Why Long-Term Disability Benefits May Be Terminated After Initial Approval

If you have a disabling health condition that keeps you out of work, you may be receiving long-term disability (LTD) benefits. While it is a relief to be approved after the process of filing a claim, it is important to keep in mind that an insurance company can still find a reason to terminate your payments.

It can be valuable for you to be aware of the different reasons an insurance company may deem you no longer qualified to receive long-term disability benefits. You may be able to avoid some of the pitfalls that your insurance company may use to deem you unqualified or to strengthen an appeal for a denial of benefits.

Reasons Your Benefits May Be Terminated

Change in Your Definition of Disability

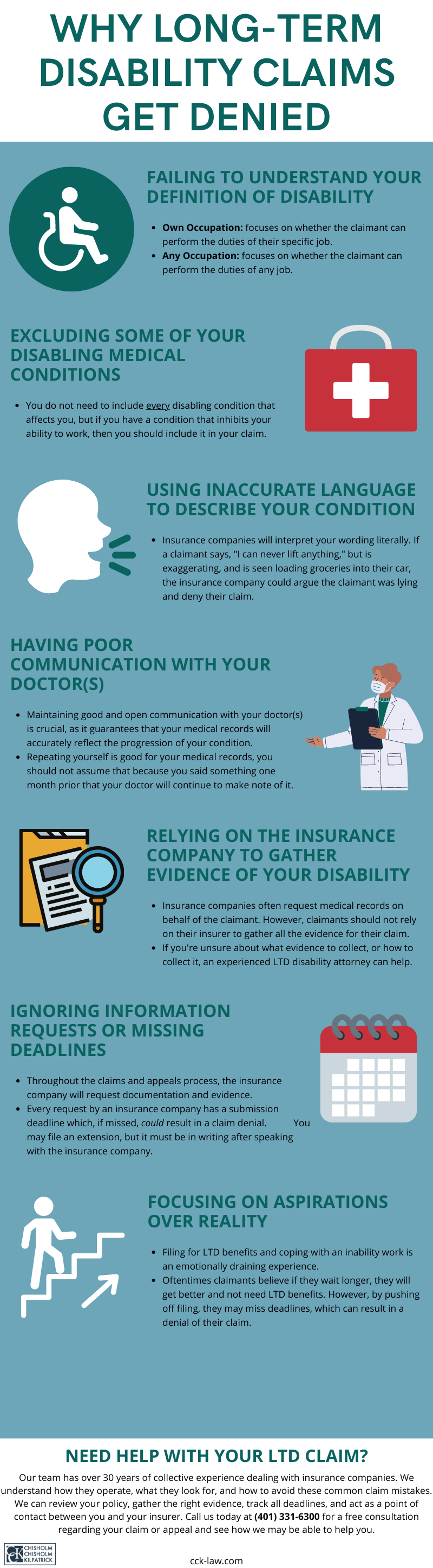

One of the most essential parts of the long-term disability process is meeting the definition of disability in your policy. It is also often the most common reason benefits are terminated and claims are denied. If the evidence you submit for your health condition does not meet the terms outlined in your policy’s definition of disability, your insurance company will likely not approve you to receive benefits.

Oftentimes in long-term disability policies, a claimant’s definition of disability will change after a certain period of time. For the first 24 to 48 months of benefits, or the period of time stated in your policy, claimants often must meet the own occupation definition of disability. Under the own occupation definition of disability, a claimant must prove that they are too disabled to work in their own personal occupation. Once that period is up, their policy will switch to the any occupation definition of disability. Under the any occupation definition, a claimant must prove their health condition is so disabling that they cannot work in any occupation in the workforce. This transition can often lead to the termination of benefits for many claimants.

Unsurprisingly, the any occupation definition of disability can be much harder to satisfy. For example, your health condition may cause you to be unable to work your profession as a neurosurgeon or a construction worker, but if your insurance company deems you able to work a more sedentary office job your benefits may be terminated.

How to counteract this: When a change in your definition of disability occurs, you may want to obtain additional and updated evidence of your disability. It can be useful to get evidence from a vocational expert, who may be able to evaluate your ability – or inability – to work while suffering from your disabling condition. Evidence that highlights the severity of your condition and addresses your inability to function in the workforce can serve as substantial evidence against a benefit termination due to the change in the definition of disability.

