Total Disability Based on Individual Unemployability (TDIU)

CCK Law: Our Vital Role in Veterans Law

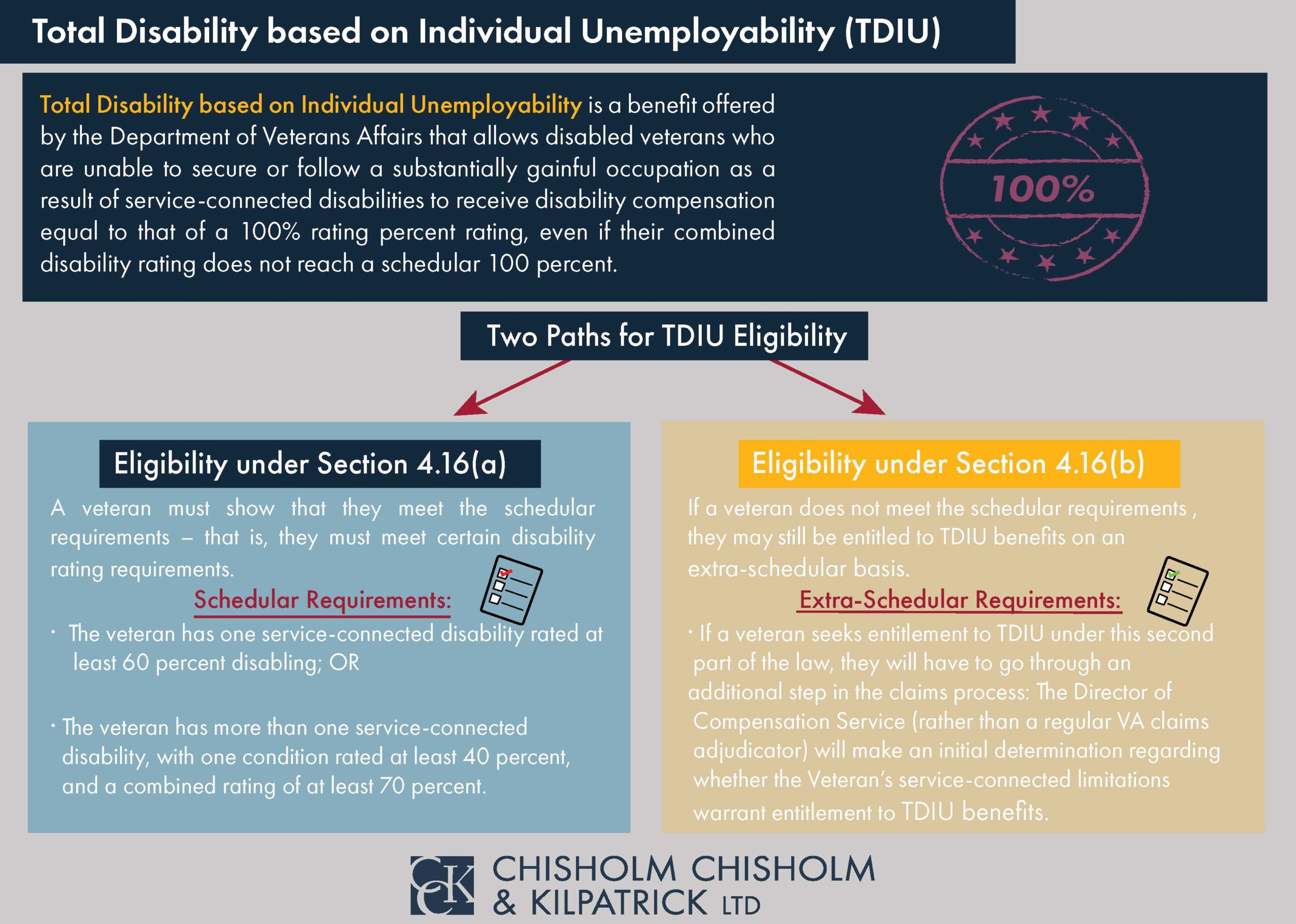

Total Disability based on Individual Unemployability (TDIU) is a benefit offered by the Department of Veterans Affairs (VA) that allows disabled veterans who are unable to work due to service-connected disabilities to receive disability compensation equal to a 100 percent rating, even if the veteran’s combined disability rating is less than that.

In this guide to TDIU benefits, we will discuss how:

- Veterans must be unable to obtain and maintain “substantially gainful employment” due to service-connected conditions to qualify for Individual Unemployability benefits.

