Texas State Veteran Benefits: Housing, Finance, Education, and Recreation Benefits

Texas provides a range of benefits, resources, and aid designated specifically to support veterans. Continue reading to learn more about the Texas state veteran benefits allocated to support veterans living in the state.

What Housing Benefits Are Available to Texas Veterans?

Texas State Veterans Homes are homes provided by the State of Texas to qualified veterans, their spouses, and Gold Star Parents. These homes provide long-term care for veterans who are disabled.

In order to be eligible for this program, applicants must supply a doctor’s note explaining the veteran’s need for skilled nursing care. The veteran must also have lived in the state for at least one day.

Additionally, Texas State Veterans Homes have certain military service requirements. To be eligible for the housing, veterans must have served at least 90 days, have a DD-215, and have been honorably discharged.

Texas State Veterans Homes are owned by the State of Texas, however, and are regulated by both the Texas Health and Human Services Commission and VA. Third-party operators manage the day-to-day services of these facilities while being overseen by the Texas Veterans Land Board.

Veterans who are rated with a 70 percent VA disability rating or higher can generally live at a veterans home for free. Texas State Veterans Homes provide a community for veterans, while also helping to alleviate some of the costs of care.

There are nine Texas State Veteran Homes, with locations in:

What Financial Benefits Are Available to Texas Veterans?

There are several financial Texas state veteran benefits and incentives. These benefits include:

Disabled Veterans Property Tax Exemption

Disabled veterans living in Texas are eligible for certain tax exemptions, which can range based on the severity of the veteran’s disability.

Veterans who were totally disabled by their military service are eligible for total property tax exemption. Surviving spouses are also eligible for this exemption.

Veterans with a VA disability rating that ranges between 10 percent and 90 percent can receive a reduction of their homes’ assessment value between $5,000 and $12,000, depending on their VA disability rating. Surviving spouses are eligible for this exemption as well.

Additionally, certain counties offer homestead tax exemptions for veterans.

Free Driver’s License

Veterans can receive a Texas driver’s license or ID card free of charge if they meet all four of the following requirements:

- Have a service-connected disability rating of at least 60 percent

- Were honorably discharged

- Receives compensation because of the disability, and

- Not subject to sex offender registration requirements.

This benefit does not apply to commercial driver’s licenses.

Texas Veteran Home and Land Loans

Texas also provides both home and land loans to veterans through the Texas Veteran Land Board.

Home loans are available to eligible Texas veterans and military members. These loans generally have a competitive, low-interest rate with little or no down payment. Veterans, military members, and their spouses, can receive nearly $650,000 on a fixed-rate loan for 15-, 20-, 25-, or 30-year terms. If the veteran is disabled, with a VA service-connected disability, they can receive a discounted interest rate.

The Texas Veteran Land Board provides land loans, allowing Texas veterans and military members to borrow up to $150,000 to purchase land at a competitive interest rate. The program typically requires a minimum five percent down payment for tracts of one acre or more.

Veterans Home Improvement Program (VHIP)

The Texas Veterans Land Board also provides loans for home improvement purposes. The Veterans Home Improvement Program (VHIP) offers below-market interest rate loans to qualified Texas veterans for the purposes of home repairs or improvements.

The program offers loans up to $50,000 for 2- to 20-year terms or loans from $7,500-$10,000 for 2- to 10-year terms.

Veterans who are rated at 30 percent or higher for a VA service-connected disability may also qualify for a discounted rate.

What Educational Benefits Are Available to Texas Veterans?

Texas also provides a variety of educational Texas state veteran benefits, including:

Hazelwood Act and Education Services

The Hazelwood Act is a benefit offered to qualified Veterans, as well as their spouses and dependent children, which provides for up to 150 hours of tuition exemption. The benefit includes most fee charges at public institutions of higher education in Texas but does not include living expenses, books, or supply fees.

To be eligible for the Hazelwood Act, the veteran must have designated Texas as their Home of Record on their DD-214, entered the service in Texas, or been a Texas resident.

Additionally, veterans must have received an honorable discharge or general discharge under honorable circumstances and served at least 181 days of active-duty service. Veterans must also currently reside in Texas.

