Long-Term Disability (LTD) Claims for Office Managers

It is important to have long-term disability (LTD) insurance when you are a part of the workforce. These insurance policies are vital if you develop a medical condition that disables you or if you suffer from a severe injury. In the United States, 13.7 percent of adults suffer from a condition that impairs their mobility, and 10.8 percent of adults suffer from a condition that impairs their cognitive abilities. Thus, such benefits play a key role in many people’s lives, including office managers.

If you are an office manager, you may require long-term disability benefits. This article will address what you need to know when filing your claim.

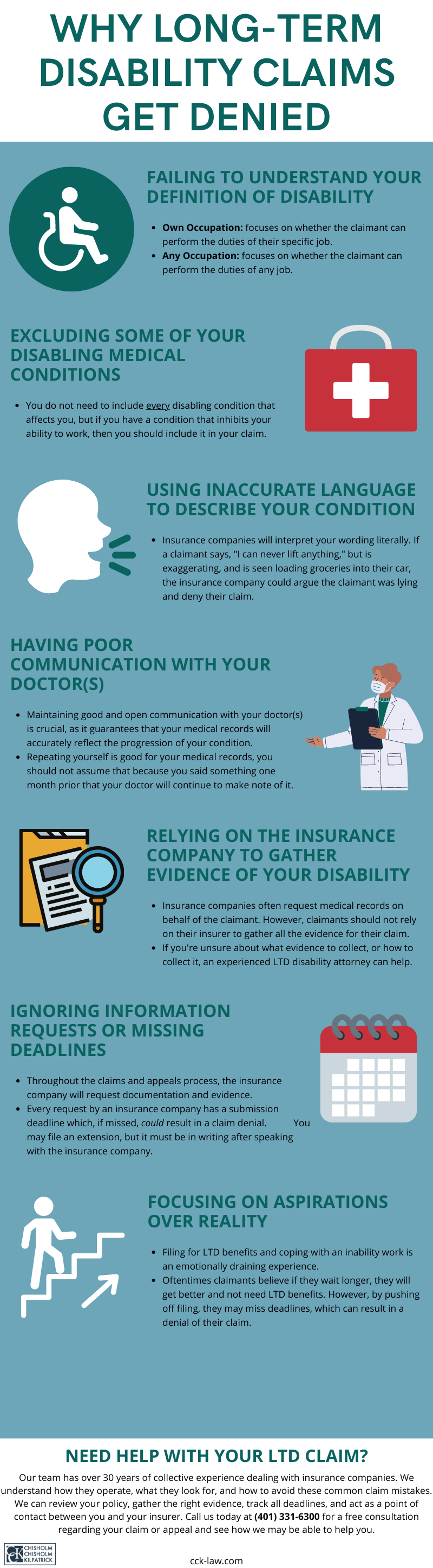

Definition of Disability for Office Managers

Office managers often have a variety of tasks for which they are responsible. Of course, it depends on their specific job, but, generally, their main goal is to ensure the smooth operation of daily tasks in the office space. To receive long-term disability benefits as an office manager, you must prove to your insurer that you are unable to perform the material duties of your position.

The first step is to read your LTD policy thoroughly. Your policy contains a lot of invaluable information that can help you with your claim, such as the “definition of disability” you must meet.

There are two definitions of disability you may encounter when you read your policy: the “own occupation” definition and the “any occupation” definition. In short, the own occupation definition asks whether you can perform the duties of your specific, i.e., own, job; the any occupation asks whether you can perform the duties of any job at all.

Why is this important? First, it is often more difficult to prove an any occupation definition because you must prove that you cannot perform any work of any kind. Insurers often use the “Dictionary of Occupational Titles” (DOT) or the “O*Net Database” when reviewing the duties of various jobs.

In the DOT, part of the job description for an office manager reads “analyses and organizes office operations and procedures, such as typing, bookkeeping, preparation of payrolls, flow of correspondence, filing, requisition of supplies, and other clerical services.” This is only a part of a multifaceted definition. While this definition has not been updated since 1991, many of the elements are still relevant to a modern office manager.

So, when describing your condition in the claimant forms, or when determining what evidence you should gather, you may want to reference this definition, as it will likely be used by your insurer to help decide your claim. You must show that the duties listed therein are impossible for you to carry out.

Types of Office Managers

As with any profession, there are myriad types of office managers in the modern workplace. Since the definition in the DOT is generalized, it is important to accurately describe all duties for which you are responsible.

Four of the most common types of office managers include:

- Corporate office managers: When people think of an “office manager,” this is the one they most likely have in mind. These individuals oversee in-person offices, either as a whole company or as a branch of a larger company.

- Medical office managers: Office managers who help oversee the workflow in a medical or dental office must be aware of health laws, lab procedures, and more. Usually, these managers supervise medical assistants in a doctor’s or dentist’s office.

- Legal office managers: Law firms often have office managers. This type of office manager must be familiar with different laws and usually take care of payroll, supervising paralegals, and overseeing human resources.

