VA Survivors Benefits: VA Benefits for Deceased Veterans’ Dependents

The U.S. Department of Veterans Affairs (VA) offers several survivors benefits to dependents of U.S. military veterans who have passed away. These include Dependency and Indemnity Compensation (DIC), VA Survivors Pension, educational assistance, burial benefits, health care, and home loan programs.

How to Qualify for Dependency and Indemnity Compensation (DIC)

Dependency and Indemnity Compensation (DIC) is a monthly VA benefit paid to the surviving spouse, children, or sometimes dependent parents of a veteran who died of causes related to military service.

In order for surviving dependents to qualify for DIC, the veteran needs to meet at least one of the following criteria:

- The veteran passed away while on active duty, active duty training, or inactive duty training;

- The veteran passed away due to a service-connected condition; or

- If the veteran’s death was not service-related, but they received disability compensation for a service-connected condition considered totally disabling:

- For a period of at least 10 years prior to death; or

- Since separation from active duty and for a period of at least five years prior to death; or

- For at least one year prior to death if they were a former prisoner of war who died after September 30, 1999.

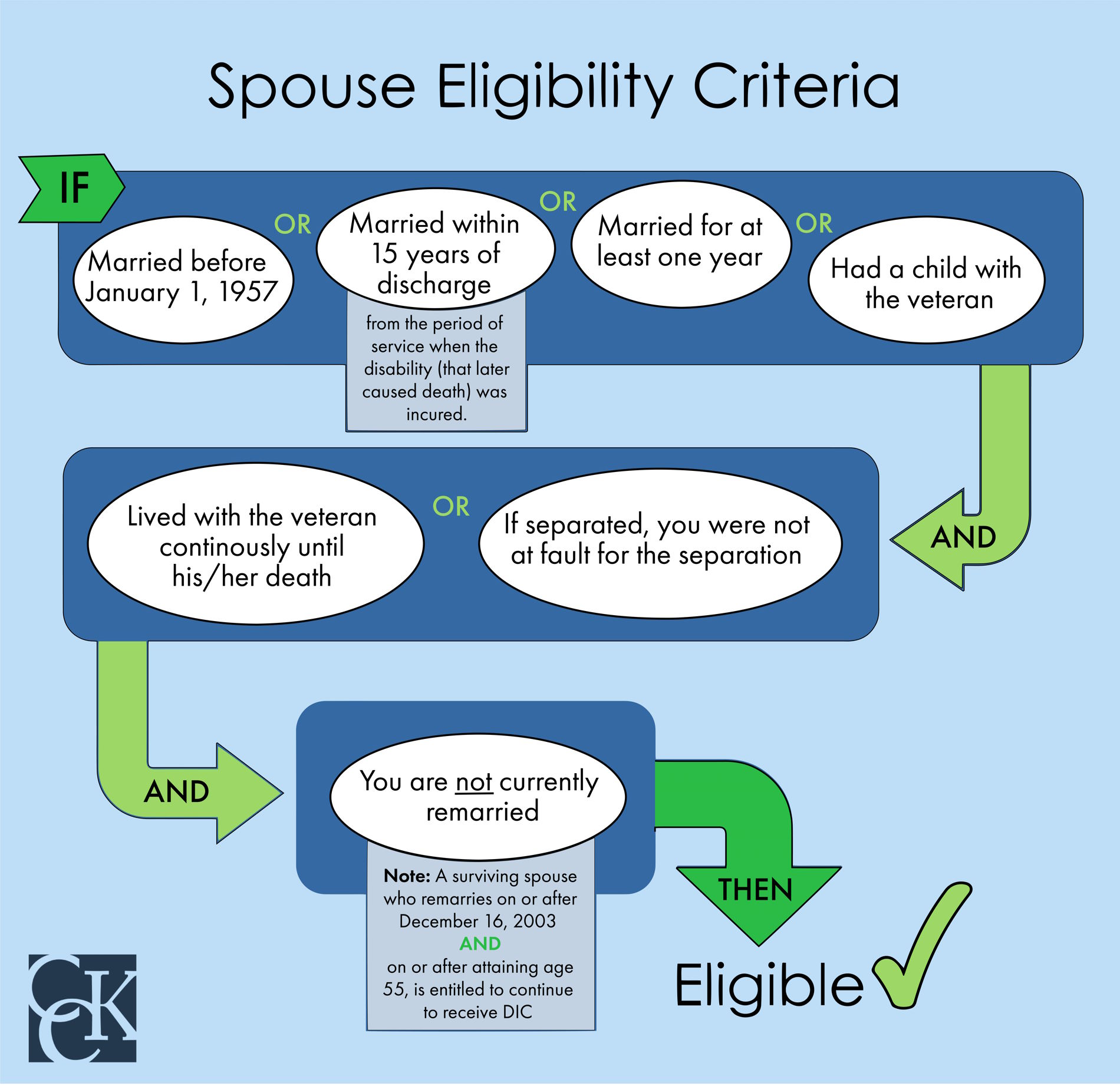

Surviving Spouse Eligibility

In addition to these requirements, a surviving spouse seeking DIC benefits typically should have been married to the veteran for at least one year prior to their death. Surviving partners who were not technically married to the veteran may also qualify for DIC benefits in certain circumstances:

- If the state’s laws allow for common law marriages; or

- If the veteran and surviving spouse share a child and either lived together continuously until the time of the veteran’s death or, if separated, the surviving spouse was not at fault for the separation.

A surviving spouse or partner must provide evidence that they meet these criteria.

Surviving Child Eligibility

A surviving child of the veteran may also receive DIC benefits provided they meet VA’s criteria:

- The child is not married; and

- The child is not included on the surviving spouse’s compensation; and

- The child is under age 18 (or under 23 if attending school).

Surviving Parent Eligibility

A surviving parent of the veteran may be eligible for DIC benefits if the following is true:

- They are the biological, adoptive, or foster parent of the veteran; and

- Their income is within a certain income range.

VA DIC Benefit Rates

VA does not pay survivors the same monthly amount the veteran was receiving at the time of their death. Instead, DIC has its own exclusive rates, which change based on the annual cost-of-living adjustment (COLA).

As of December 1st, 2020, DIC pays a monthly benefit of $1,357.56 to spouses or children of qualifying veterans, while eligible surviving parents are paid based on their income level and living situation.