- TDIU has a number of requirements such as ratings and income.

- CCK Law has observed that VA makes mistakes on important factors such as effective dates, and veterans should be prepared to anticipate or respond to these errors.

What Is TDIU?

Total Disability based on Individual Unemployability (TDIU) is a disability benefit that allows VA to compensate veterans at VA’s 100 percent disability rate, even if their combined schedular rating does not equal 100 percent.

TDIU is awarded in circumstances in which veterans are unable to secure or maintain substantially gainful employment due to their service-connected disabilities. TDIU can provide a substantial increase in financial benefits for those whose schedular ratings do not combine to 100 percent.

There are two types of TDIU a veteran may be awarded: schedular and extraschedular.

What Is the Benefit Amount of Individual Unemployability?

As of 2025, Individual Unemployability compensation is equivalent to a 100 percent disability rating, which is $3,831.30 per month for a single veteran.

Notes:

- Veterans receive additional monthly compensation for a spouse or dependent children.

- As with all VA compensation, the TDIU rate does change each year to align with federal Cost of Living Adjustment changes.

Visit our 2025 VA disability pay chart or 2026 VA disability pay chart to see the compensation for veterans with dependents.

Who Is Eligible for Individual Unemployability?

Any veteran with an other-than-dishonorable discharge who is unable to get or keep a substantially gainful occupation due to a service-connected disability can qualify for Individual Unemployability benefits from VA. Any service-connected mental or physical impairment can qualify a veteran for individual unemployability benefits.

Other Requirements to Be Awarded TDIU

There are two forms of TDIU: schedular and extraschedular. Both schedular and extraschedular TDIU are regulated under 38 CFR 4.16, which encompasses subsection (a) and (b). Each subsection describes a way by which veterans may meet the requirements for TDIU.

Schedular TDIU

The schedular requirements for Individual Unemployability are as follows:

- The veteran has one service-connected disability rated at least 60 percent disabling; OR

- The veteran has more than one service-connected disability, with one condition rated at least 40 percent, and a combined rating of at least 70 percent.

Extraschedular TDIU

An extraschedular disability rating is one that grants veterans a higher rating than the one they would receive based on the standard rating schedule used by VA. Therefore, if the rating schedule does not adequately reflect the severity of a veteran’s condition, they can argue for an extraschedular rating.

VA regulation 38 CFR § 3.321(b)(1) lists the criteria veterans must meet for VA to consider granting an extraschedular disability rating. First, veterans must display an “exceptional or unusual disability picture with such related factors as marked interference with employment or frequent periods of hospitalization as to render impractical the application of regular [schedular standards.” This means that the veteran’s condition must be so unique that the standard disability rating schedule does not adequately or accurately reflect the degree to which the disability limits their functional capacity.

How to Apply for TDIU

To apply for TDIU, veterans should fill out VA Form 21-8940: Veteran’s Application for Increased Compensation Based on Unemployability.

The form asks for information such as:

- The nature of your service-connected medical condition that prevents you from maintaining substantially gainful employment

- Whether you have been hospitalized or under a doctor’s care during the past 12 months

- The date you became too disabled to work

- Your employment history for the last five years you worked (It is important to note that VA requests information about the last five years when you worked, not for the previous five years. E.g., if you have not worked since 2010, you would need to give information about your employment from 2005 to 2010)

- All education and work-related training you received before and after becoming too disabled to work

There are three ways to apply for TDIU:

- Through VA’s website

- In person at a local VA office

- With the help of a legal representative or a VA-accredited claims agent

Effective Dates and TDIU

VA often sets the wrong effective date for TDIU claims. Being aware of your rights may lead to significantly higher back pay.

An “effective date” is the date from which a veteran’s benefits start. When VA approves a disability claim, the veteran receives back pay to their effective date. In most cases, a veteran’s effective date is when they filed their claim. Because of how common this is, VA will often set the effective date of your TDIU claim to when you submitted your VA Form 21-8940 (i.e., the date you sought unemployability benefits). This may be incorrect.

By law, VA must assume each veteran is seeking the highest disability rating possible. Therefore, if VA receives evidence that the veteran may be unemployable (e.g., a doctor’s observation to this effect), then VA should have proactively added a TDIU claim dated back to this point. In other words, your effective date should be when you actually became entitled to TDIU.

If you are granted individual unemployability, establishing the proper effective date can result in a substantially higher award of retroactive benefits. If you feel VA has made an error here, please contact CCK Law for a free case evaluation.

