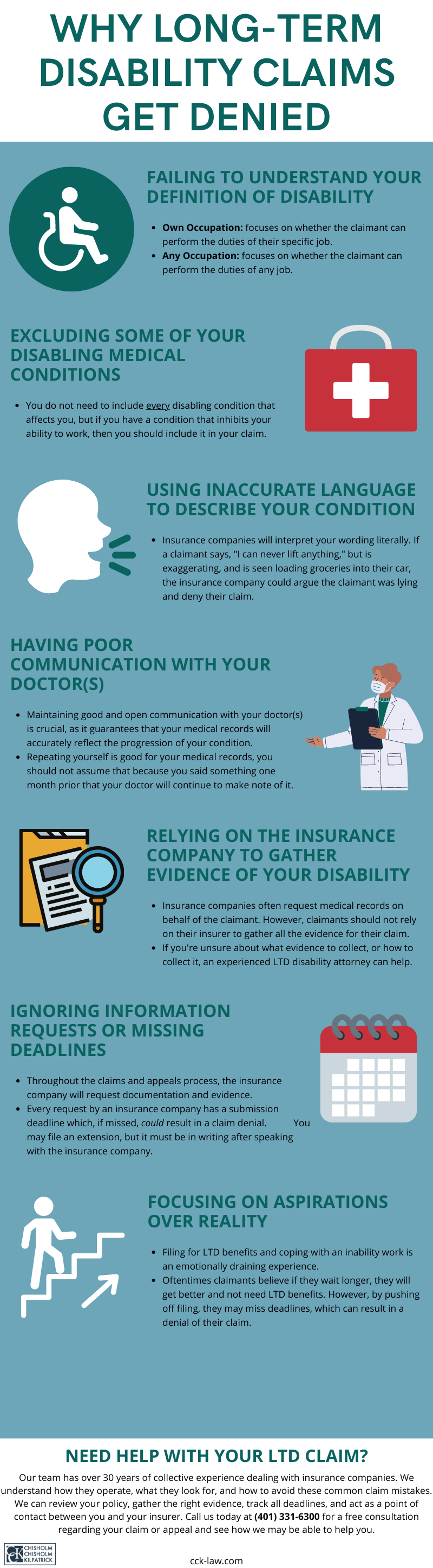

It is important to understand what type of long-term disability policy you have and what it covers. Claimants who do not understand their policy often run into issues and, as a result, commit simple mistakes that can lead to a denial of benefits.

Typically, accountants will have either a “group policy” or an “individual policy.”

- Group policies: These are long-term disability policies that your employer provides to you through a benefits package. You cannot buy a group policy yourself. Your employer may pay a part, all, or none of the monthly premiums. Of course, these policies have less flexibility than their “individual” counterparts.

- Individual policies: These are policies that you buy yourself directly from the insurance company and, therefore, must take care of the generally higher monthly premiums yourself. However, these policies also afford the policyholder more flexibility in what their LTD insurance covers.

Moreover, group policies are subject to ERISA. This federal law governs certain employer-provided benefits, including long-term disability insurance. ERISA can impact claims, especially if you do not understand its strict regulations.

If an accountant works for a company, then they most likely have a group policy. To find out, they should contact a member of human resources (HR) who can tell them. If they do have a policy through their employer, HR can provide them with the details of their policy, including any plan-governing documents.

However, an accountant may also have an individual policy. Of course, if an accountant is self-employed, then it is likely they have an individual policy, assuming they have a policy at all.

To determine if they have an individual policy, the accountant should check their personal bank statements. If they have an individual policy, they will notice premium payments to an insurance company. If so, they may contact their insurer directly and request information on their plan, including any plan-governing documents.

Important, some accountants choose to have both a group and an individual policy in order to maximize their coverage.

Accountants and the Definition of Disability

Once you determine which policy you have, it is vital to read it thoroughly. These policies are often hard to understand, and it can be easy to overlook or misunderstand something within them.

Your policy contains a lot of essential information that you should know. This information can include the maximum benefit period; limitations and exclusions; information on offsets; filing deadlines; and more. Among the most important pieces of information you will find within your policy is the “definition of disability.”

The definition of disability is what you must prove your condition meets to receive an approval of benefits. Typically, you will find either an “own occupation” definition or an “any occupation” definition within your policy.

- Own occupation: This definition is generally easier to prove when filing a claim. In short, your condition meets an “own occupation” definition if your condition prevents you from working the material duties of your specific job. Thus, you may not be able to work your own job, but you may be able to work a different job but still be disabled under your policy.

- Any occupation: If your policy has an “any” definition, it is typically harder to prove when filing a claim or an appeal. This definition asks whether you can perform the duties of any job whatsoever.

Some policies may transition from an own occupation definition to an any occupation definition after a set period — usually 24 months. When this happens, your insurer will reevaluate your claim. If they determine that your condition does not satisfy the new definition, they can terminate your benefits.

The Material Duties of an Accountant

The insurance company will look to see if your condition prevents you from performing the duties of an accountant. When you submit your claim, it is vital to explain fully how your condition affects you and what the specific duties of your job are.

