Long-Term Disability (LTD) Claims for Anesthesiologists

When a medical professional, such as an anesthesiologist, develops a condition that impairs their ability to work, it can be overwhelming. When they cannot adequately perform their duties, their patients suffer.

If you find yourself unable to work, you may want to consider filing for LTD benefits. This article will address some of the questions you may have as an anesthesiologist filing for long-term disability benefits.

Why Should Anesthesiologists Consider Filing for LTD Benefits?

Anesthesiologists are vital members of the medical community. They are doctors who specialize in medicine that helps control pain—usually during medical procedures such as surgery. This medicine usually puts the patient to sleep so that they do not feel any pain during the procedure. Anesthesiologists monitor the heart rate, breathing, blood pressure, body temperature, and bodily fluids of the patients. Moreover, they may also help manage the pain after the surgery.

When the physical and/or cognitive abilities of an anesthesiologist are impaired, it can make their job stressful and nearly impossible to complete. Therefore, it is vital that an anesthesiologist file for long-term disability benefits. LTD benefits help medical professionals focus on their health while also protecting the well-being of their patients.

How Can I Find Out More About My Long-Term Disability Coverage?

Before you file for long-term disability benefits, it is important to understand your coverage. Generally, there are two types of LTD policies: individual and group policies. Individual policies are purchased directly from an insurance company. Group policies are provided through an employer’s benefits package.

Some people decide to have both an individual and a group policy simultaneously. Anesthesiologists may choose this option to cover supplemental costs and ensure maximum coverage.

How can anesthesiologists find out more about their coverage? If you believe that you have a group policy, you can ask your employer directly. Usually, you would contact someone in human resources. If your benefits package includes LTD coverage, your employer will inform you and provide you with all the relevant documents pertaining to your plan.

However, if you do not have a group policy or believe you may also have an individual policy, you can check your financial accounts. If you see recurring premium payments, then you most likely have an individual policy. You can also contact the insurance company directly and request information on your coverage.

Once you have received your policy’s documents—whether through your employer or directly from the insurance company—you can begin to review them. All relevant information pertaining to your long-term disability coverage is contained therein. This information can include certain filing deadlines; how to appeal; maximum benefits period; and more.

Why Is It Important to Read and Understand My Long-Term Disability Policy?

As mentioned, your long-term disability policy has a lot of valuable information that guides you through the claim process.

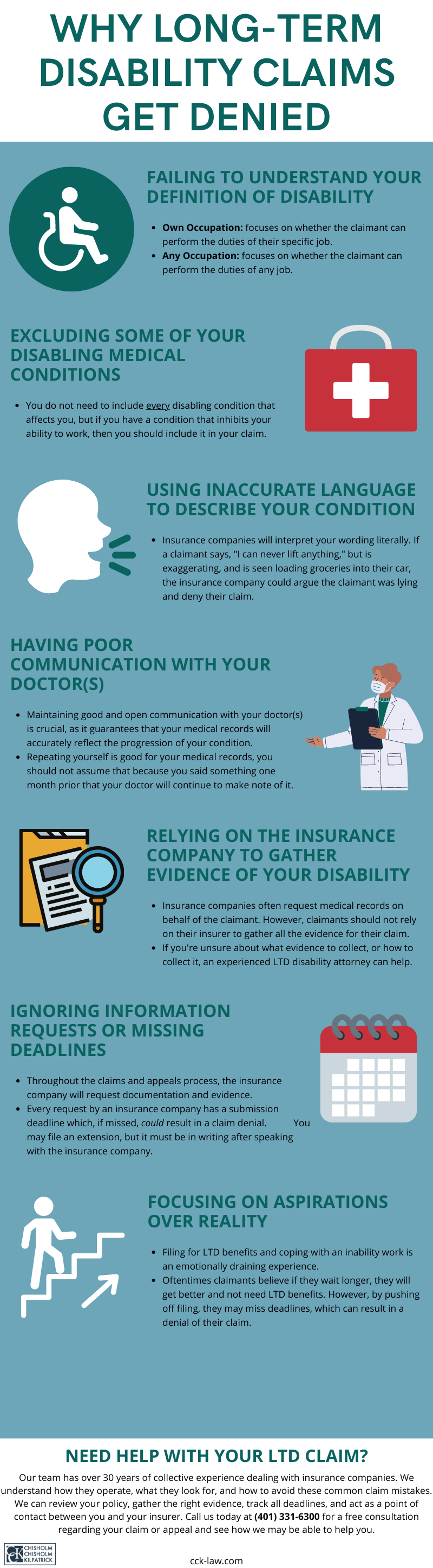

You must thoroughly read and understand your long-term disability policy. When you understand your policy, you equip yourself with the knowledge to evaluate your coverage. Properly evaluating your policy will help you avoid common mistakes while filing for your benefits.