How to Use Evidence to Prove TDIU Claims

In order to adequately demonstrate entitlement to TDIU, you must show that your service-connected disabilities have prevented you from acquiring and/or maintaining substantially gainful employment. Aside from filing Form 21-8940, you will likely find it helpful to submit statements to VA explaining your service-connected disabilities, the impact they have on your daily functioning, and how they inhibit your ability to work.

Statements can be submitted from any relevant person: you, friends, family, co-workers, or previous supervisors. In addition to lay evidence, opinions from medical and vocational experts can be quite beneficial to a TDIU claim.

Another form of evidence that can be helpful in proving eligibility for TDIU is vocational expert reports. Vocational expert reports can detail the impact of that the veteran’s disabilities has on their ability to acquire or maintain substantially gainful employment. These opinions can be a powerful tool to contradict unfavorable evidence in the record, such as a compensation and pension (C&P) exam that does not support entitlement to TDIU. This is because expert opinions usually provide a more thorough analysis of the veteran’s disability than the “check-the-box” style of a C&P exam.

Learn more about vocational experts and other forms of helpful evidence for a TDIU claim.

Frequently Asked Questions about TDIU

What Is “Marginal Employment” in the Context of TDIU?

TDIU is generally reserved for veterans who are unable to secure “substantially gainful” employment. However, “marginal employment” will not disqualify a veteran for Individual Unemployability. This is because VA does not consider marginal employment to be substantially gainful.

There are two ways for a veteran’s employment to be considered “marginal” for the purposes of TDIU:

- If a veteran is working, but their income does not exceed the federal poverty threshold.

- If a veteran is working in a protected work environment. A protected work environment is a situation in which an employer is making special accommodations that allow the veteran to get and keep their job (e.g., the need for extra breaks), and these special accommodations would be considered unreasonable if the veteran were working for another employer. This type of work is considered marginal because the veteran would otherwise not be able to acquire or maintain this job without such accommodations in a competitive work environment.

Earning too much income is one of the most common reasons that VA revokes TDIU status. VA monitors income through the Social Security Administration. If VA believes that a veteran is earning more than the federal poverty threshold, it will likely ask the veteran to fill out VA Form 21-4140 to verify their employment status. If the veteran does not provide evidence of marginal employment, then VA will likely issue a notice of intent to revoke TDIU benefits. If you are struggling to prove your legitimate claim for TDIU, consider contacting CCK Law for a case evaluation.

What Happens to TDIU Status if a Veteran Retires?

If a veteran is retirement age or has already retired but their disabilities still prevent them from working, they may still be eligible for TDIU. The determination of eligibility is not based on age or the reason for leaving last employment. The relevant question is whether the disabilities presently prevent the veteran from working.

Can a Self-Employed Veteran Qualify for TDIU?

If veteran is self-employed, VA applies the same standard in determining TDIU eligibility as it does for all other veterans. Essentially, VA looks at annual income to determine whether the veteran earns above the poverty threshold, and potentially looks at the conditions of employment in making its decision. If a veteran is self-employed, they can still be eligible for TDIU.

What Can VA Not Take Into Consideration When Evaluating a Veteran for TDIU?

There are certain things VA CANNOT take into account when evaluating veterans for individual unemployability:

- VA cannot consider non-service-connected disabilities in TDIU claims – Although a veteran may have a non-service-connected condition that prevents them from working, VA cannot take that disability into consideration when evaluating them for TDIU. VA should only be evaluating the effect that your service-connected disabilities have on your ability to work.

- VA cannot consider age in TDIU claims– For the same reason VA cannot consider non-service-connected disabilities, age cannot be taken into account when evaluating a veteran for individual unemployability. Even if the veteran has retired long ago, the operative question remains: do the veteran’s service-connected disabilities prevent them from working?

- VA cannot ask why the veteran stopped working during TDIU claims – No matter the reason for leaving a prior occupation, VA cannot consider this information when evaluating a veteran for TDIU. The focus must remain on the veteran’s service-connected disabilities, and their impact on the veteran’s ability to work.

Is TDIU Permanent?

TDIU might be permanent if VA determines you have a static disability (i.e., a medical condition that will not change or improve).

There are three ways VA will indicate that your rating is total and permanent on your rating decision letter:

- Include a statement such as “Eligibility to Dependents Chapter 35 DEA/CHAMPVA are established”

- Include the phrase “No future exams are scheduled” (as VA is not planning to reevaluate your condition at a later date)

- Include language such as “total disability that is permanent in nature”

Note that there are other ways to lose TDIU status. See below.

