Long-Term Disability (LTD) Claims for Prosthodontists

There are around 3,500 prosthodontists working in the United States. These professionals are highly trained dentists who specialize in the replacement and restoration of teeth, as well as jaw repairs. When a prosthodontist is afflicted by a medical condition or injury, they may find themselves unable to perform their challenging duties. At this point, it becomes vital to file for long-term disability (LTD) benefits.

According to the CDC, around 27 percent of adults in the US are experiencing a disability at any given time. These disabilities can easily affect both a person’s physical and cognitive abilities. However, proving that LTD benefits are necessary can still be difficult, even for highly skilled professionals.

The Material Duties of Prosthodontists

It is vital when filing a claim for long-term disability benefits for claimants to prove to their insurer that their disability prevents them from carrying out their material duties. Note that many insurance companies rely on the Dictionary of Occupational Titles (DOT) or the O*NET Database for their understanding of a particular job, but these resources are not always up to date or comprehensive. The claimant must be prepared to highlight discrepancies.

Prosthodontists’ practice focuses primarily on the replacement and restoration of teeth. They are trained to replace real teeth with artificial teeth or dentures, treat jaw disorders, give dental implants, put in crowns and bridges, and more. Many prosthodontists also work with neck deformities, which require replacing missing parts of a person’s jaw and/or face.

This kind of work requires years of extensive training. To be a prosthodontist, individuals must obtain a bachelor’s degree, a dental degree, an additional three years of prosthodontics training/education, and certification to practice dentistry and prosthodontics.

Prosthodontists typically perform their duties in a dentist’s office, where they must spend long hours on their feet, often in awkward positions that cause the body to twist or bend. Prosthodontists work on a high number of patients during the day with little rest. The repetition associated with dentistry can add to the likelihood of developing a medical condition—especially a musculoskeletal condition.

Long-Term Disability Insurance Coverage for Prosthodontists

A prosthodontist may receive this coverage through their employer (i.e., group policies) or directly from the insurance company (i.e., individual policies). Long-term disability insurance can protect a percentage of a prosthodontist’s pre-disability earnings. This coverage is usually between 60 and 80 percent.

When a prosthodontist cannot work due to a medical condition or injury, these LTD benefits are important. They allow the prosthodontist to focus on treatment for their condition without worrying about income. However, the process for obtaining these benefits is not always simple.

Definitions of Disability for Prosthodontists

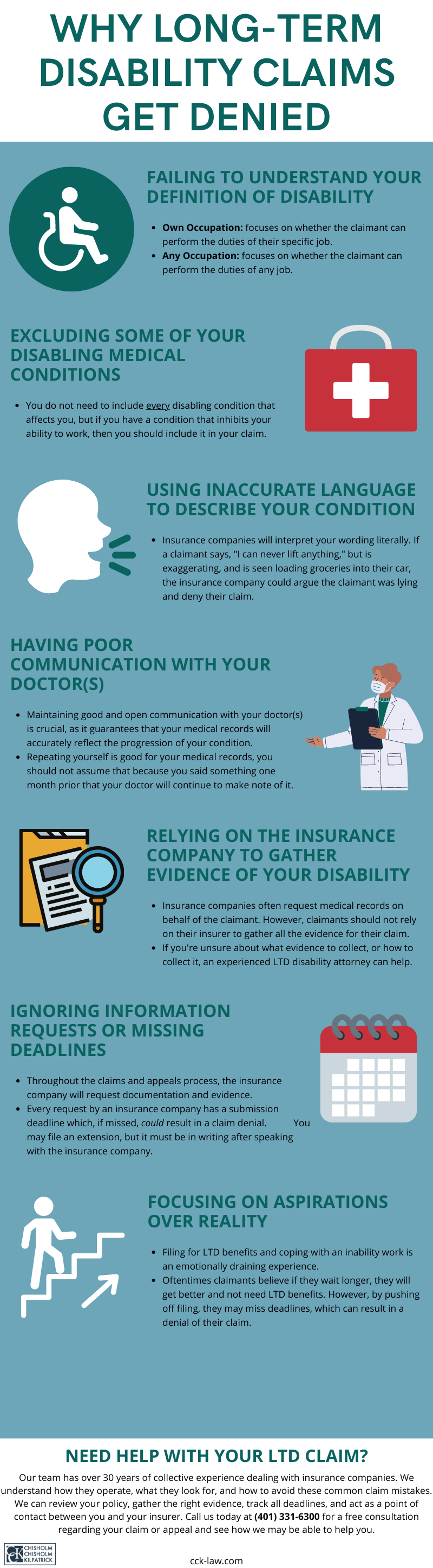

Long-term disability policies have either an “own occupation” or an “any occupation” definition of disability. This definition is crucial for a claim. It lays out what a claimant must establish to receive benefits.

