100 Percent VA Disability and Working

CCK Law: Our Vital Role in Veterans Law

VA assigns disability ratings to veterans with service-connected conditions. A disability rating is based on how severe the veteran’s condition is and how it impairs their earning capacity. Schedular VA disability ratings range from 0 to 100 percent. When a veteran has multiple service-connected conditions, each with its own disability rating, VA combines them using “VA Math” to get a combined disability rating. This combined disability rating then determines the amount of monthly compensation they will receive. As mentioned above, 100 percent is the highest combined schedular disability rating a veteran can receive. Depending on the circumstances, veterans may still be able to work while receiving a 100 percent disability rating.

How VA Rates Disabilities and Combined VA Ratings

VA assigns those who have become disabled as a result of military service with a disability rating. This rating is based on how severe the veteran’s condition is and how the disability impairs their average earning capacity. Veterans receive a disability rating by filing a claim for service connection with VA. If VA decides in the veterans’ favor, it will grant service connection for the disability and assign a percentage rating based on severity, ranging from 0 percent to 100 percent. These ratings are assigned at 10 percent increments.

When a veteran has multiple service-connected conditions, each with its own individual rating, VA does not simply add them together. Instead, they are combined using “VA Math” to establish a combined disability rating. Essentially, VA starts with the premise that a veteran is 100 percent efficient, or non-disabled. If a veteran has a disability rating of 20 percent, VA will see them as 80 percent non-disabled and 20 percent disabled. To include another disability rating of 10 percent, VA will take 10 percent of the 80 percent non-disabled portion, and add it to the existing 20 percent rating. This process continues with each disability rating a veteran has.

Importantly, the veteran’s combined disability rating corresponds to a dollar amount specified by VA in the VA disability pay chart. Veterans with a 100 percent schedular disability rating will receive the highest amount of monthly compensation.

Working with a 100 Percent Schedular Disability Rating

The eligibility requirements to qualify for the 100 percent schedular disability rating are rather straightforward:

- You must have a service-connected disability; and

- VA must rate it at the 100 percent level as outlined by the criteria for that condition; or

- You have multiple service-connected disabilities that combine to 100 percent

With the 100 percent combined disability rating, you do not have any restrictions on work activity. As such, if you meet the 100 percent rating for your service-connected condition, and you are still able to work, then you may do so.

Working with a 100 Percent Permanent and Total Rating

Veterans rated with a 100% Permanent and Total VA disability rating do not face any restrictions on work activity, unless the veteran was awarded this rating through Total Disability based on Individual Unemployability (TDIU). 100% schedular permanent and total ratings are protected from being reduced.

Working With TDIU

Total disability based on individual unemployability (TDIU) is a benefit that allows veterans to be compensated at VA’s 100 percent disability rate, even if their combined schedular disability rating does not equal 100 percent. TDIU is awarded in circumstances in which veterans are unable to secure and follow substantially gainful employment as a result of their service-connected conditions. Here, substantially gainful employment refers to whether a veteran’s annual income meets or exceeds the federal poverty threshold for a single person. Therefore, there are certain circumstances in which veterans may still be employed while receiving TDIU benefits.

