7 Common Long-Term Disability Claim Mistakes

The long-term disability (LTD) claim process is complex, and simple mistakes can be detrimental when filing a claim for LTD benefits. Insurance companies do not want to approve claims if they can help it, so a simple mistake can be enough for them to issue a denial.

In this article, we will discuss seven of the most common long-term disability claim mistakes and what you can do to avoid them.

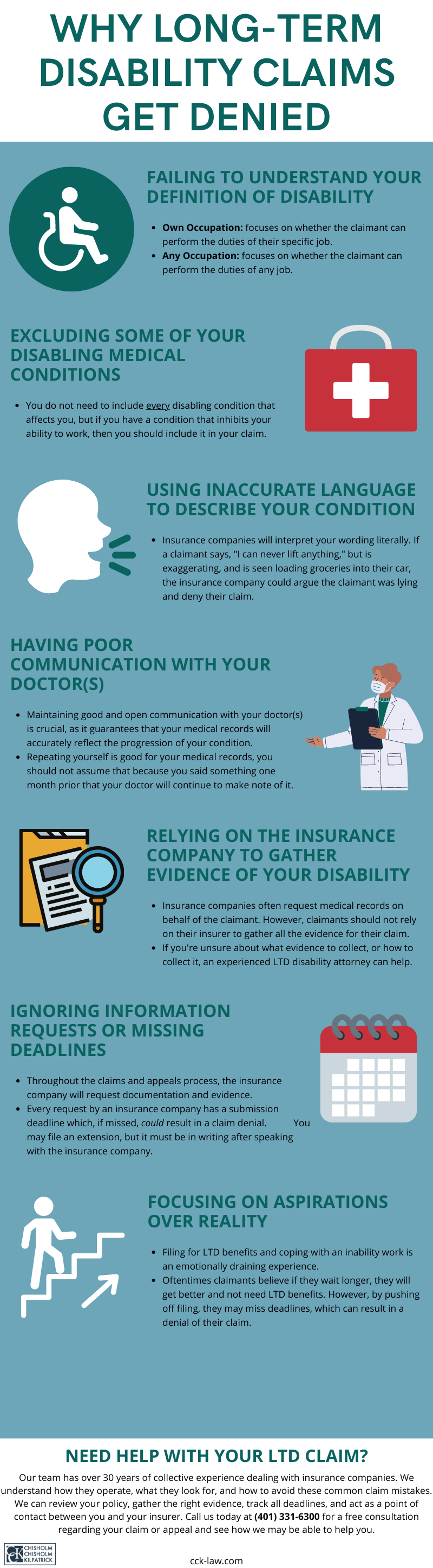

1. Failing to Understand Your Definition of Disability

Many claimants fail to understand the definition of disability located within their long-term disability insurance policy. Every policy contains such a definition, and it is a vital component of a person’s claim.

Typically, there are two types of definitions a claimant is likely to encounter: own occupation and any occupation. The own occupation definition focuses on whether the claimant can perform the duties of their specific job. The any occupation definition is broader, asking if they can perform the duties of any job. In some cases, any occupation definitions also include a “gainful component,” which refers to whether the claimant can perform the duties of a job that covers a certain percentage of their pre-disability earnings.

Some long-term disability policies include both definitions; in this instance, the own occupation definition typically transitions to an any occupation definition after a set time—usually 24 to 48 months.

It is important to know the specifics of your definition of disability, as you must demonstrate how you meet it in order to receive benefits.

2. Excluding Some of Your Disabling Medical Conditions

Most claimants usually have one primary condition that impairs them. In their claim, they may focus on this condition exclusively. This is a common mistake as there are other conditions you may have that also impair your ability to work.

Of course, this does not mean you need to include every disabling condition that affects you. Some conditions may have no relevance to your claim or to your primary ailment. Yet some are relevant. A good rule of thumb is that if you have a condition that inhibits your ability to work, you should include it in your claim.

If you are unsure of what to include, this is a suitable time to consult an experienced long-term disability lawyer. An LTD lawyer understands what insurance companies are looking for and what to include with a claim. They can guide you through this process to ensure you are accurately presenting your entire situation.

3. Using Inaccurate Language to Describe Your Condition

When speaking with family and friends, it is normal for people to say something like, “I can never drive anymore.” While this type of phrase may seem harmless, claimants should not use them in their claim. It is among the most common claim mistakes to use such language when describing a condition’s effects.

Insurance companies will interpret this language literally. For example, a person who says “I can never lift anything” may find themselves in a tough situation. The insurance company will take such language as absolute truth.

Insurers often use surveillance tactics to monitor claimants. So, if a person who says they can never lift anything is seen lifting a bag of groceries into their car, the insurance company could argue that they lied and deny the claim as a result.