The veteran also needs to have no federal veteran’s education benefits for the term or semester enrolled, that do not exceed the value of the Hazelwood Act benefits. There are also certain academic requirements that need to be upheld.

Legacy Act

The Legacy Act refers to the Hazelwood Act for children. Under this statute, eligible veterans may assign or transfer unused hours of tuition exemption, as outlined in the Hazelwood Act, to eligible children.

In order to be eligible, the child must a Texas resident and the biological child, stepchild, adopted child, or claimed dependent, of the veteran.

Additionally, the child must be aged 25 or younger on the first day of the semester or term for which the exemption is being applied.

Hazelwood Act for Spouses

Just as the benefits of the Hazelwood Act can apply to dependent children, certain spouses may also be eligible for the benefit. Spouses of 100 percent total and permanent disabled veterans, as determined by VA, are eligible for the Hazelwood Act, so long as they meet certain requirements.

The spouse must have been the veteran’s spouse at the time of their entry to military service. The Veteran must also have been a member of the US Armed Forces or the Texas National Guard who:

- Died as the result of service-related injuries; or

- Became totally and permanents disabled as the result of their service; or

- Went missing in action; or

- Was killed in action

The spouse also needs to be classified by the educational institution as a Texas resident.

Texas High School Diplomas for Wartime Veterans

Under the Texas Education Code, veterans who left high school before receiving their diploma to serve in the military during wartime can receive their diploma. To be eligible, the veteran must have:

- Been honorably discharged from the United States Armed Forces

- Been scheduled to graduate from high school after 1940 and before 1975, or after 1989

- Left school after completing sixth grade or higher, but before graduating from high school, to serve in one of the following wars

- World War II

- Korean War

- Vietnam War

- Persian Gulf War

- Iraq War

- Afghan War

- Any other formally declared war or military engagement

What Employment Benefits Are Available to Texas Veterans?

Texas also provides several employment Texas state veteran benefits, such as:

Veterans Preference Policy

Under Texas Government Code Title 6, Subtitle B, Chapter 657, veterans have preference in employment with state agencies or offices. Widows, who have not remarried, and children of those killed during active duty are also eligible for this preference.

State agencies must provide this preference to qualified veterans over other applicants who do not have greater qualifications.

Veterans’ employment preference is ordered as the following:

- A veteran with a disability

- A veteran

- A veteran’s surviving spouse who has not remarried

- An orphan of a veteran if the veteran was killed on active duty

Military Time Credit to Establish Credit Toward Retirement

After a veteran’s first retirement contribution has been posted with the Employees Retirement System of Texas, veterans can buy up to 60 months of eligible active-duty United States military service to establish credit.

Importantly, no veteran can buy more than 60 months.

To be eligible for this benefit, the veteran must not be eligible for a full military retirement benefit and the veteran’s military status must not be dishonorable.

Veteran Entrepreneur Program

Texas also offers a Veteran Entrepreneur Program (VEP) which provides veteran entrepreneurs and veteran small businesses with tools and resources to help start and grow their businesses. These services include:

- Consulting services

- Business Partner Referral Services

- Outreach and educational services

Veterans may also apply to the Veteran Entrepreneur Program for a Veteran-Owned business logo.

What Recreational Benefits Are Available to Texas Veterans?

In addition, Texas offers several recreational Texas state veteran benefits, such as:

Veterans Hunting & Fishing License

Texas disabled veterans are eligible for the “Disabled Veteran Super Combo Package” which includes a hunting and fishing license and five state endorsements. This package includes:

- Resident hunting license

- Resident fishing license

- Archery endorsement

- Freshwater fishing endorsement

- Saltwater fishing endorsement with red drum tag

- Upland game bird endorsement

- Migratory bird endorsement

The Federal Duck Stamp is not included in this package, which is required for hunting waterfowl.

To be eligible for this package, veterans can provide official proof of disability issued by VA or a Texas Driver’s License with “Disabled Veteran” designation.