Surviving dependents may also qualify for additional compensation provided they meet certain factors.

How to Qualify for VA Survivors Pension Benefits

VA Survivors Pension is a monthly benefit paid to surviving spouses and unmarried dependent children of wartime veterans who meet certain income requirements set by Congress.

Surviving spouses who did not remarry after the veteran’s death may qualify for Survivors Pension, provided the deceased veteran meets the following VA requirements:

- For service on or before September 7, 1980, the veteran must have served at least 90 days of active military service, with at least one day during a wartime period (see below).

- For active duty after September 7, 1980, the veteran must have served at least 24 months or the full period for which they were called or ordered to active duty, with at least one day during a wartime period.

- The veteran was not dishonorably discharged.

To receive VA Survivors Pension as a dependent child, the surviving child must be unmarried and either under 18 years of age, under age 23 and attending a VA-approved school, or permanently incapable of self-support due to a disability incurred before age 18.

What Are Eligible Wartime Periods?

According to the VA, eligible wartime periods include:

- Mexican Border Period (May 6, 1916 – April 5, 1917)

- World War I (April 6, 1917 – November 11, 1918)

- World War II (December 7, 1941 – December 31, 1946)

- Korean conflict (June 17, 1950 – January 31, 1955)

- Vietnam era (February 28, 1961 – May 7, 1975 for veterans who served in the Republic of Vietnam during that period, otherwise August 5, 1964 – May 7, 1975)

- Gulf War (August 2, 1990 – a future date to be set by law or Presidential Proclamation)

What Is the Income Limit for VA Survivors Pension Benefits?

To qualify for VA Survivors Pension, surviving dependents must meet an income limit set by Congress, meaning the survivor’s yearly family income and assets must be less than a predetermined amount. The benefit paid to the survivor is the difference between their countable income and assets, and the annual pension limit.

Countable income includes earnings, disability and retirement, interest and dividends, and net income from a business, while assets include investments (i.e., stocks and bonds), furniture, boats, and property besides a primary residence.

As of December 1, 2020, the net worth annual pension limit is $130,773.

VA Accrued Benefits

If a veteran’s claim is still pending at the time of his or her passing, the surviving spouse may be substituted into the pending claim as the claimant. If service connection or an increased rating is later awarded, the surviving spouse will receive VA accrued benefits (i.e., the retroactive pay the veteran would have received if they were alive), up to the date of the veteran’s death.

