Long-Term Disability Offsets Explained

An individual may file for long-term disability benefits if they become disabled and cannot work due to a health condition. Depending on the terms of your long-term disability insurance policy, you may receive a monthly benefit that is a fixed amount or one that equates to a certain percentage of your pre-disability income. This amount is generally referred to as your gross monthly long-term disability benefit. However, under many long-term disability policies, there are provisions that allow your insurance company to deduct certain amounts from your gross benefit based on other income sources. These are known as long-term disability benefit offsets.

Offsets may consist of other benefits or income, and your policy may label these provisions as “Other Income Benefits or Deductible Sources of Income.” They are more commonly referred to as benefit offsets because they reduce the amount of money that your insurance company must pay you each month. While the amount you receive before offsets is known as your gross benefit amount, the benefit amount you receive after offsets is generally referred to as your net monthly benefit amount.

Common Offsets in Long-Term Disability Policies

Many common types of offsets typically apply to long-term disability benefits, so it is important to read your LTD policy carefully to determine what is considered an offset under your specific plan. You will want to take note of these so that you are prepared for any offsets taken out of your monthly benefit.

Types of offsets that frequently appear in long-term disability policies can include:

- Social Security benefits (Disability and retirement)

- Workers comp

- Unemployment

- State disability benefits

- Severance benefits

- Employer-provided retirement benefits

- Personal injury or other settlements, judgments, etc.

- VA benefits

- Pension benefits

- Sick pay

- Salary continuance

- Work earnings

How Does My Insurance Company Determine My Net Long-Term Disability Benefit Amount After Offsets?

Your long-term disability policy should specify how your net benefit amount is calculated if you are receiving other income benefits that are considered offsets under your policy. The way your particular net benefit is calculated will often depend on the other types of income benefits involved.

The offset may be a straightforward dollar-for-dollar reduction. This might be the case with other disability benefits, sick pay, or pension benefits. However, sometimes, only a portion of the other income benefit is deducted from your gross long-term disability benefit. With Social Security Disability benefits, for example, your base benefit from Social Security will be deducted dollar-for-dollar from your gross long-term disability benefit, but if your Social Security Disability benefit later increases due to a cost-of-living adjustment, the offset on your long-term disability benefit may not increase. Similarly, your long-term disability policy may specify that for personal injury settlements or awards, your insurance company will offset only the portion of those benefits that is attributable to loss of earnings.

Other times, the offset amount is determined by certain formulas specified in the policy. For example, if you are receiving disability benefits while working, your long-term disability policy may specify a formula that calculates your net benefit given your work earnings.

It is important to note that these formulas can vary widely depending on your policy or insurance company. You will want to make sure that you understand how your specific earnings will work with the offset formula within your policy. It is also possible that your policy may have a limit on the amount of work earnings you can make and still receive long-term disability benefits, and if your earnings exceed that limit, your benefits may be terminated. However, claimants have the right to file an appeal if this happens.

What If the Offset from My Other Benefits Exceeds My Monthly Long-Term Disability Benefit?

You may find that your offset amount exceeds your gross long-term disability benefit. Most long-term disability policies have a minimum benefit provision, so you should still receive some amount each month from your insurance provider. Often, the minimum benefit is the greater of $100 or 10% of your gross monthly benefit.

This guarantees you will receive a minimum payment even if the offsets from other income benefits are greater than your gross monthly long-term disability benefit, or if monthly offsets reduce your LTD benefit below the minimum benefit amount. For example, if your policy provides for a minimum benefit of the greater of $100 or 10% of your gross monthly benefit, and your gross long-term disability benefit is $2,000 per month while you receive $2,100 in other income benefits, your net LTD benefit will be $200. Similarly, if you receive $2,000 per month in LTD benefits and your other income benefits are $1,900, your long-term disability net benefit would still be $200.

Offsets and Lump-Sum Payments

A lump-sum payment is when you receive a benefit in one lump sum, rather than as benefits broken up over months. You may receive a lump-sum payment of a benefit that covers the same time period as your long-term disability benefits. The insurance company will examine the period that the lump-sum payment covers to determine how much should be offset from your long-term disability benefit each month.