Additionally, any Texas resident on full-time active-duty military service can receive this package. To prove full-time active-duty military service, veterans can provide military service records indicating that their home of record is in Texas or that their duty station for the six months immediately prior to the time of application was in Texas.

Disabled Veterans State Park Passport

Texas offers a Disabled Veterans State Park Passport which offers free entry to Texas state parks for U.S. veterans with a rating of 60 percent or more for a service-connected disability. The passport also includes free entry for a companion.

To receive a Disabled Veterans State Park Passport, veterans need to provide:

- A present valid identification such as a driver’s license; AND

- Disabled Veterans of Texas license plate receipt; OR

- Veteran’s award letter which establishes the degree of disability; OR

- Tax exemption letter for Texas veterans

What Burial Benefits Are Available to Texas Veterans?

Further, Texas also provides several burial Texas state veteran benefits, including:

Texas Veterans Cemeteries

Texas veterans, as well as their spouses and dependent children, are eligible for burial in the four Texas State Veteran’s Cemeteries. These cemeteries are located in:

These cemeteries are managed by the Texas Veterans Land Board and they complement the six other national veterans cemeteries which are located in Texas. Burial benefits at the Texas State Veteran Cemeteries are identical to the ones provided by VA National Cemeteries.

There is no charge for burial of the veteran or their family.

Are You a Texas Veteran Looking to Appeal a Negative VA Decision?

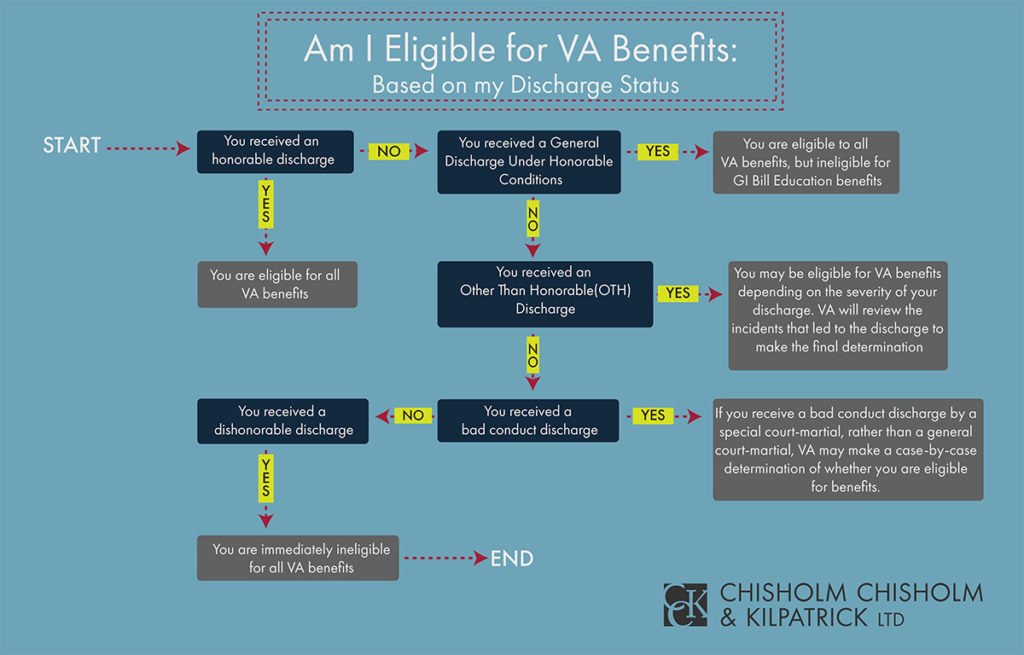

Texas veterans looking to appeal an unfavorable VA decision may benefit from the services of Chisholm Chisholm & Kilpatrick LTD. CCK is a hub for thought leaders in the field of Veterans Disability Law, with decades of combined experience representing disabled veterans and their families.

Our accredited lawyers and claims agents have the experience and skill to advocate for Texas veterans appealing unfavorable VA decisions. With an office located in Houston, Texas, CCK is uniquely positioned to help Texas veterans receive the VA disability compensation they deserve. Call our office today for a free case consultation.