Social Security Disability Insurance (SSDI) and VA Individual Unemployability (TDIU)

CCK Law: Our Vital Role in Veterans Law

Social Security Disability Insurance (SSDI) and Total Disability based on Individual Unemployability (TDIU) can be two vital benefits Veterans rely on. Learn what each of these programs are meant for, and how they work together.

What is Social Security Disability Insurance (SSDI)?

SSDI stands for Social Security Disability Insurance. SSDI is a federal insurance program that replaces the income a worker loses because of a significant disability. The SSDI system is funded through workers’ payroll taxes. In return for contributing, those workers are “insured” by the U.S. government if they become severely disabled. The SSDI system is managed by the Social Security Administration (SSA).

Eligibility for SSDI. Anyone who pays (or used to pay) payroll taxes and has a “total” disability is potentially eligible for SSDI. Someone with a partial disability or a short-term disability (lasting less than a year) would not qualify. To be considered totally disabled by the SSA, you must have a medical condition that meets the criteria of a condition listed on the SSA’s list of severe impairments.

Not the same as SSI. SSDI is not the same as Supplemental Security Income (SSI), although both are managed by the SSA. To be eligible for SSI, your yearly income must be below a certain level. For SSDI, this is not the case. A person of any income level can receive SSDI.

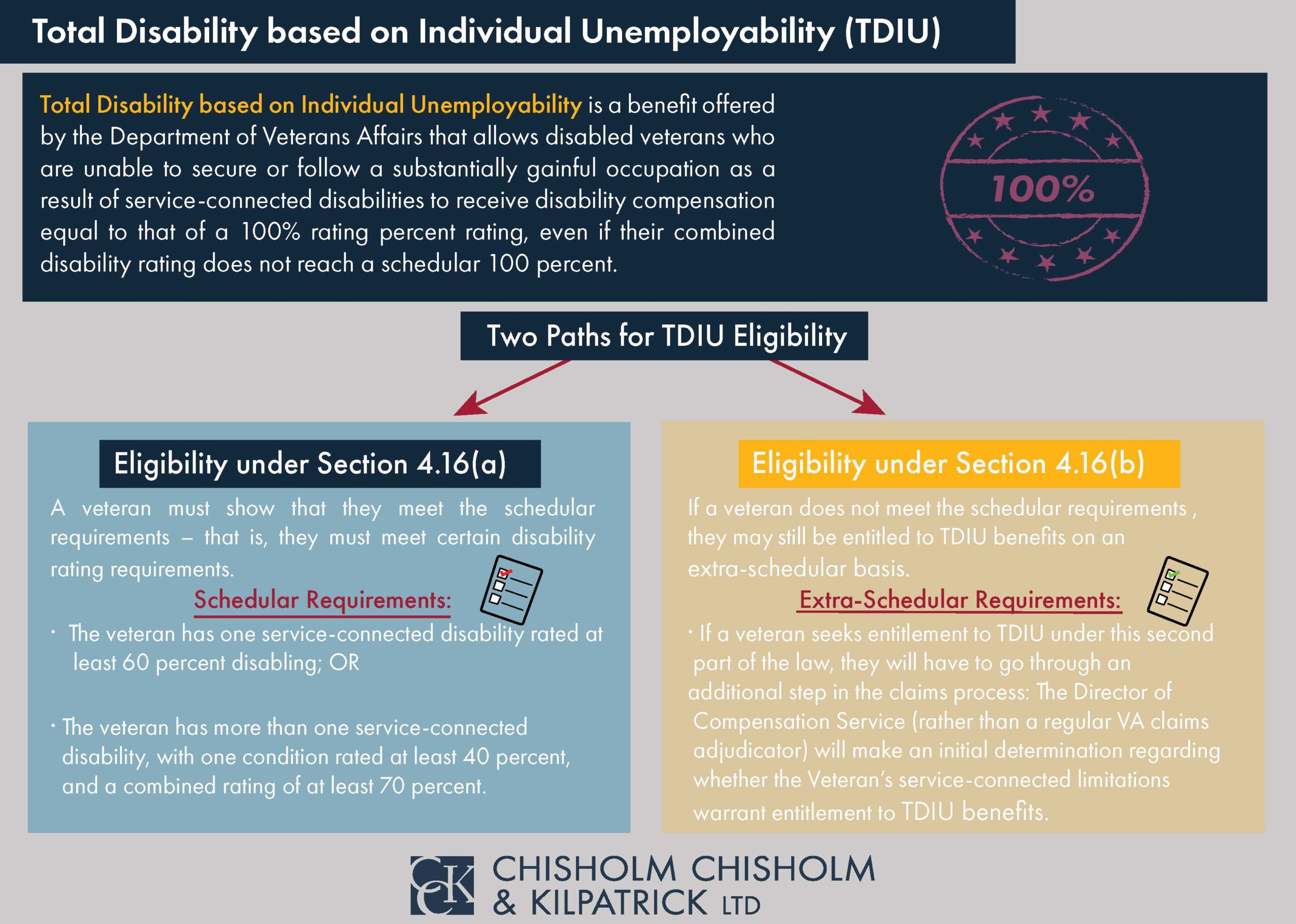

What is Total Disability Based on Individual Unemployability (TDIU)?

TDIU (also known as IU) stands for Total Disability Based on Individual Unemployability. TDIU is a Department of Veterans’ Affairs (VA) disability benefit available to veterans whose service-connected disability or disabilities render them unable to work. Rather than making up for lost income, TDIU is meant to compensate veterans who were made unemployable by in-service injuries, illnesses, or events.

RELATED: Read our in-depth description of TDIU Eligibility

Eligibility for TDIU. To be eligible for TDIU, you must meet the following requirements:

- You are unable to work due to your service-connected disability(s); and

- You have a single, service-connected disability rated at least 60%; or

- You have more than one service-connected disability, with at least one disability rated at 40% and a total combined rating of at least 70%.

- NOTE: Some veterans may still be entitled to TDIU even if they do not meet the percentage requirements above, but the process is different.

What’s the difference between SSDI and Individual Unemployability (TDIU)?