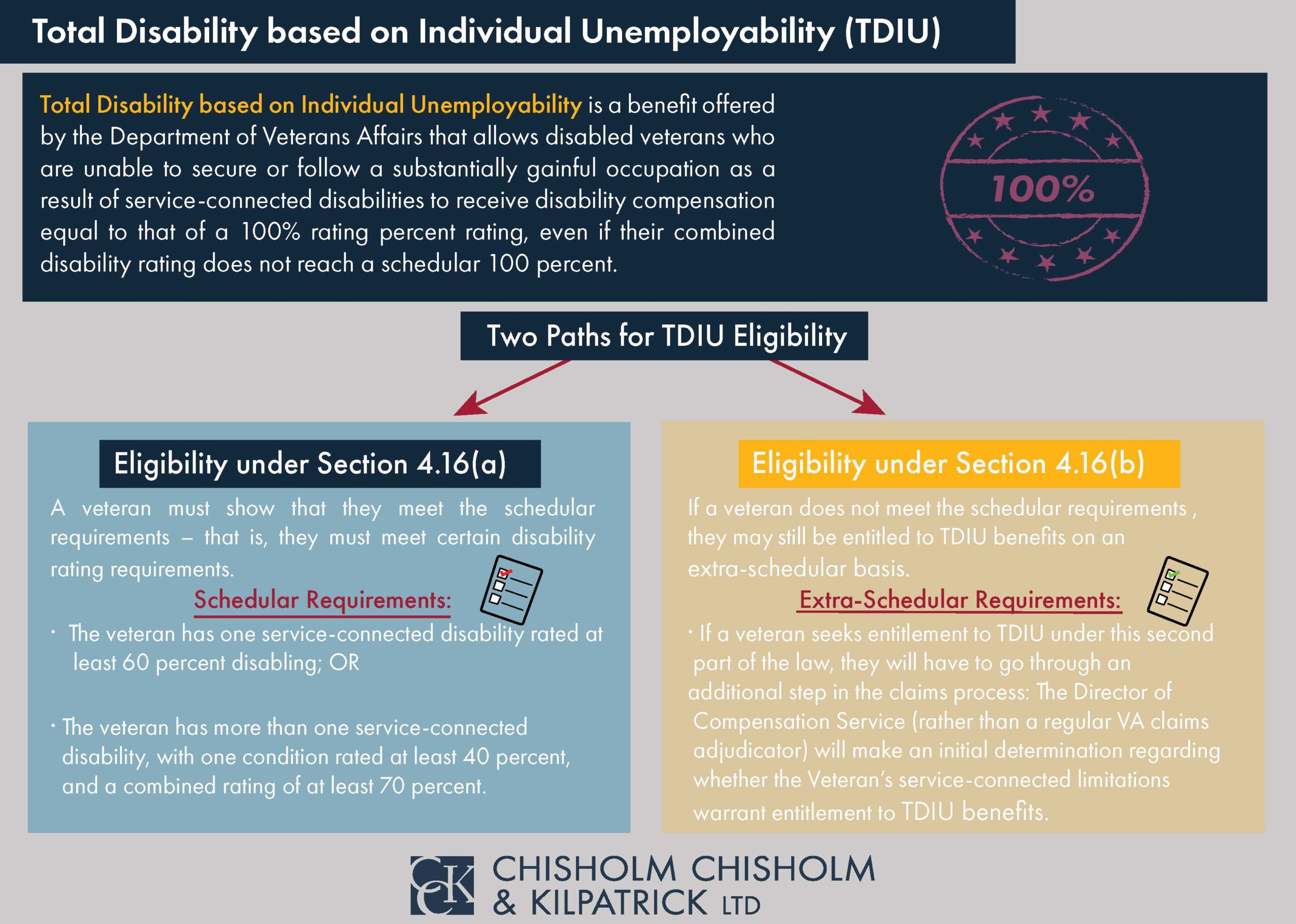

How to Get TDIU

VA outlines TDIU regulations in 38 CFR § 4.16, which encompasses subsections (a) and (b). Each subsection describes a way by which veterans may meet the requirements for TDIU. In order to qualify for TDIU under 38 CFR § 4.16(a), a veteran must have:

- One service-connected condition rated at 60% or more; or

- Two or more service-connected conditions, one of which is rated at least 40% disabling, with a combined disability rating of at least 70%

Those who do not meet the schedular requirements under 38 CFR § 4.16(a) may still be considered for TDIU under 4.16(b). Under this subsection, VA must refer your entitlement to TDIU to the Director of Compensation Service for extraschedular consideration.

Marginal Employment

As mentioned above, TDIU is generally reserved for veterans who are unable to work; however, if a veteran is able to maintain what is called “marginal employment,” they can still qualify for TDIU. Generally speaking, marginal employment is the opposite of substantially gainful employment. If a veteran is working, but their income does not exceed the federal poverty threshold for one person, they can still be considered for TDIU.

For example, if you are only able to work 8 hours per week at a restaurant and your earnings are below the poverty level, your employment may qualify as marginal. Therefore, you may be able to continue working while receiving VA disability compensation at the 100 percent level.

Protected Work Environment

Veterans who are working and earning an income above the federal poverty threshold may still be entitled to TDIU if they are working in a protected work environment. A protected work environment can be described as employment that allows certain accommodations without which you would not be able to continue working. Importantly, VA recognizes that protected work environments do not fall under the umbrella of substantially gainful employment.