If the lump-sum payment covers a retroactive time period, there will also likely be an overpayment on your long-term disability claim because the LTD insurance company paid your full gross benefit during that past time period when it should have been offsetting these other benefits. This means that you will owe money back to the insurance company. Often, the entire lump-sum amount you receive for other income benefits ends up being paid back to your insurance company.

It is also important to note that if you receive a lump-sum award of other income benefits that do not cover a specific time, such as a personal injury settlement, your insurance company will often assign a time frame to determine how much it should deduct from your monthly long-term disability benefits.

Can My Insurance Company Make Me Apply for Other Income Benefits that Are Considered Offsets?

Many long-term disability policies will require you to apply for all other income benefits for which you may be eligible. For example, long-term disability policies often require claimants to also apply for Social Security Disability benefits.

Even if you do not apply for these benefits, your insurance company could begin estimating the amount of payment that other income benefits would provide you. They may start offsetting that amount from your long-term disability benefit, even if you are not actually receiving the other benefit.

What to Do if Your Insurance Company Starts to Apply an Offset to Your Long-Term Disability Benefits

If you receive a letter notifying you that your insurance company is going to start applying an offset to your long-term disability benefits, the first thing you will want to do is read your policy to determine if the offset is appropriate. Your policy will outline which income benefits are considered offsets under your plan.

It is important to evaluate your policy carefully. There may be nuances to the offset provision, such that while other income you receive may fall generally into an offset category, it might not be a proper offset due to other conditions of your policy. For instance, your policy may say that pension benefits are an offset, but also state that offsets only apply to other income benefits you are receiving as a result of the same disability for which you are claiming long-term disability benefits. It is important to be on the lookout for these kinds of incongruities.

If the offset is appropriate under your policy, you will also want to ensure that the insurance company is calculating it correctly. Is your insurance company including Cost-of-Living Adjustments in the offset when it should not? Is your insurance company offsetting your entire personal injury settlement, rather than just the portion attributable to loss of earnings? You will want to ask yourself questions such as these so that you can be sure you are getting all the benefits to which you are entitled.

Call Chisholm Chisholm & Kilpatrick for a Free Case Evaluation Today

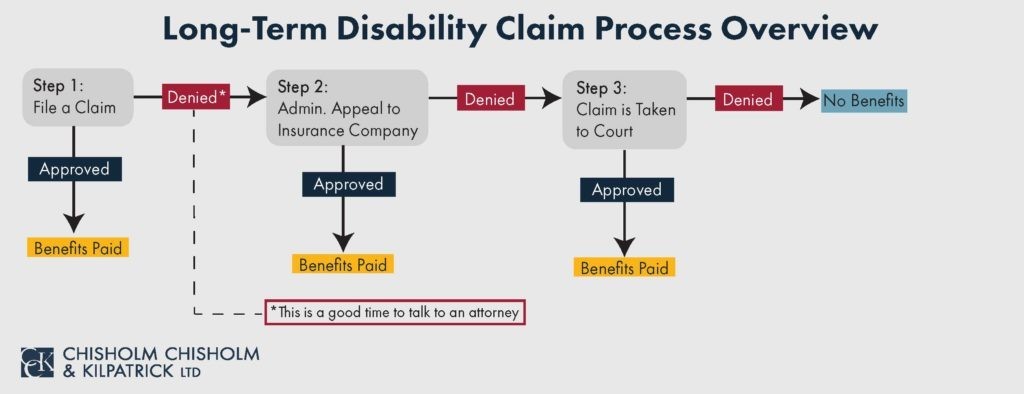

Navigating the long-term disability claim process can be confusing, especially if you have other income sources that may offset your benefits. Offsets can be complicated and greatly impact your monthly claim. If your insurance company begins to apply an offset to your benefits and you are unsure if they are doing so correctly, the legal team at Chisholm Chisholm & Kilpatrick is available to help.

We want to ensure that you are receiving the full benefits you are entitled to. Our long-term disability attorneys are familiar with how insurance companies operate and can assist you with evaluating your claim. For a free case evaluation with a member of our team, you can call 800-544-9144.

About the Author

Share this Post