How to Apply for VA Survivors Benefits

To apply for VA survivors benefits (i.e., DIC, Survivors Pension, and Accrued Benefits), the surviving dependent should download and fill out VA Form 21P-534EZ. Once the form is complete, it can be submitted online, via mail, or in person at a VA Regional Office.

It is also important to note that VA survivors’ benefits are not taxable. VA Survivors Pension, accrued benefits, and DIC are all tax-free benefits that do not need to be included on a tax return.

Additional VA Survivors Benefits and How to Qualify

VA offers additional programs to surviving dependents of veterans. The compensation offered through these programs is intended for specific purposes, such as education, home loans, burial fees, and more.

Dependents’ Educational Assistance (DEA) Program

The Survivors’ and Dependents’ Educational Assistance (DEA) program, a part of the GI Bill, aims to offer education and training to eligible survivors and dependents of veterans who:

- Died while on active duty; or

- Passed away due to a service-connected disability: or

- Are currently permanently and totally disabled due to a service-connected condition(s).

The DEA program allows eligible students enrolled in the following programs to receive financial assistance from VA:

- College, university, or other schooling;

- Career training, licensing, and certification tests;

- On-the-job training or apprenticeships;

- Tutorial assistance; and

- Work-study.

To apply for DEA benefits, VA requires eligible dependents and survivors to complete and submit VA form 22-5490: Dependents’ Application for VA Education Benefits. Surviving spouses who qualify can collect DEA and DIC benefits at the same time.

CHAMPVA Insurance

The Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) is a health benefits program in which VA shares the cost of certain health care services and supplies with eligible surviving dependents.

CHAMPVA provides coverage to the spouse or widow and to the children of veterans. To qualify, the veterans must have:

- Been rated permanently and totally disabled due to a service-connected condition; or

- Been rated permanently and totally disabled due to a service-connected condition at the time of death; or

- Died of a service-connected condition; or

- Died on active duty and the dependents are not otherwise eligible for the Department of Defense’s TRICARE benefits.

Surviving spouses who remarry before age 55 no longer qualify for CHAMPVA benefits; however, if they remarry on or after their 55th birthday, they can continue their benefits. Moreover, if the remarriage (prior to the age of 55) ends by death, divorce, or annulment, the surviving spouse may qualify again for CHAMPVA.

Home Loan Benefits for Surviving Spouses

A surviving spouse of a veteran can get a VA-backed home loan if they obtain a Certificate of Eligibility (COE) to show their lender. To secure a COE, the veteran must meet one of the following criteria:

- Is missing in action; or

- Is a prisoner of war (POW); or

- Died while in service or from a service-connected disability; or

- Had been totally disabled prior to death, but their disability may not have caused their death (in certain situations).

If the veteran died while in service or from a service-connected disability, the surviving spouse could qualify for a COE as long as they did not remarry before age 57 or before December 16, 2003.

Veterans Burial Allowance

Veterans burial allowance helps cover the costs of burial, funeral, and transportation. Surviving family members of a veteran may be eligible for a burial allowance if they are paying for the funeral and burial costs and will not be reimbursed by any other organization.

A surviving spouse, partner from a legal union, child, parent, or executor/administrator of the veteran’s estate can request the burial allowance.

To qualify, the veteran must meet at least one of the following conditions:

- The Veteran’s death was the result of service-connected disability;

- The Veteran was receiving VA disability compensation or pension at the time of their death or was entitled to receive VA disability or pension but instead received their full military retirement or disability pay;

- The Veteran’s death occurred while they were hospitalized by VA or while they were receiving care at a non-VA facility under VA contract;

- The Veteran died while traveling under proper authorization and at VA expense to or from a specified place for the purpose of examination, treatment, or care;

- The Veteran had a claim for VA compensation or pension pending at the time of death and would have been entitled to benefits prior to the date of death;

- The Veteran died while a patient at a VA-approved state nursing home on or after October 9, 1996.

How CCK Can Help You Secure Survivors Benefits

If VA denied your claim for VA survivors benefits that you believe you are entitled to, reach out to CCK today for a free consultation at 800-544-9144.

The team of experienced and knowledgeable veterans’ advocates at CCK may be able to help you secure the VA benefits you need during this difficult time.

About the Author

Share this Post