You can avoid this issue by using accurate and detailed language to describe your condition. Be honest and avoid downplaying or exaggerating your condition. For example, perhaps you can lift things sparingly, or only if they are under a certain weight. Rather than stating, “I can never lift anything,” it is more accurate to say, “I rarely can lift anything.”

However, if you truly cannot lift anything, it is okay to use absolute language. It is important to analyze your situation and describe it as fully and honestly as you can.

4. Having Poor Communication with Your Doctor(s)

Maintaining good and open communication with your doctor(s) is crucial, as it guarantees that your medical records will accurately reflect the progression of your condition. However, many people do not like discussing their condition in detail with their doctor or may feel embarrassed to do so.

If you fail to tell your doctor specifically what you are experiencing, they cannot note it in your records. Further, if you say you are “okay,” the insurance company could infer that you no longer require LTD benefits. Yet you may have only meant that you were “okay” relative to the last time you visited your doctor.

Moreover, repeating yourself is good for your medical records. You should not assume that because you said something one month prior that your doctor will continue to make note of it. Instead, it is helpful to keep telling your doctor what you experience each visit, even if you have said it before. This ensures your doctor will make note of it, and this will show how debilitating your condition is over time.

It may also be beneficial to keep a symptom diary. Sometimes people forget what symptoms they have when they visit the doctor. When you bring a detailed symptom diary to your appointments, it shows exactly what you experience each day. You may decide to include medications you take, how well you sleep, and other factors that affect your ability to work.

5. Relying on the Insurance Company to Gather Evidence of Your Disability

Insurance companies often request medical records on behalf of the claimant. However, claimants should not rely on their insurer to gather all the evidence for their claim. There are a few reasons for this.

First, insurance companies handle many claims. As a result, it is common for delays to occur in the acquisition of your medical records. Additionally, insurers sometimes use third parties to collect these medical records, which can result in further delays or incomplete files.

To ensure that your insurance company receives all relevant evidence, you should collect it yourself. Moreover, doctors are more likely to quickly respond to patient requests for records rather than an insurance company’s requests.

If you are not sure about what evidence to collect, or how to collect it, an experienced long-term disability attorney can assist you. Consulting an LTD lawyer is beneficial as they can review your long-term disability policy and determine the best evidence to prove your claim.

6. Ignoring Information Requests or Missing Deadlines

Throughout the claim and appeal process, the insurance company will request documentation and evidence. It is easy to want to push these requests aside, but this can lead to complications.

Every request by an insurance company has a submission deadline which, if missed, could result in a claim denial. Likewise, if you are receiving benefits and miss a deadline, it could give your insurer grounds to terminate your benefits.

If you know that you cannot submit the requested materials by the set deadline, you should communicate this directly with the insurance company. You may file for an extension, but you must get this extension in writing.

Additionally, if you receive your LTD policy through your employer, then ERISA law governs it. ERISA law brings its own set of deadlines and strict rules to which you also must adhere.

7. Focusing on Your Aspirations Rather Than Your Reality

Hardworking professionals rarely want to stop working. Filing for long-term disability benefits and coping with their inability to work is an emotionally draining experience. One of the most common claim mistakes one can make is focusing on their aspirations for the future rather than the reality of their situation.

What does this mean? Oftentimes, claimants believe if they wait a little longer, they will get better and not need their LTD benefits. However, by pushing off filing for benefits, they may miss deadlines, which can result in a denial of their claim.

Similarly, a person receiving benefits may believe they are well enough to return to work. If you can return to work, you should; but it is not beneficial to do so prematurely.

It is best to fully analyze what you can do in your current state and be realistic about what you cannot. Returning to work is a big step and not one you should rush into. A good option is to make a return-to-work plan with your doctor. This plan can outline what you must accomplish before your doctor signs you off to return to work. Moreover, it is important, in most situations, to share this plan with your insurance company so that there is no confusion over your intentions.

Call Chisholm Chisholm & Kilpatrick Today

These seven common mistakes do not have to define your long-term disability claim. Recognizing and understanding them can help you avoid them. Filing for LTD benefits can be stressful, but the legal team at Chisholm Chisholm & Kilpatrick understands this and wants to help.

Our team has over 30 years of collective experience dealing with insurance companies. We understand how they operate, what they look for, and how to avoid these common claim mistakes. We can review your policy, gather the right evidence, track all deadlines, and act as a point of contact between you and your insurer. In short, we can help you no matter where in the long-term disability process you are.

Call us today at 800-544-9144 for a free consultation regarding your claim or appeal and see how we may be able to help you.

About the Author

Share this Post