The Definition of Disability and Its Importance for an LTD Claim

One of the most important pieces of information located within your LTD policy is a definition of disability. Every policy has a definition, and every claimant must prove they meet this definition to receive long-term disability benefits.

An insurance company will only consider you “disabled” if you can prove you are disabled under this definition. Typically, there are two definitions of disability: the “own occupation” definition and the “any occupation” definition. While the specific wording of these definitions may vary between policies, they generally follow the same principle.

The own occupation definition asks whether you can do the duties of your specific job, i.e., your own job. Anesthesiologists are likely to have an own occupation definition within their policy. Many medical professionals have an own occupation definition because of the highly specialized nature of their jobs and because of the high pay associated with their professions. Ordinarily, own occupation definitions are easier to prove.

The any occupation definition asks whether you can perform the duties of any job whatsoever. For example, anesthesiologists do have desk work to complete; therefore, the any occupation definition would ask whether they can still perform other sedentary jobs, regardless of their relation to their current position. Typically, a policy with an any occupation definition is harder to prove.

Additionally, some policies will switch from one definition to another after a certain period has passed. Usually, an own occupation definition will transition to an any occupation. The period before this happens is generally between 12 and 24 months. However, not all policies make this switch, so it is important to carefully read all documentation first to know if this is something about which you must worry.

This definition of disability is very important for your LTD claim. Once you know and understand which definition of disability your policy adheres to, you will know what evidence you must gather to prove it.

What Issues Do Anesthesiologists Face When Filing a Long-Term Disability Claim?

There are several issues an anesthesiologist might face when filing a long-term disability claim. The LTD process is generally split into three phases: the initial claim; the administrative appeal; and litigation. Ideally, the claim process would not go to the administrative appeal. Unfortunately, it is common for insurance companies to deny initial claims.

Dealing with insurance companies is difficult. They routinely ask for additional evidence or documentation and tend to prioritize their financial needs over their clients’ health needs. This leads to issues for anesthesiologists who need LTD benefits. For example, if a claimant misses a single deadline, the insurance company can deny their claim.

Insurance companies do not want to pay claims if they can help it. They often look for reasons to issue a denial. They use several tactics for this, including conducting surveillance against claimants to raise doubt. For example, a private investigator may be hired to stake out the claimant’s house and take photographs. If these photographs show anything that counters the claim of disability, it can be used to issue a denial.

Moreover, insurance companies also routinely generalize the duties of different professions. Therefore, it is important to document your pre-disability duties. Make sure to meticulously list every duty your specific job entails. This will help add specificity to these generalized definitions and avoid wrongful denials of benefits.

When you submit an initial claim for LTD benefits—or an appeal of a denial of benefits—you must submit evidence that proves your disability. If you do not submit enough evidence, the insurance company is likely to cite a “lack of evidence” and deny your claim. Therefore, it is best to provide supplemental evidence. Supplemental evidence can include specialized reports from your treating physicians; witness statements from family, friends, and coworkers; and outside experts’ opinions.

What Other Benefits May Be Available to Me?

The first benefits you turn to may be your long-term disability benefits, but you may also be eligible for Social Security Disability Insurance (SSDI) benefits.

There are several rules that apply to SSDI claims. Anesthesiologists usually obtain SSDI benefits when their disability is expected to last at least one year or result in death. Additionally, if someone is unable to perform any substantial gainful activity, they may be eligible for SSDI benefits, too.

It is important to note that the definition of disability can be different under SSDI claims versus LTD claims. There are different rules for each type of claim. You may find that you are disabled under one policy but not the other.

What If My Insurance Company Denies My Long-Term Disability Claim?

As mentioned, insurance companies routinely deny LTD claims. However, when your claim is denied, you have the right to appeal. The administrative appeal stage is a critical phase. If you have a group policy, then it is likely governed by ERISA law. This means that if your insurance company denies your initial claim, the appeal stage is your last opportunity to submit new or updated evidence. This is significant if your appeal is denied and must go to litigation.

However, this is not a process you must do alone. While many claimants decide to handle this process by themselves, it is beneficial to have a long-term disability lawyer to help assist you. An attorney can act as a point of contact between you and the insurance company. The LTD lawyers from Chisholm Chisholm & Kilpatrick have over three decades of experience dealing with insurance companies and know how they operate. We want to alleviate the stress associated with the long-term disability claim process so you may focus on what is most important: your health.

Call CCK Today for a Free Case Evaluation

If your insurance company denies your long-term disability claim, you may want to contact an attorney. The legal team at CCK is prepared to fight for your benefits. We will represent you throughout the entire process. Even after your insurance company approves your benefits, we can continue to represent you should they require further information.

Call us today at (800) 544-9144 for a free case evaluation with a member of our team. We will evaluate your claim and see if we may be able to help you.

About the Author

Share this Post