Long-Term Disability Insurance: What Is It, and Is It Worth Getting?

Unfortunately, we as humans are not invincible. It is easy to assume that “an accident won’t happen to me,” or “I’m healthy! I won’t get sick,” or “my illness really isn’t that bad.” Of course, there is no way of knowing what will happen in the future, which is why insurance exists in the first place: to financially safeguard us from unfortunate accidents or circumstances.

As much as we might not like the consider it, it is possible that an accident or illness could debilitate us enough that we are no longer able to successfully work. According to the Social Security Administration, about 1 out of every 4 people currently 20- years of age will become disabled before reaching retirement age. It is scary to consider, especially if you have a family who depends on your income, but this is where long-term disability (LTD) insurance can help. If you want to protect your income in the case that you become disabled and unable to work, you may want to consider purchasing long-term disability insurance. Such benefits can provide you with a monthly benefit amount that can help cover your expenses.

What is Long-Term Disability Insurance?

Long-term disability (LTD) insurance is an insurance policy that replaces all or a percentage of your income if you become disabled due to illness or injury and cannot work. Long-term disability insurance can be purchased directly from an insurance company or you may receive it as a benefit through your place of employment.

Long-term disability insurance may cover disabling medical conditions for upwards of two, five, or even ten years, depending on the individual policy and your medical condition. It may also cover you until you reach retirement age.

How Does Long-Term Disability Insurance Work?

In short, if you apply for long-term disability benefits and are approved, you will begin receiving benefit checks that cover all or a portion of your pre-disability earnings.

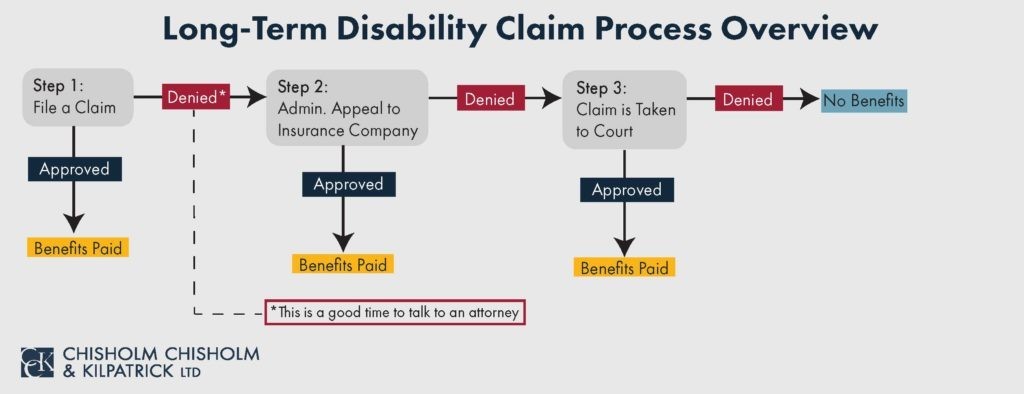

In order to receive long-term disability insurance benefits, you will have to file a claim with your insurance company. This claim must include evidence of your disabling condition, such as medical records and physician’s notes. You can handle your claim yourself, but it can sometimes be useful to involve a long-term disability attorney, especially if your initial claim is denied by the insurance company and you have to file an appeal.

Once your claim is approved, you will begin to receive benefits. However, there is often a waiting period that takes place before you receive your first benefit check. This waiting period, often referred to as an elimination period, typically lasts 60 to 180 days, depending on your specific policy. The elimination period typically begins after the day you first began missing work due to your disability.

Once you begin to receive benefits, you will get them monthly until you are able to return to work, or for the period of time specified by your policy. There are also policies that allow for a partial return to work, but you will need to review your policy’s guidelines carefully to avoid termination of benefits.

How Much Does Long-Term Disability Insurance Pay?

LTD insurance typically pays a reduced portion of your regular monthly income, usually ranging from 60 to 80 percent of your normal income.

Are There Any Offsets to My Long-Term Disability Insurance?

LTD insurance benefits will often be offset by other income you receive while disabled. Other income could include, Social Security Disability Insurance (SSDI) benefits, passive income from a business you may own, retirement benefits, etc.

In many cases, if you are receiving benefits from an employer-provided LTD policy, your insurer will require you to apply for SSDI benefits so that they may offset those benefits and pay less out of their pockets. SSDI offsets can be tricky.