More specifically, a protected work environment could be demonstrated by one or several of the following being true of the veteran’s situation:

- The veteran does not need to complete critical job functions due to their limitations (e.g., interacting with customers)

- The veteran is not as productive or as reliable as other employees

- The veteran does not receive any negative consequences for erratic behavior or mistakes that stem from their disability

To demonstrate that you work in a protected work environment, you will likely have to submit supportive evidence, such as a lay statement from your employer. VA makes determinations regarding protected work environments on a case-by-case basis.

Has VA Actually Defined What a Protected Work Environment Is?

One barrier in obtaining TDIU benefits under a protected work environment is the fact that VA has not specifically defined “protected work environment.” Instead, it is determined on a facts-found basis, meaning either the Regional Office or the Board of Veterans’ Appeals will look at the facts of the veteran’s case, the accommodations provided by their employer, and then make a determination based off of that evidence. Oftentimes, this can make it difficult for a veteran to know what evidence they should submit, because without a standard to compare their situation against, it is basically all up in the air.

Nonetheless, when veterans are putting together evidence in support of their cases, they can look to how the SSA or the Department of Labor define the critical functions of their job. From there, they can demonstrate what they are unable to do regardless of any accommodations in place to help them perform those functions.

Applying for TDIU Benefits

VA Form 21-8940, Veterans’ Application for Increased Compensation Based on Unemployability, is an application for TDIU benefits. The purpose of this form is to provide VA with additional information about the veteran, such as their level of education and employment history, to supplement the request for TDIU. If veterans do not submit Form 8940 along with their claim for TDIU, it is almost guaranteed that VA will ask them to provide one. If veterans fail to submit the form, VA could use that as grounds to deny their claims.

Social Security Disability Insurance vs. VA Disability Compensation and Working

What is SSDI?

Social Security Disability Insurance (SSDI) is a federal insurance program that replaces the income a worker misses out on due to a significant disability. The SSDI system is funded through workers’ payroll taxes. In return for contributing, those workers are “insured” by the U.S. government if they become severely disabled. The SSDI system is managed by the Social Security Administration (SSA).

Difference between SSDI and TDIU

Some important differences between SSDI and TDIU are as follows:

Origin of Disability. For TDIU, VA only considers your service-connected disabilities. For SSDI, the SSA considers all of your disabilities, regardless of their origin or cause.

Age: For TDIU, VA cannot consider your age when determining your eligibility. For SSDI, your age is a very important factor in your claim.

Qualifying for SSDI and TDIU

It is important to note that if you are receiving SSDI benefits, you will not automatically qualify for or be granted TDIU benefits. Even though both benefits are meant for totally disabled persons who are unable to work, receiving SSDI does not automatically make you eligible for TDIU because of the differences mentioned above.

However, receiving SSDI could potentially help with your TDIU claim. VA is required to take SSA’s decisions into consideration if they are related to your service-connected disabilities and you make VA aware of them. Once VA is aware of your SSA records, it must attempt to get those records. Importantly, those records may contain medical opinions or vocational reports from SSA staff that could help support your TDIU claim.

Can Veterans Work with 100% Permanent and Total (P&T) VA Ratings?

If a veteran is rated at 100 percent for a service-connected condition and also as permanently disabled, this is an indication that VA does not expect the veteran’s condition to improve. Arguably the greatest advantage to having a permanent and total (P&T) disability rating is the fact that your rating becomes protected. This means that you are no longer subject to routine and traditional VA examinations for that condition. Importantly, P&T status is a special designation that is awarded by VA. Just because you have a 100 percent schedular disability rating or receive TDIU benefits does not mean VA considers your condition to be P&T.

It is important to note that veterans can still work if they have a condition that is deemed P&T. Ultimately, certain conditions might be considered permanent regardless of whether or not the veteran is working. However, veterans should be mindful of the fact that the idea of a P&T disability rating presumes that the condition is totally incapacitating.

Can Veterans Work with Temporary and Total VA Disability Ratings?

Veterans who are rendered temporarily incapacitated due to a service-connected condition may be entitled to receive temporary and total disability compensation equivalent to a 100 percent VA rating. The VA offers three forms of temporary 100 percent disability ratings: prestabilization, hospitalization, and convalescence. Similar to P&T ratings, VA does not prohibit veterans with temporary and total disability ratings from working. However, if a doctor determines that you are able to work during the time that VA issues a 100 percent rating, there may be grounds for VA to discontinue the 100 percent.

About the Author

Share this Post