Some important differences between SSDI and TDIU are as follows:

Origin of Disability. For TDIU, VA only considers your service-connected disabilities. For SSDI, the SSA considers all of your disabilities, regardless of their origin or cause.

Age. For TDIU, VA cannot consider your age when determining your eligibility. For SSDI, your age is a very important factor in your claim.

If I’m receiving SSDI benefits, will I automatically qualify for Individual Unemployability?

No, not automatically. Even though both benefits are meant for totally disabled persons who are unable to work, receiving SSDI does not automatically make you eligible for Individual Unemployability because of the differences mentioned above.

But receiving SSDI could potentially help with your TDIU claim. VA is required to take SSA’s decisions into consideration if they are related to your service-connected disabilities and you make VA aware of them. Once VA is aware of your SSA records, they must attempt to get those records. Those records may contain medical opinions or vocational reports from SSA staff that could help support your TDIU claim. Additionally, if an SSA adjudicator finds that your service-connected condition alone prevents you from working, a VA adjudicator who disagrees must provide an adequate explanation as to why.

However, receiving SSDI could also potentially hurt your TDIU claim. When reviewing your claim, VA must consider favorable as well as unfavorable evidence in your SSA records. So, if your SSA records include negative medical opinions or other unfavorable evidence, that will be taken into account by VA. Additionally, your SSA records may hurt your claim if you have many disabilities or other similar-but-not-service-connected disabilities. For Individual Unemployability, you must show that you are unemployable because of your service-connected disability or disabilities alone. So SSA records that show that your non-service-connected disability or disabilities are responsible for your unemployability could make it harder to prove your VA claim.

Wounded warriors and P&T disability in SSDI claims. Social Security provides expedited processing of disability benefit applications for wounded warriors and veterans with a VA compensation rating of 100% Permanent & Total (P&T).

Can I receive SSDI and TDIU benefits at the same?

Yes, you can qualify for and receive SSDI and Individual Unemployability at the same time. And, unlike some other federal benefits, there is no “double-dipping” offset. That is, you can collect the full amount of both SSDI and Individual Unemployability at the same time.

About the Author

Share this Post