The insurance company is likely to reference either the “Dictionary of Occupational Titles” (DOT) or the “O*Net Database” to ascertain the duties of your job for their review. However, the DOT has not been revised since 1991, though your insurer may still use it as a reference. Nonetheless, it is important to be cognizant of what the DOT lists as the duties of an accountant.

In the DOT, there are several entries for “accountant.” Part of the standard definition reads: “Analyzes financial information detailing assets, liabilities, and capital, and prepares balance sheet, profit and loss statements, and other reports to summarize current and projected company financial position …” This is only a fragment of the entire definition, but it is clear how the DOT summarizes the duties of an accountant.

If your insurance company decides that you did not demonstrate how your condition prevents you from performing the duties of your job — per the definition of disability within your policy — they can deny your claim.

Types of Accountants

There are several types of accountants, and each has its own set of duties. It is important to specify exactly what your job is and what you do. Some examples include:

- Certified Public Accountants (CPAs);

- Cost and Staff Accountants (i.e., management accountants);

- Chartered Accountant (CA);

- Auditor; and

- Tax Examiner.

Of course, this list could go on. The most important thing to remember is that different types of accountants may have different duties. Thus, it is vital to fully explain what your job entails and how your condition impairs you.

You Must Prove That Your Condition Impairs Your Ability to Work

Accountants must use math daily while handling highly sensitive (and important) financial information. A mistake could be detrimental and cost a company a lot of money. Therefore, any condition that impairs an account’s cognitive abilities could qualify them for long-term disability benefits.

For example, a condition such as insomnia can impact a person’s mental health. When a person suffers from insomnia, they are not getting adequate sleep; they may arrive late to work because of fatigue; or they may be irritable, tired, and liable to make mistakes. Moreover, the fatigue that comes with insomnia can also lead to other conditions such as depression or anxiety.

Additionally, a physical condition could also impair you. For example, chronic pain may make it difficult to get up in the morning, which can lead to tardiness at work.

Of course, these are just some of the conditions that may qualify an accountant for LTD benefits, but it is important to be aware of how a medical condition can make working impossible.

To prove that your condition is preventing you from carrying out the duties of your job as an accountant, you must submit evidence with your claim or appeal. Your medical records will be your primary source of evidence. Some accountants may find that their medical records are sufficient to win their benefits, but many claimants must also submit supplemental evidence to reinforce their claim.

What Happens If the Insurance Company Denies an Accountant’s LTD Claim?

Insurance companies are notoriously difficult to deal with during an LTD claim. Often, they care more about their bottom line than approving long-term disability claims. Claimants may easily get overwhelmed. During the initial claim, your insurer may deny you your benefits for any number of reasons.

Additionally, insurers typically employ surveillance tactics on claimants. They may hire someone to surveil claimants to see if any “inconsistencies” appear within the claim.

For example, if an accountant says that their condition prevents them from driving “all the time,” thereby prohibiting them from going to work, but surveillance shows them driving to a doctor’s appointment, their insurer can use this against the claim to issue a denial.

Nevertheless, the prospect of receiving a denial is a reality for many, and it may be disheartening for the claimant. In such moments, it may seem an impossible obstacle to overcome. However, if the insurance company denies your claim, you have the right to appeal.

Appealing Your Insurer’s Decision

Within your policy, there should be information on how you can appeal your insurer’s denial. It is important to pay close attention to this information because it will include important filing deadlines and other details pertaining to your appeal.

Your insurance company will send you a denial letter which will include any reasons they had for issuing the denial. You should directly address these issues in your appeal and may find that you must submit new or updated evidence to do so.

If you have an ERISA-governed plan, the administrative appeal stage is typically the last time you may submit new or updated evidence. Therefore, it is important to ensure you have all relevant evidence to support your claim on file should your case go to litigation; ERISA litigation has no jury and does not usually allow new evidence.

Are There Other Benefits Accountants May Be Eligible For?

When you file for long-term disability benefits, your insurer is likely to require you to also file for Social Security Disability Insurance (SSDI) benefits. Of course, they require this because, in the end, it benefits them — not you. In short, when you apply for SSDI benefits and, subsequently, receive them, the insurance company can offset your LTD benefits.

Nevertheless, you may be eligible for SSDI benefits. Typically, if your condition does not allow you to receive gainful employment or may result in death, you should be eligible.

However, there is no guarantee that you will qualify. For example, the definition of disability may be different from your LTD policy. Therefore, it is possible that you meet the definition of disability under your long-term disability policy but not your SSDI policy, and vice versa.

How Can Chisholm Chisholm & Kilpatrick Help with an Accountant’s LTD Claim?

At Chisholm Chisholm & Kilpatrick, we recognize that every claim is unique. We also understand how stressful filing a claim or appealing a denial is and want to help. Our legal team has over three decades of collective experience obtaining benefits for our clients. We know how the insurance company operates, and we know how to navigate these claims.

We can help you at any stage in the process by evaluating your policy; determining and collecting evidence to support your claim; submitting all forms and evidence on your behalf; acting as a point of contact between you and your insurer; and more. In short, we can handle all aspects of your claim to alleviate your stress.

Call CCK today at (800) 544-9144 for a free case evaluation. We will review your case and see if we can assist.

About the Author

Share this Post