Your Insurance Company Reevaluates Your Evidence

While you are receiving benefits from your insurance company, they will likely ask you to provide updated medical records. This is to ensure that your health condition continues to meet the requirements of your policy. Sometimes, your insurance company may question the validity of your pain or decide that your medical records alone are not strong enough, in which your benefits may be terminated based on insufficient evidence.

How to counteract this: It can be very useful to ask your physician for a personal report of your symptoms. It is important to be honest with your doctor about how your disability affects you, so they can highlight the various ways your condition impairs you that your medical records may not cover. It can be imperative to your claim that your insurance company has a more in-depth understanding of your condition than medical records alone.

You may also want to seek supplementary evaluations by other medical professionals or vocational experts who can provide additional evidence for your condition. Another way to bolster your claim is to request impact statements from personal acquaintances such as friends, family, or coworkers. People with whom you have personal relationships maybe be able to describe the ways they have witnessed your disability affect your daily life. The more evidence proving your disability should not be terminated, the better.

Video Surveillance Investigation

Insurance companies have the right to hire private investigators to watch and record you with video surveillance. This means that an investigator can discreetly track you in your daily activities, whether that means attending medical appointments, going shopping, or eating a meal out with your family. The purpose of video surveillance is for an insurance company to bear witness to your actions and activities and see if they can find anything that will disprove your claim.

It is important not to generalize – or guess – about the limitations of your impairment. For your insurance company, all evidence is fact. If you generalize in your claim that you are unable to lift around five pounds, and a surveillance recording shows you lifting a large shopping bag, your insurance company may question the validity of your evidence, or determine that your health has improved, and terminate your benefits.

How to counteract this: Be honest with your doctor. It can be tempting to want to glaze over details due to embarrassment, or not wanting to seem “weak” because of your condition, but an insurance company will take advantage of generalizations or exaggerations regarding your condition. It can be helpful to seek medical evaluations that can determine exactly what your physical and cognitive limitations are so that you and your insurance company is aware of your boundaries and there is less room for a termination of benefits based on inaccurate or generalized evidence.

Benefits Terminated After Social Media Investigation

Similar to video surveillance, your insurance company may investigate your social media. This can mean seeing the statuses you put on Facebook, reading your tweets on Twitter, and viewing the pictures you post on Instagram. Social media can pose a particular danger to your claim, as it tends to be where we show our “best selves.” It may not be where we want to talk about the hardships of our health. Instead, you may post a picture of yourself that was taken on a good day – the weather was nice and you went on a short walk – even though you find yourself bed-ridden due to your condition for the rest of the week. Unfortunately, an insurance company investigator will only see your “healthy” picture, not the time you spent in bed, and may use that as evidence to terminate your benefits, arguing that your condition may not be as disabling as you claim.

How to counteract this: Be careful of what you post online. When you do post online, make sure that it does not contradict anything you submitted in your LTD claim. Your insurance company may grasp any detail of your public posts to use as evidence to disprove your claim.

You Do Not Apply for Social Security Disability Insurance Benefits

Long-term disability insurance companies often require LTD claimants to apply for Social Security disability insurance (SSDI). This is because SSDI payments can offset long-term disability benefits, which means that your insurance company will not have to pay you the amount of money you get from SSDI. Insurance companies love to save money where they can, and if they see that you are not applying for Social Security disability insurance, they may terminate your long-term disability benefits altogether.

How to counteract this: Ensure that you apply for Social Security disability insurance in a timely manner. Deadlines are important when it comes to LTD and SSDI, as missed deadlines can mean a loss of benefits. Managing your disability can be stressful and distracting, but you want to make sure that you meet all the terms of your long-term disability policy. It can be useful to contact an attorney or professional for help if you do not feel you can manage on your own.

Not Submitting Proof of Treatment for Your Disability

It is often a requirement in long-term disability policies that you seek regular treatment for your disability. Your health is important to them so far as they would like to see your condition improve so they can discontinue payments. Failure to provide proof of periodic visits to a doctor can be a sign to your insurance company that you are not seeking treatment.

How to counteract this: Even if your doctor does not require you to make frequent visits, it is important that you continue to seek treatment, if only for a confirmation as to the state of your disability. Any time you see an expert or professional regarding your disability, it is important to provide documentation to your insurance company as proof of your visit.

