Long-Term Disability Lump-Sum Settlement Offers: What to Know

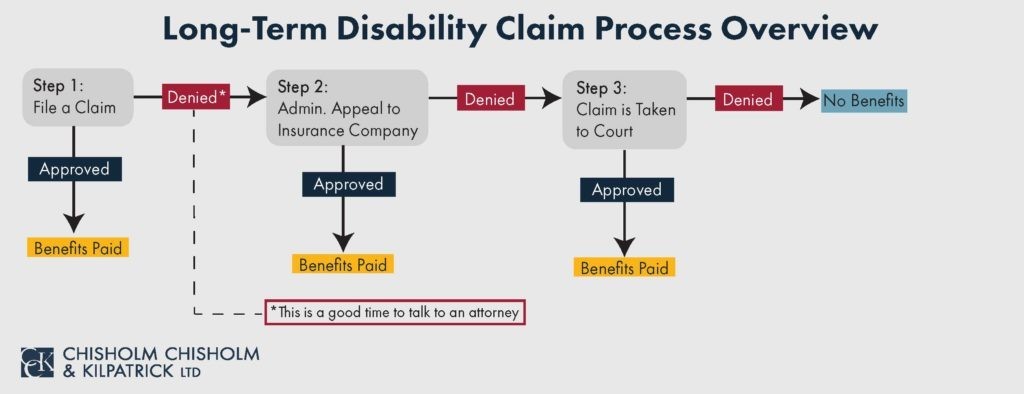

If you become disabled and are unable to work, you might qualify for long-term disability (LTD) insurance benefits. Long-term disability insurance protects a portion of your income in the event that a medical condition renders you unable to work. Once your LTD claim is approved, you will typically begin receiving monthly benefits. However, at some point, the insurance company may offer you a lump-sum settlement in lieu of continued monthly benefits or to avoid a lawsuit in court.

In this article, CCK Law will discuss:

- Lump-sum settlement offers

- Why insurance companies offer such settlements

- The pros and cons of accepting a lump-sum settlement offer

- And more

What is a Lump-Sum Settlement Offer?

A lump-sum settlement is when your insurance company offers to pay you your future long-term disability benefits in one lump sum now, rather than continuing to send you monthly benefits. Typically, lump-sum settlement offers are only for a portion, rather than the full value, of your future long-term disability benefits. If you accept such a settlement, you will not receive any further monthly benefits.

There are advantages and disadvantages to accepting a lump-sum settlement offer, and while a sizable, immediate sum of money may seem tempting at first, it is important to fully evaluate your options before making your decision.

Why Would an Insurance Company Make a Lump-Sum Settlement Offer?

It is important to note that when an insurance company makes a settlement offer, it is likely because it is to its advantage as a business to do so. Insurance companies typically offer lump-sum settlements because they believe, in the long run, it will save them money compared to paying you monthly benefits for the duration of your disability.

Not all claimants are offered lump-sum settlements. This is because insurance companies consider a number of factors when determining whether a one-time payment is more cost-effective for their business than continuing monthly payments.

These factors include:

- The nature of your disability: If the nature of your disability is such that your condition is not likely to improve, the insurance company may be more likely to offer you a settlement. This is because you are likely to receive LTD benefits for the maximum benefit period, and thus the insurance company is almost guaranteed to pay you the full value of your future long-term disability benefits if you remain on claim. Because settlement offers are typically only for a portion of your future LTD benefits, an accepted lump-sum settlement allows the insurance company to reduce the overall amount it must pay on your claim.

- Your age/The duration of your policy: Alternatively, a young person has a greater chance of resolving their disability before the maximum benefit period is reached. In this situation, an insurance company is less likely to offer a settlement as your condition may improve, and they may be able to stop paying you at an earlier date.

Things to Consider When the Insurance Company Offers You A Lump-Sum Settlement

If you are considering a lump-sum settlement offer from your long-term disability (LTD) insurance company, there are some questions you may want to ask yourself or a lawyer.

These questions can include:

- What is my long-term disability claim’s current value? To properly evaluate the insurance company’s settlement offer, you need to determine the full value of your LTD benefits. As mentioned above, often the insurance company’s offer is less than the full present value of your long-term disability claim. Calculating the full value of your LTD benefits allows you to evaluate exactly how much money you would be giving up if you were to accept the lump-sum settlement. Determining the full value of your claim may seem as simple as taking your monthly benefit and multiplying it by the maximum number of years you could receive it, but that is often not the case. Money today is worth more than money several years from now. Consequently, you need to reduce your future monthly long-term disability benefits to their present value to properly calculate the value of your claim. Once you have determined the present value of your future benefits, you can compare this to the insurance company’s lump-sum settlement offer. The insurance company may have calculated a different present value in reaching its settlement offer. It is important to carefully review the insurance company’s calculations and consider seeking outside opinions from lawyers or financial experts to help you evaluate the offer if necessary.

