Do I Have to Pay Back My Long-Term Disability?

Developing a disability can be stressful for you and your family. Fortunately, many employers offer long-term disability (LTD) benefits to their employees. This insurance — which you can also buy privately from an insurance company — can protect a percentage of your pre-disability earnings when you are unable to work due to an illness or injury. Typically, this percentage falls between 60 and 80 percent. So, when you cannot work for an extended period, these benefits can bring peace of mind to both you and your family. However, some claimants may wonder if they must pay back their LTD benefits to their insurer.

If your insurer approves these benefits, then you will receive benefits on a month-to-month basis. Usually, these benefits do not require you to pay them back to your insurer. However, there are exceptions of which all long-term disability claimants should be aware.

What Is a Long-Term Disability Insurance Overpayment?

First, it is pertinent to understand what an “overpayment” of LTD benefits is. Sometimes, an insurance company overpays a long-term disability claimant. This can happen due to errors committed by the claimant, but it can also occur due to errors committed by the insurance company.

Additionally, there are scenarios where an LTD insurer will apply an overpayment if you are receiving other benefits (e.g., Social Security Disability Insurance) and they did not offset your benefits. Regardless of the reasons, in these situations, your insurer can demand you reimburse them for this overpayment.

3 Common Reasons Why Claimants May Need to Pay Back LTD Benefits

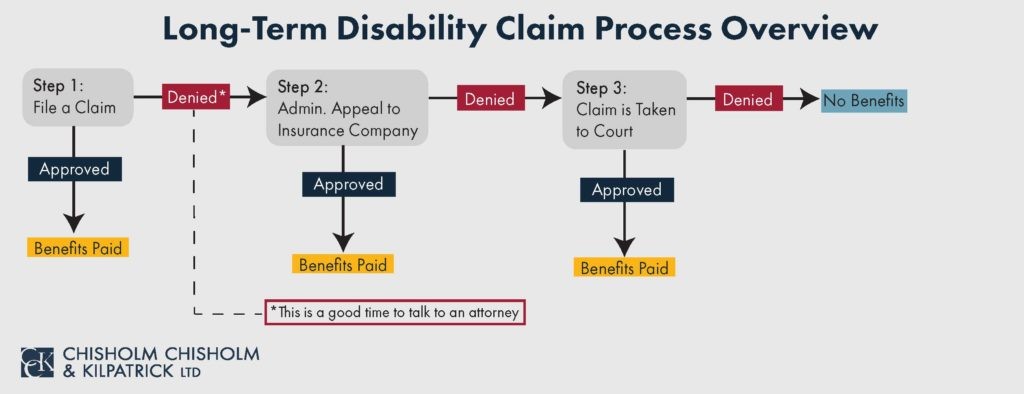

As mentioned, mistakes can happen during the long-term disability claims and appeals process. It can be disheartening when you receive benefits for your disability only to have your insurer inform you that you must pay back some of these benefits.

We will discuss three of the most common scenarios that befall long-term disability claimants and require them to repay some of their benefits to their insurers.

Social Security Disability Benefits

The most common reason that claimants must pay back long-term disability benefits is when they begin receiving Social Security Disability Insurance (SSDI) benefits.

A long-term disability insurer is entitled to offset your monthly benefits based on the disability compensation you receive from Social Security. Typically, the application process for SSDI benefits takes longer than the process of applying for long-term disability.

You may receive a denial of you SSDI claim. In these situations, you may appeal this denial but doing so may delay your receipt of these benefits further. As such, you likely will begin collecting your LTD benefits, without the applicable SSDI offset, for a period.

If your SSDI claim is then approved, then those are benefits the long-term disability insurer should have been offsetting but were not. As a result, your long-term disability claim has been overpaid.

Once you are approved for SSDI and receive your retroactive benefits, it is important to notify your long-term disability insurer so they can calculate any overpayment on your claim. Usually, the overpayment to the insurance company is most, if not all, of the retroactive benefit you receive from Social Security.

Consequently, it is important to hold onto the retroactive award you receive from Social Security so that you can pay back the long-term disability insurer in a timely manner.

Personal Injury Settlements

You may suffer an injury due to an accident, such as a motor vehicle accident or a slip and fall. In such cases, you may file a personal injury lawsuit to hold others accountable for your disability.

Comparable to SSDI benefits, personal injury settlement offsets are commonly found in group policies rather than individual policies. However, the terms surrounding this offset can vary.

For example, based on the terms of your plan, your insurer may be entitled to offset most, if not all, of your personal injury settlement. Yet in other plans, the language may state that the insurer is only entitled to offset compensation that you received due to lost wages.

When you receive a third-party settlement, it is important to inform your insurance company as soon as possible. This allows them to efficiently calculate any overpayment you may have to repay.

If you are able, you should hold onto the money you received from your settlement until you know the amount you must pay back to the insurer. By holding onto this settlement, you ensure that you repay this overpayment in a timely manner.

Working While Receiving Long-Term Disability Benefits

Lastly, it is sometimes possible to work and continue to receive long-term disability benefits. If you return to work on a full- or part-time basis and continue to meet your policy’s definition of disability, your work earnings will also likely be an offset.

In most cases, you are obligated to inform the insurance company right away if you return to work. However, there may be a delay in notifying the insurer. Likewise, the insurer may continue to pay you your full benefit without accounting for your work earnings. In such situations, you will likely owe money back to your insurer for the earnings you received during that time.

The amount of the overpayment will likely depend on the policy language. It may also depend on what, if any, formulas are used when calculating the offset for work earnings.

For example, your policy may have a dollar-for-dollar offset for work earnings. This means that you will owe the insurance company the exact amount you received working. However, in some policies, your insurer may only be entitled to offset a percentage of your work earnings. They may also use a formula to calculate how much can be offset from your benefit.

Review your policy to ensure that your insurer is calculating the offset correctly. Additionally, it is crucial to notify your insurer immediately if you return to work. Delaying this notification can increase the amount you may need to repay.

Call CCK Today for a Free Case Evaluation

Chisholm Chisholm & Kilpatrick has been helping long-term disability claimants for over 20 years obtain LTD benefits. We may be able to help you too. Our experienced attorneys understand how overpayments can affect claimants, and we can help you navigate this often complex process. In short, we will ensure that your insurer is treating you fairly and only asserting the overpayment to which they are entitled under the terms of your policy.

CCK can help you no matter where in the long-term disability process you are. Call us today at (800) 544-9144 for a case evaluation with a member of our team. We will analyze your case and determine if we can assist you.

About the Author

Share this Post