How Chisholm Chisholm & Kilpatrick Can Help You If Your Benefits are Terminated

If your long-term disability benefits are denied or unexpectedly terminated, you can still fight for your benefits. Before your benefits are cut off, your insurance company will likely send a letter to inform you by mail. This letter should list the reasons why your benefits are being terminated and include instructions on how to appeal.

You can handle an appeal on your own, but there are benefits to contacting an attorney. The long-term disability attorneys at Chisholm Chisholm & Kilpatrick have extensive experience appealing benefit denials and know how to prove your case. Our attorneys can help you understand the terms and requirements of your policy, and will help you gather the strongest possible evidence so you will begin to receive benefits again.

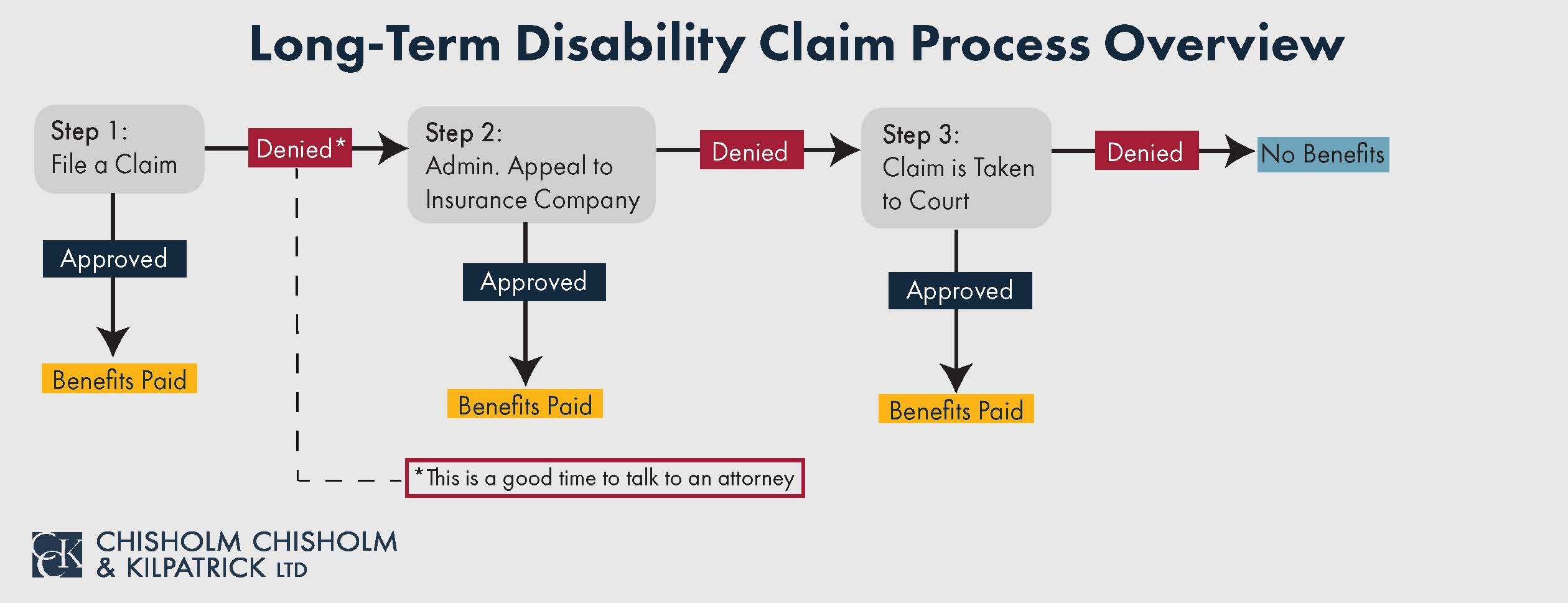

Seeking the help of a lawyer can be especially important in the appeal stage. Many LTD cases are governed by ERISA, which tends to favor insurance companies over claimants. The appeal may be your only chance to get new evidence on the record. If you are denied again and your case is taken to court, you will not be able to submit any further proof of your disability.

CCK understands that the long-term disability process can be difficult, especially when you are managing your health at the same time. We know that the last thing you want to deal with is a loss of benefits. If you are facing a loss of benefits and are unsure how to proceed, contact us today for a free consultation. You can call us at (800) 544-9144 or contact us online.

About the Author

Share this Post