When Can VA Reduce or Terminate My TDIU or Unemployability Benefits?

VA may propose to reduce or terminate a veteran’s Individual Unemployability benefits for a number of reasons:

- If you do not respond to a request for VA Form 21-4140, Employment Questionnaire. This request is usually triggered by VA receiving information (e.g., Social Security Administration wage reports) that you may have sustained substantially gainful employment in the previous calendar year. If you do not submit this form and evidence of continued eligibility within the deadlines provided in the request, your benefits may be subject to reduction or termination.

- If your ability to maintain substantially gainful employment changes and you are able to work.

- If your service-connected condition(s) have improved, warranting a lower rating.

- If VA eliminates the benefit or changes the requirements. (As of 2025, this is highly unlikely.)

What Is the Difference Between 100% Schedular Ratings, Permanent and Total Disability, and TDIU?

- Total Disability based on Individual Unemployability (TDIU) is a benefit reserved for veterans whose disabilities do not combine to 100 percent, but who are deemed unable to acquire or maintain a gainful occupation; these veterans are compensated at an amount equal to a 100 percent disability rating.

- 100% Schedular Ratings are assigned to veterans whose disabilities combine to 100 percent (using VA math) and are therefore paid at the 100 percent rate.

- Permanent and Total (P&T) disability ratings are assigned for service-connected disability(s) if the condition is totally disabling and not expected to improve. Those assigned a P&T disability rating will not have to undergo future reevaluations from VA. They will be paid at the 100 percent rate.

Can I Collect Individual Unemployability Benefits and Social Security Benefits at the Same Time?

Yes, veterans can collect both SSDI and TDIU benefits simultaneously with no offset. Keep in mind that each program has different requirements, and approval for one benefit does not guarantee entitlement to the other.

What If My VA Individual Unemployability Benefits Claim Has Been Denied?

If your claim for Total Disability based on Individual Unemployability has been denied, you can appeal VA’s decision. Keep in mind that, in most cases, veterans have one year to appeal a denied claim before the decision becomes final. After that, the veteran will need to start over with a new claim and a new effective date (i.e., less back pay).

If you choose to appeal, it is highly advisable to seek assistance from an experienced VA individual unemployability attorney or accredited representative.

How Much Does It Cost to Have an Attorney Help with a VA TDIU Appeal?

The attorneys and accredited representatives at Chisholm Chisholm & Kilpatrick work on a contingency fee basis, meaning there is no cost to the veteran unless we win retroactive benefits for you from VA, otherwise known as back pay. VA-accredited disability attorneys do not charge veterans more than 33 percent of retroactive benefits (plus added expenses such as outside experts).

Contact the Individual Unemployability Lawyers at Chisholm Chisholm & Kilpatrick Today

If your claim for total disability based on individual unemployability (TDIU) benefits has been denied, the experienced team of accredited representatives at Chisholm Chisholm & Kilpatrick may be able to help. We take pride in fighting for the benefits you deserve. Contact us for a free consultation at 800-544-9144.

Client Testimonials

“Chisholm Chisholm Kilpatrick LTD has represented us since we were turned down for T.D.I.U. at the B.V.A. Our claim went all the way to Court. The court remanded the case back to the R.O. for T.D.I.U., our attorneys appealed there denial back to the B.V.A. We filed for T.D.I.U. in 2007. We got our favorable decision in 2014 and was awarded T.D.I.U. but only went back to 2009. We were awarded more than $83,000. Chisholm + Chisholm + Kilpatrick L.T.D. filed an appealed for T.D.I.U. from 2007 to 2009 we got a favorable decision in 2017 and awarded $104,948. I would highly recommend this law firm. They went above my expectations, and kept us informed at every step. Job well done!”

Shirley T.

“I am a Vietnam vet. I was exposed to Agent Orange in Vietnam. I have many physical problems treated by the VA hospital for years. By the year 2001 I was no longer able to work. The VA over time would only give me a 60% disability. I kept trying to get a higher percentage but could not for 17 years. Chisholm Chisholm & Kilpatrick offered to help me, and in a short time due to them I received a 100% disability with backpay. Thank you.”

James D.

“I was fighting for my VA disability compensation for 10 years. I was ready to give up and then CCK took my case. I immediately felt at ease because they kept me informed every step of the way and there was so much less stress for me. Thanks to CCK I am now receiving TDIU benefits and I am very thankful.”

Raul B.

Share this Post