How Long Do Long-Term Disability Benefits Last?

LTD benefits last for as long as you remain disabled under the terms of your policy, or until you reach the Maximum Benefit Period. For more information regarding how long you can receive LTD benefits, please read How Long does Long-Term Disability Last?

Can I Have More Than One Long-Term Disability Insurance Policy?

You are not limited to one LTD policy. Some people purchase additional individual policies to supplement their employer-provided LTD policy. Individual policies are governed by state insurance law, as it is a contract between the policyholder and the LTD insurance carrier.

Typically, disability policies provided by employers are governed by a federal law known as ERISA, or the Employee Retirement Income Security Act. ERISA laws and regulations can introduce unique challenges which can make it difficult for claimants to access their benefits. If your ERISA-governed LTD claim is denied, it is wise to contact an attorney for assistance.

So, Is Long-Term Disability Insurance Worth it?

Now that you know how long-term disability insurance operates, you may ask, is it worth paying the premiums? Ultimately, if you do not want to have to worry about your income in the case that you fall victim to a long-term disabling injury or illness, acquiring long-term disability insurance can be a smart and safe choice.

Still, it is fair to acknowledge that people often elect not to get long-term disability insurance. Firstly, it costs money. Depending on your plan, long-term disability premiums can be expensive, depending on a number such as your age, the state of your health, and your specific policy.

Often, younger people with less disposable income may opt out of long-term disability insurance, though the younger and healthier you are, the cheaper the premium. Some may also opt out of it if they depend on someone who can support them in the event of a disability, such as a spouse or family member. If any of these reasons apply to you, they are fair to consider in your decision to pay for long-term disability insurance.

However, there are many reasons that you will want long-term disability insurance, the least of which is that you never know when you might develop a disabling illness or sustain a debilitating injury. Other reasons it may be worth it to invest in long-term disability insurance include:

- You are your family’s main source of income: If you have dependents who rely on your income, you may want to invest in long-term disability insurance so that you do not have to worry about being able to support them in case you are unable to work and do not have an emergency fund.

- You do not have anyone else’s income to fall back on: Some people have spouses or families they are able to depend on if they are unable to work. If you do not have anyone to fall back on in the case of a disability, you may want to consider buying long-term disability insurance.

- You are getting older: Unfortunately, the older you get, the more expensive long-term disability coverage can become to buy. In some cases, the earlier you buy, especially if you are younger or healthy, the less you may have to pay on premiums going forward. It is often recommended to invest earlier rather than later.

- It is best to get long-term disability insurance when you are healthy: The healthier you are when you purchase your policy, the cheaper your premiums will be. If you find your health declining and suddenly wish to buy insurance, it will be more difficult to find an affordable plan. In some cases, insurance companies may deem you uninsurable if your health is poor enough.

- LTD Insurance covers a range of conditions: Long-term disability insurance covers many types of disabilities, ranging from bodily injuries to chronic illness to mental health. However, not all policies are the same, so when buying a policy, you will want to carefully review what is covered.

- You cannot depend on Social Disability or Workers’ Compensation Insurance: All Americans are eligible for Social Security disability insurance (SSDI); however, its qualifications tend to be more restrictive than long-term disability and can be difficult to meet. If you have a Workers’ Compensation policy, it will only cover injuries or illnesses specifically acquired from a work-related cause. If your disability is not due to your job, it will not cover you, so it is good to have LTD to fall back on.

Ultimately, when considering long-term disability insurance, the question you want to ask yourself is, “If I can’t work, how long would I be able to go without a paycheck?” No matter what your answer is, it is worth looking into in case you ever need to safeguard your income due to your health.

How Do I Get Long-Term Disability Insurance?

The most common way to acquire long-term disability insurance is through your employer’s group policy. You can also get long-term disability insurance by purchasing it privately through an insurance company. Sometimes, people choose to have both by supplementing their group coverage with an additional individual disability plan, as group policies may be limiting.

Chisholm Chisholm & Kilpatrick Can Help with Long-Term Disability Claims and Appeals

If you plan on getting, or already have, long-term disability insurance and find yourself needing to file a claim or appeal, the attorneys at Chisholm Chisholm & Kilpatrick are available to help. We understand that the process of filing for long-term disability can be overwhelming, and we can assist you every step of the way. For a free initial consultation with a member of the CCK team, contact us at 800-544-9144.

About the Author

Share this Post