Highly trained professionals—such as physicians, dentists, and surgeons—will generally have LTD coverage that contains an “own occupation” definition of disability, which is easier to establish to receive benefits. It is strongly advisable that you study your policy to know the specifics of your coverage.

An “own occupation” definition asks whether an individual can perform the duties of their own job. In other words, can you perform the duties of a prosthodontist? In contrast, an “any occupation” definition of disability asks whether an individual can perform any job at all; i.e., are you completely disabled from all work of any kind?

However, an “own occupation” definition may have caveats. For example:

- A policy may transition from an “own” definition to an “any” definition after a set period. If you have such a policy, your insurer will reevaluate your claim at the end of the period. Your condition must meet the new definition for you to continue receiving benefits.

- A policy may include a “gainful component” component. A gainful component asks if you can perform the duties of a job that can earn you a certain percentage of your pre-disability earnings—usually 60 to 80 percent. If your condition prevents you from finding such gainful employment, then you are considered disabled. Moreover, this component often considers a claimant’s education and skill set.

Examples like these show why it is critical to read and understand one’s own policy.

How to File a Long-Term Disability Claim as a Prosthodontist

Before filing a long-term disability claim, one should spend time reading and understanding one’s policy. A policy contains critical specifics like the definition of disability, waiting period length, filing deadlines, appeal requirements, limitations and exclusions, and more. When claimants do not read their policy or do not understand what their coverage entails, they often make serious mistakes that are detrimental to their claim.

A claimant initiates their claim by submitting a notice of claim to their insurer. This notifies the insurer that you are about to file an LTD claim.

Next, the claimant files claimant forms and submits evidence that supports their case. This is a sensitive step. The evidence requirements may vary based on the specific condition and the policy’s definitions. While it is possible for a claimant to do this on their own, it is easy to overlook something. Consulting a long-term disability attorney may be beneficial during this phase to ensure that one has submitted the strongest evidence to illustrate a need for benefits.

Individuals who have received their LTD policy through an employer must be aware of ERISA as they submit their claim. ERISA is a federal law that governs group policies. Thus, such policies must adhere to its strict deadlines and regulations. Unfortunately, ERISA often benefits the insurance company, so it is vital for claimants to ensure that a claim is compliant with this law to ensure a fair review.

What Prosthodontists Should Do if Their LTD Claim Is Denied

Insurance companies deny many claims. Prosthodontists who receive a denial on their initial claim may be disheartened and overwhelmed. They have the right to appeal their insurer’s decision. Information on how to begin the appeal process, including the appeal deadlines, is within the insurance policy. Note the policy may allow multiple rounds of appeals.

Claimants will receive a denial letter. Within this letter will be the insurance company’s reasons for issuing the denial. Claimants should use this denial letter to help guide their appeal.

If a claimant submits any new or updated evidence, it should directly address the issues within the denial letter. This ensures they are fixing any errors that caused the initial denial. Under ERISA, the administrative appeal stage is the final time a claimant may submit evidence on the record.

If claimants receive denials of their appeal(s), they have the right to sue in federal court. However, litigation under ERISA is not easy, nor does it resemble what most people think of as “court.” For example, there is no jury; the final decision resides with a judge. Often, the insurance company avoids litigation by settling with the claimant. The claimant is not required to accept a settlement they do not like, but it may be difficult to know that they have achieved an optimal offer.

Call CCK Today

Chisholm Chisholm & Kilpatrick has a proven record of success. We help our clients receive the long-term disability benefits they need and to which they are entitled. We can help you at any point in the process, from the initial claim through litigation.

Call us today at (800) 544-9144 for a free case evaluation with a member of our team. We will analyze your case and determine if we can help.

About the Author

Share this Post