- Does my policy include terms for fluctuations in payment? Some long-term disability policies include cost-of-living adjustments, which can increase the value of your benefit over time. If your policy includes such terms, it is important to make sure that you are taking those into account when determining whether it is worth it to you to give up future monthly benefits in exchange for a lump sum now.

- What is my life expectancy? If you will not reach retirement age for ten or twenty years and expect that you will be receiving benefits for that long, it is important to consider how a lump-sum settlement’s value will change over time and whether it will last for that entire period of time. If you are older, or if your disabling condition is terminal, you may want to consider how a lump-sum settlement will provide for your family or loved ones after your death, as monthly benefits will cease once you are gone.

- Will my lump-sum settlement be taxed? If your lump-sum settlement is taxable, it is important to be aware that your settlement total may be significantly reduced by taxes. If you are considering accepting a lump-sum settlement, you should consider discussing the tax implications of such a settlement with an accountant or other tax professional.

- Am I good with my finances? While receiving a large sum of money is tempting, it is very important to consider how this money will be spent and how long it will last you. Long-term disability benefits provide a steady monthly income. Suppose you rely on that monthly income to support yourself or your family. In that case, you need to consider how you will manage your money and support yourself going forward if you choose to forego those monthly benefits in favor of a lump-sum settlement. Consider your costs of living, the money you spend on managing your condition, and if that might increase over time, and how a lump-sum settlement may be used to provide for your family. It can be useful to put a financial plan in place. It is also important to be honest with yourself regarding how well you handle money and whether you can trust yourself to make the lump-sum settlement last if necessary.

Pros and Cons of a Lump-Sum Settlement Offer

To some, the decision of whether or not to accept a lump-sum settlement offer may seem clear. However, there are both positives and negatives that come with accepting an LTD settlement, and it is important to consider them all.

Pros:

- Once you accept a lump-sum settlement offer, your relationship with the long-term disability insurance company is over. After you accept, you will no longer have to worry about dealing with them regarding payments, requests for updated records and documentation, or policy changes.

- You do not have to worry about your insurance company reassessing your disability and terminating your benefits.

- You can invest the lump-sum settlement to grow your rate of return funds for the future.

- The lump-sum settlement becomes part of your estate and can be passed down in the event of your death, while your long-term disability benefits would simply end if you passed away while on claim.

- If your disability improves and you want to try to return to work, you do not have to worry about it negatively affecting your long-term disability benefits.

Cons:

- The offer you accept will likely be lower than the total value of your long-term disability benefit claim.

- You no longer have a steady monthly income.

- Once you accept, your relationship with your long-term disability insurance company is over, and you cannot renegotiate or resume receiving monthly benefits.

- Accepting a settlement offer can sometimes disqualify you from other benefits.

- If you spend the money too quickly or are not careful with your finances, you may not have the funds necessary to support yourself in the future.

Negotiating a Lump-Sum Settlement Offer

While you can decide to accept a lump-sum settlement offer on your own, seeking outside opinions is often recommended. The help of a lawyer in this decision can be highly valuable, especially if you are going to negotiate an offer with your insurance company. Often, an insurance company’s first settlement offer is much lower than the total value of your long-term disability claim. An attorney can help try to increase the insurance company’s offer or provide advice as to whether a settlement is the best option for you.

Alternatively, you may be receiving monthly benefits and decide you may want to request a lump-sum settlement from the insurance company. Insurance companies may not want to consider this for your particular claim, or if they do, they may question your motivation for requesting a settlement. This could lead to a reevaluation of your claim, which could put your current benefits in danger. Before attempting such negotiations, it is often a good idea to seek legal counsel.

Remember that a lump-sum settlement is almost always in the interest of the insurance company and not because they have determined that it is the best option for you. You need to consider all your options before agreeing to a settlement so that you can be sure you are getting what you deserve.

How Chisholm Chisholm & Kilpatrick Can Help

Chisholm Chisholm & Kilpatrick has a team of legal professionals with expertise in long-term disability and ERISA law. If you need guidance on how to handle a lump-sum settlement offer with your insurance company, they are ready to assist you. Our attorneys know how insurance companies operate and are experienced with the ways they seek to save money by offering settlements. A member of our team can evaluate your claim and help you navigate this process if you have been offered a settlement.

Our lawyers are also here to help if you suspect you are being treated unfairly by your insurance company or have been wrongfully denied benefits. We understand that handling your long-term disability claim and making important financial decisions, while also trying to manage a disabling health condition, can be extremely stressful.

Call CCK today at (800) 544-9144 for a free case evaluation. A member of our team will analyze your case and determine if we can assist you.

About the Author

Share this Post