- Virtual office managers: This type of office manager typically works for several companies at once. They may or may not travel to these locations; usually, they work from a home office. Virtual managers will usually work part-time for several companies at once. While they may not be in office, these managers have just as many responsibilities as the abovementioned types.

Regardless of which type of office manager you are, there are some common duties they all share, such as organizational skills; leadership skills; effective communication; and excellent time management.

How Does an Office Manager Determine If They Have LTD Coverage?

Office managers may have either a “group policy” or an “individual policy.” Many office managers are employees of a company. As such, they likely have a group policy. Employers provide group policies as part of their employee benefits package. Some office managers, however, are self-employed. In these situations, you may have an LTD policy if you bought it directly from your insurer; these are individual policies.

Now, it is possible to have both at the same time. For example, if you have a group policy through your employer but want additional coverage, you can also buy your own.

You may not know which — if any — policy you have. To find out, you can ask your employer directly if you have an LTD policy; ordinarily, a member of human resources can provide you with your plan’s governing documents.

If you believe you may have an individual policy, you can check your bank statements; if you have an individual policy, you will see premium payments to your insurer. To receive your policy’s governing documents, you can contact the insurance company directly.

It is important to be aware of which policy you have. If you have a group policy, you must be aware of ERISA. ERISA governs such policies and comes with its own strict set of regulations and deadlines. In these situations, consulting with an experienced long-term disability attorney is beneficial.

How Do Office Managers Establish a Long-Term Disability Claim?

As is evident by the abovementioned duties, an office manager does many things as part of their job, from payroll to organizing the daily tasks of all employees. Thus, office managers sometimes must do sedentary work, and also be able to move around the office. As such, a condition that affects either the physical or the cognitive abilities of an office manager can impair their ability to work.

Regardless of what condition you suffer from, to establish your claim, you must first read your policy. As mentioned earlier, your policy has essential information concerning your claim. This information can include limitations, exclusions, deadlines, offset information, and more.

When you are ready to begin filing for long-term disability benefits, you must submit a notice of claim to your insurance company. They will then send you the claim forms, which you must fill out. Do not feel hindered by the limited space on these forms to describe your condition; you can always add pages so that you may fully describe how your condition affects you.

You must also collect and submit evidence that shows how your condition prevents you from carrying out the duties of an office manager under the definition of disability within your policy. Medical records are your primary source of evidence. However, some claims may require supplemental evidence. Supplemental evidence can include witness statements, vocational evaluations, and specialized doctor reports.

How Does ERISA Impact LTD Claims?

ERISA is a federal law. It governs both short- and long-term disability policies, among other employer-sponsored benefits. It is meant to protect the employee, but it often benefits the insurance company. When you file for LTD benefits with a group policy, you are subject to certain procedural obstacles that ERISA presents. For example, under ERISA, you normally cannot submit evidence after the appeal stage.

During the administrative appeal, you may submit evidence, but if your insurer denies your appeal, you often cannot submit new evidence during litigation. The standard of review during litigation is often difficult to overcome under ERISA.

Litigation is also quite different under ERISA. The primary difference is that a judge — not a jury — decides your case. Nonetheless, an ERISA attorney is beneficial to have when filing a group policy claim. ERISA can be complex, and even simple, common mistakes can be detrimental to your case.

What Other Benefits May Be Available?

Long-term disability benefits may not be the only benefits for which you are eligible. Social Security Disability Insurance (SSDI) benefits may also be an option. There are a multitude of rules that apply to SSDI claims, but you may qualify if your condition prohibits you from performing any gainful activity or may result in death.

Additionally, many insurers require you to file for SSDI benefits when you file for LTD benefits. They do this so that, if you do receive SSDI benefits, they can offset your long-term disability benefits.

Importantly, if your condition qualifies for long-term disability benefits, it does not mean it will also qualify for SSDI or vice versa.

What If the Insurance Company Denies a Long-Term Disability Claim?

Insurance companies do not like paying claims. They often prioritize their financial needs over their clients. As such, many LTD claims are denied. When you receive such a denial, it may seem like an impossible obstacle to overcome.

However, when your insurer issues your LTD claim a denial, it is your right to appeal. Your insurer will send you a denial letter that explains the reason(s) for the decision. It is vital to directly address these reasons in your appeal.

The time to file an appeal is limited. As mentioned, this may also be your last opportunity to submit new or updated evidence. You should consider contacting a long-term disability lawyer who can help you navigate this complex process.

Contact Chisholm Chisholm & Kilpatrick Today

Regardless of where in the process you are, you do not have to do this alone. Office managers are important team members in any office. Yet they are not immune to missing work due to a debilitating medical condition. As such, they want to know that they can receive the financial assistance they deserve to help them get by. The legal team at Chisholm Chisholm & Kilpatrick understands this and wants to help.

Our long-term disability insurance attorneys have over 30 years of combined experience and can ensure your claim receives a fair review from your insurance company. Call CCK today at (800) 544-9144 for a free case evaluation with a member of our team. We will analyze your case and determine if we can assist you.

About the Author

Share this Post